The breakthrough growth of technology and the need to promote cross-border trade activities make SMEs prioritize choosing modern payment methods. Credit cards and debit cards are favored by businesses because of their fast and convenient payment speed, and are financial management tools that help SMEs save time and optimize resources. In addition, validly recorded expenses will be deducted from corporate income tax. Grasping the trend, the increasing demand for businesses to use credit cards and debit cards, banks create more attractive incentives, increasing benefits for SMEs. VPBank stands out with two card lines: VPBiz Debit Cashback debit card and VPBiz Mastercard credit card. These are two product lines that the bank has carefully researched and designed "tailor-made" to bring many outstanding benefits, bringing prosperity to small and medium enterprises.

Business debit card with the biggest incentives on the market

Difficulties in the consumer market have caused many businesses' revenue to plummet. SMEs have had to find many solutions to tighten their belts, cut spending, cut staff, and optimize operating costs. In order to share the current challenges of businesses, VPBank has pioneered many breakthrough policies that bring outstanding financial benefits to customers.

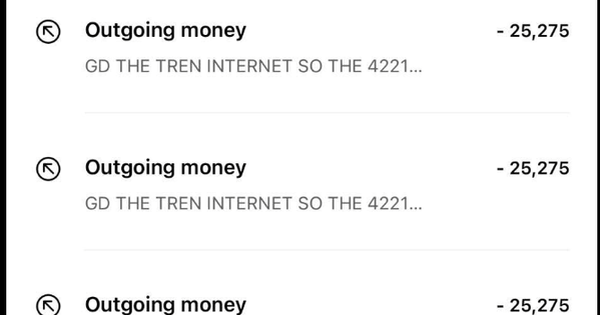

Accordingly, customers using VPBiz debit cards will enjoy the most attractive privileges on the market: Unlimited 0.5% cashback for all spending areas and 100% exemption of annual fees for the first year and subsequent years when meeting the condition of total accumulated transactions of 20 million VND or more... In particular, from now until December 31, 2023, new customers who open a debit card and spend a minimum of 500,000 VND will receive a refund of 200,000 VND, and those who spend a minimum of 3 million VND will receive an additional refund of 400,000 VND. For customers who already have a debit card but have not activated it, when they activate it and spend a minimum of 3 million VND, they will receive a refund of 400,000 VND. VPBank's VPBiz Debit Cashback card is also favored by thousands of businesses because of its fast and convenient payment features, and can be used at 33 million points of sale in 22 countries around the world. In addition, the card is designed to be absolutely safe and secure according to international PCI DSS standards.

Pioneering corporate credit card with installment payment feature

In the digital age, credit cards are financial assistants that help businesses manage cash flow effectively and transparently. VPBank's credit cards are one of the pioneering card lines with this feature. The bank has introduced a policy to support businesses participating in the installment payment program for credit transactions on each card and the entire outstanding balance on the contract. Accordingly, with each main card and each sub-card on the card contract, businesses have the opportunity to participate in the installment payment program for credit transactions and the entire outstanding balance on the card contract. This special policy is an effective solution that VPBank has implemented to share financial difficulties for businesses.

Another plus point for VPBiz Mastercard corporate credit card is that corporate customers who register for credit card installments will have the maximum period extended to 36 months. In addition to paying a fixed monthly installment amount, customers will only have to pay an interest rate of 1.1% / month, a superior policy to support businesses in managing cash flow.

"I am very satisfied when using VPBank's corporate credit card. Thanks to the credit card installment policy of up to 36 months, I can save a part of my budget and reserve more financial resources for operations," said Ms. Van Anh, Director of a garment company in Hanoi.

With the goal of providing optimal cash flow management solutions and flexible capital utilization tools for businesses, VPBank is constantly striving to improve VPBiz card products and services to meet the needs of 6 million businesses and business households across the country.

Source link

Comment (0)