ANTD.VN - The Tax Department of Region I has just issued some notes to taxpayers on personal income tax settlement in 2024.

Who must pay personal income tax?

In particular, regarding the deadline for submitting personal income tax (PIT) finalization dossiers in 2024, according to the provisions of the Law on Tax Administration, the deadline for submitting PIT Finalization declarations for organizations and individuals paying income is no later than the last day of the third month from the end of the calendar year; for individuals directly finalizing PIT, no later than the last day of the fourth month from the end of the calendar year.

Pursuant to Decree No. 91/2022/ND-CP, if the last day of the tax declaration submission deadline coincides with a prescribed holiday, the last day of the deadline shall be considered the working day following that holiday.

Therefore, the Tax Authority said that the deadline for the 2024 personal income tax settlement period is as follows: For organizations and individuals paying income, the latest deadline is March 31, 2025. In case individuals directly settle personal income tax, the latest deadline is May 5, 2025.

However, the tax authority notes that individuals with excess personal income tax payments according to the final settlement are not required to submit personal income tax finalization dossiers within this deadline.

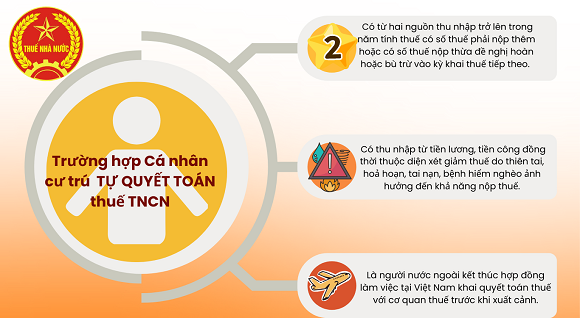

Regarding the subjects of personal income tax settlement in 2024, individuals who are residents with income from salaries and wages must directly declare personal income tax settlement in the following cases:

|

Cases where individuals must make personal income tax settlement |

The Tax Department also noted that in cases where individuals meet the conditions for authorization to settle personal income tax according to regulations, individuals are encouraged to authorize the settlement to the income-paying organization to save time and costs for individuals as well as reduce the number of settlement dossiers sent to the tax authority.

In addition, from the work of managing and handling records, the tax authority found that one of the mistakes that individuals often make when declaring and settling personal income tax is that individuals do not fully summarize their sources of income, or incorrectly declare the income received from income-paying organizations, and the amount of personal income tax deducted during the year.

Deploying automatic personal income tax refund for the 2024 tax period

To support the declaration and settlement of personal income tax of taxpayers more accurately, simply and conveniently, the Tax sector has deployed upgrades on electronic tax applications: eTax Mobile, Electronic tax for individuals (https://canhan.gdt.gov.vn/ICanhan/Request)

Currently, taxpayers can use their level II identified VneID accounts to access eTax Mobile and iCanhan applications and use the functions "Look up settlement information" and "Suggested personal income tax settlement declaration" to look up some information about their income and create a suggested personal income tax settlement declaration with some pre-filled indicators by the system.

|

The deadline for individuals to self-settle taxes is no later than May 5, 2025. |

On January 24, 2025, the General Department of Taxation issued the Automatic Personal Income Tax Refund Procedure. In order for taxpayers' personal income tax refund dossiers to be processed automatically, the General Department of Taxation encourages taxpayers to use the "Suggested Personal Income Tax Finalization Declaration" function and link and register bank account numbers (identified and authenticated) on electronic tax applications (eTax Mobile application, electronic tax application for individuals - iCanhan) to submit personal income tax refund dossiers.

After receiving the personal income tax refund dossier of the taxpayer, the tax industry's IT application system will classify the dossiers that are eligible for automatic processing, the IT system will automatically synthesize data to warn and perform post-refund control processing or refund recovery (if any).

Taxpayers shall be responsible before the law for the tax refund amount declared to the tax authority. In case of detecting fraudulent tax refunds by taxpayers, the tax authority shall recover the tax refund and handle it according to the law.

What to do when you discover that your income has been misreported or overstated?

The Tax Department of Region I notes that in cases where individuals discover that enterprises use their personal information (Name, Tax Code, Citizen Identification Number) to declare and calculate salary and wage expenses when determining corporate income tax obligations while no actual income is paid to individuals, affecting the data and personal income tax settlement obligations of individuals, individuals can send feedback electronically to the tax authority about the incorrect income declaration or false income declaration.

Accordingly, when a taxpayer sends feedback via eTax Mobile or ICanhan, the system will automatically send feedback information to the email address of the business being reported, and at the same time send it to the tax authority managing the business and the tax authority processing the taxpayer's file.

Based on the information provided by taxpayers, tax authorities promptly take measures to check and verify information and take strict measures against enterprises that use information of individuals to declare and calculate expenses while not actually paying income to individuals.

Source: https://www.anninhthudo.vn/quyet-toan-thue-thu-nhap-ca-nhan-nam-2024-mot-so-diem-nguoi-nop-thue-can-luu-y-post605880.antd

![[Photo] Prime Minister Pham Minh Chinh chairs conference on breakthrough solutions for social housing development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/24/1761294193033_dsc-0146-7834-jpg.webp)

![[Photo] Prime Minister Pham Minh Chinh and South African President Matamela Cyril Ramaphosa attend the business forum](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/24/1761302295638_dsc-0409-jpg.webp)

![[Photo] President Luong Cuong chaired the welcoming ceremony and held talks with United Nations Secretary-General Antonio Guterres](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/24/1761304699186_ndo_br_1-jpg.webp)

![[Photo] Solemn funeral of former Vice Chairman of the Council of Ministers Tran Phuong](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/10/24/1761295093441_tang-le-tran-phuong-1998-4576-jpg.webp)

Comment (0)