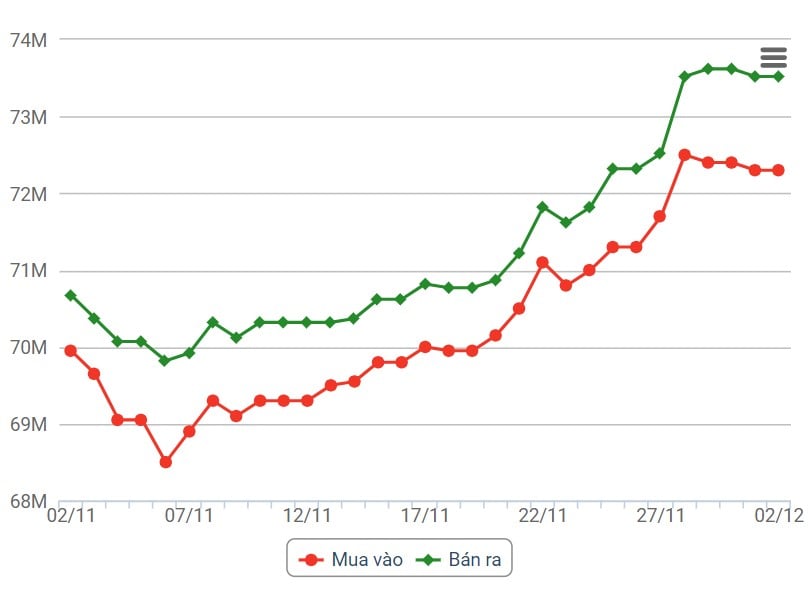

Domestic gold price

Domestic gold price fluctuations

World gold price developments

World gold prices increased dramatically in the context of the falling USD. Recorded at 5:00 p.m. on December 2, the US Dollar Index, which measures the fluctuations of the greenback against 6 major currencies, was at 103.125 points (down 0.29%).

The gold market heated up after US Federal Reserve Chairman Jerome Powell admitted that the Fed needs to act cautiously when there are signs of a weakening economy.

Jerome Powell boosted traders' confidence that the US central bank has finished tightening monetary policy and could cut interest rates from March next year.

Powell said the Fed is not thinking about cutting interest rates yet. However, analysts said it is clear that the Fed will not raise interest rates when the economy starts to slow. Spot gold rose sharply after Powell's speech, at one point hitting $2,075.09 an ounce, beating its previous all-time high of $2,072.49 reached in 2020.

Commenting on the short-term outlook for precious metals, Jim Wyckoff, senior analyst at Kitco Metals, gave a positive forecast. Gold is supported by the falling US dollar amid predictions that the FED will not raise interest rates anymore and may even lower them.

Lower interest rates reduce the opportunity cost of holding non-yielding assets, thus typically boosting gold prices.

On the other hand, David Meger, director of metals trading at High Ridge Futures, said that gold prices may fall next week, but overall the sideways trend to higher momentum will continue in the near future. Many now believe that the Fed is done raising interest rates and that a rate cut will occur in 2024.

Source

Comment (0)