Customers also have the opportunity to receive an iPhone 15 Pro Max 256GB, free referrals to investment products from iWealth Partner, and margin trading (margin loans) with interest rates from only 7.77%/year.

Techcombank has just launched a pair of bank payment accounts and TCBS securities accounts with just one registration.

Flexible payment, stable investment

Previously, to open 2 payment accounts and an investment account, customers had to perform many separate steps. In order to minimize procedures, save time and bring the most seamless experience, Techcombank has collaborated with TCBS to provide the feature of opening a Techcombank payment account and a TCBS investment account at the same time after only one registration.

Accordingly, customers only need to download the Techcombank Mobile digital banking application and perform operations proactively and easily like never before.

"We want to bring convenience in payment, effective financial transactions, and optimize values for customers from the combination of two Techcombank and TCBS accounts. The feature of opening dual accounts easily on Techcombank Mobile marks a new step for Techcombank on the journey of bringing practical values, personalization according to needs and enhancing customer experience. From there, Techcombank continues to implement the vision of transforming the financial industry, enhancing the value of life", shared a representative of Techcombank's leadership.

Opening two payment and investment accounts at the same time after just one registration on Techcombank Mobile not only saves time but also allows customers to enjoy a seamless account opening experience with a simple process.

The ability to link and synchronize total assets between Techcombank payment accounts and TCBS securities accounts helps to conveniently and centrally transact and manage finances right on the digital bank. Customers are also free to open beautiful account numbers, free to manage accounts, free to all payment transactions and securities investment activities including stocks, derivatives, warrants, listed derivative fund certificates....

Customers experience the most comprehensive investment product suite on the market integrated only in TCInvest, explore a suite of modern portfolio analysis and management tools, and improve their investment knowledge with a series of professional analysis and consulting reports that are periodically updated on TCBS's multi-channel social network.

When opening a pair of accounts, customers also enjoy a series of exclusive incentives including the opportunity to receive 10 iLucky tickets to win an iPhone 15 Pro Max 256GB on TCInvest. Customers are also introduced to free investment products from TCBS's iWealth Partner in the first 3 months and margin trading (margin loans) with interest rates from only 7.77%/year in the first 180 days from the first disbursement date at TCBS (after customers maintain a connection between their payment account and TCBS securities account for 90 days from the date of activating the TCBS securities account, for a maximum outstanding balance of VND 500 million and not applicable to Margin T+ packages).

Orientation and achievements of digital transformation journey at Techcombank and TCBS

With strong investment in the strategic pillars of "Data - Digitalization - Talent", especially investment in applying leading technologies, Techcombank continues to bring convenient features and the best experiences to users. In 2023, Techcombank was recognized by Global Finance as "The world's best digital bank from Vietnam" with convenient digital banking applications for both individual and corporate customers.

Techcombank closed the fourth quarter of 2023 with over 13.4 million customers, recording 2.6 million new customers in the whole year of 2023, double that of 2022. Of which, 46.8% joined through digital channels and 36.2% through partners in the ecosystem.

After a decade of maintaining a profit growth rate of nearly 40%/year, Techcombank has now become the leading private bank in Vietnam, with total pre-tax profit in the last 3 years reaching over 3 billion USD.

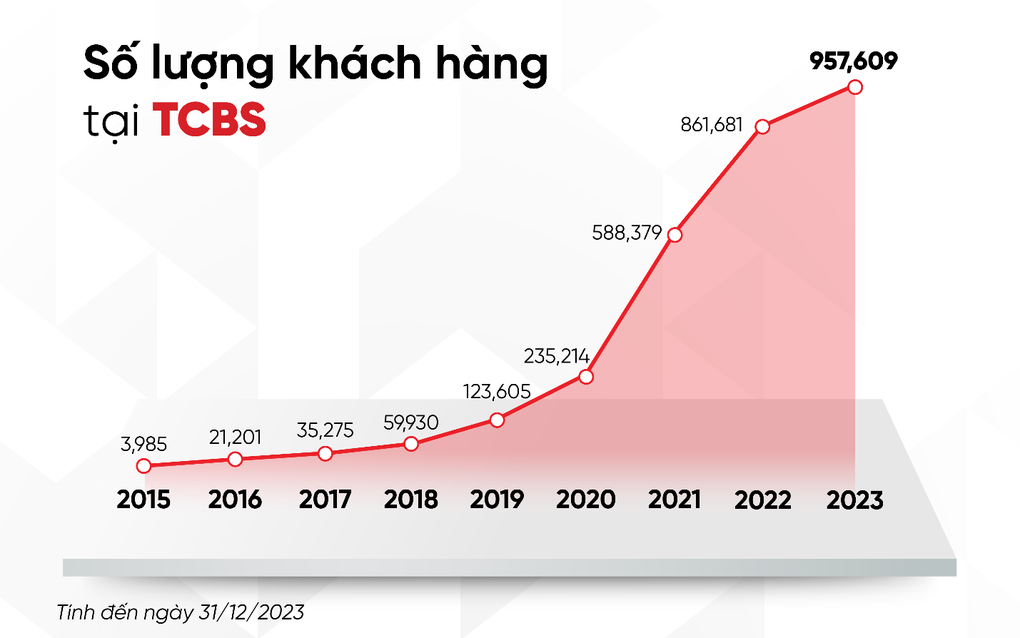

TCBS - a subsidiary of Techcombank - with its Wealthtech strategy was also recognized as the Digital Asset Manager of the Year 2023 by The Asset. The company's pre-tax profit in 2023 reached more than VND 3,028 billion, exceeding the annual plan by 51%. Outstanding financial products and solutions have helped TCBS attract nearly 95,000 new accounts in 2023, accounting for 20% of the total number of new accounts in the market, bringing the total number of TCBS users to more than one million.

Along with that, the TCInvest platform has maintained a stable access level of more than 12.4 million visits per month, with an average of over 400,000 visits per day and 85% of the number of transactions at TCBS are online transactions instead of going to the counter. This contributes to making TCInvest an application capable of providing "all-in-one" for customers' investment needs.

Source

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)