|

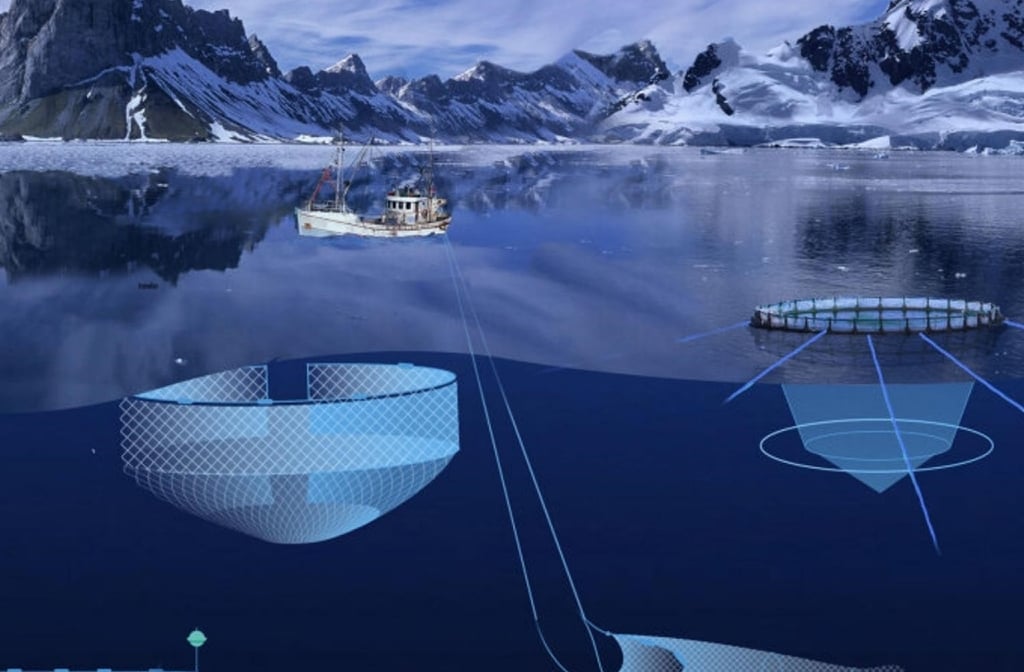

| Durian has emerged as the most important export commodity. (Source: Vinh Long Newspaper) |

From "insignificant" turnover, this item has risen to become the most important export item.

According to preliminary statistics just announced by the General Department of Customs, the export turnover of fruits and vegetables in the past 8 months is estimated at 3.5 billion USD, up nearly 56% over the same period last year. This is a record high for the fruit and vegetable industry. In particular, durian has risen from "insignificant" turnover to become the most important export item.

According to the General Department of Customs, this figure is even higher than the total export turnover of fruits and vegetables last year. Among the fruit and vegetable groups, durian and dragon fruit are the fruits that contributed the most to this growth. In particular, durian exports in the first 8 months accounted for 30% of the total turnover.

According to the Vietnam Fruit and Vegetable Association, the reason for the sharp increase in durian exports is that May and June are the peak harvest season for this fruit in the southern provinces, so the amount of goods exported to the Chinese market has increased dramatically. From August to the end of the year, the Central Highlands will enter the main harvest season. Therefore, output will skyrocket and durian exports will exceed 1 billion USD.

Currently, the purchase price of durian is increasing sharply due to the end of the season in the West. At the gardens, the price of first-class durian is being advertised at 85,000 - 100,000 VND/kg, double the price of the same period last year.

Recently, Vietnamese durian has been bought at a high price by Chinese businesses and retailers. In addition, the short shipping time and the freshness of Vietnamese products make them highly competitive compared to Thai products.

Statistics from the Ministry of Industry and Trade show that fruit and vegetable exports to major markets in the first 7 months of 2023 all grew well, except for the US market, Taiwan (China), Thailand and Australia. Leading in export value is the Chinese market, reaching 2 billion USD, up 128.5% over the same period in 2022. High growth in fruit and vegetable exports to the Chinese market contributed to promoting positive growth in the fruit and vegetable industry in 2023, as the export value to this market accounted for 64.7% of the total export value of fruit and vegetable products.

Next, exports to the US market reached 140.5 million USD, down 11.2% over the same period in 2022; to South Korea reached 125.1 million USD, up 13%; to Japan reached 105.6 million USD, up 5.5%... The demand for importing fruits and vegetables in these markets is large, but Vietnam only exports a small part of the total demand, so there is still a lot of room for businesses to exploit.

It is forecasted that in 2023, fruit and vegetable exports will likely reach the historic milestone of 5 billion USD. Experts believe that in the context of global inflation, in 2023, China will be the most potential destination for Vietnamese agricultural products thanks to its booming demand, close geographical location, logistics costs and lower risks than other markets.

In the first 7 months of 2023, Vietnam's import and export of goods with Asia reached nearly 242 billion USD.

According to the General Department of Customs, Vietnam's import and export of goods in the first 7 months of 2023 to the Asian market reached 241.84 billion USD, accounting for the largest proportion of 65% of the total import and export value of Vietnam's goods to the world and decreased by 13.5% compared to the same period last year.

Next is the Americas with 76.47 billion USD, accounting for 20.4%, down 18.7%; Europe is 42.06 billion USD, accounting for 11.2%, down 7.4%; Oceania is 8.97 billion USD, accounting for 2.4%, down 15.2%; Africa is 5.02 billion USD, accounting for 1.3%, up 4.8% over the same period last year.

Merchandise trade declined in line with the general trend of global trade.

Vietnam's goods exports to Asian markets, except China, grew positively at 1.8% (30.5 billion USD), all other major markets decreased.

For example, exports to Japan were 13.086 billion USD, down 3.1%, to South Korea were 13.175 billion USD, down 7.2%, and to ASEAN were 18.639 billion USD, down 8.7% over the same period.

Major markets such as the EU and the US also witnessed a sharp decline. In 7 months, exports to the US reached 53.096 billion USD, down 20.8%, to the EU 27 reached 25.261 billion USD, down 8.8%, to Oceania, including Australia and New Zealand reached 3.439 billion USD, down 11.1%.

Vietnam's trade in goods with the Asian region in 2022 reached 475.29 billion USD, an increase of 9.6% compared to 2021, continuing to account for the highest proportion (65.1%) of the total import-export value of the whole country.

Specifically, according to these statistics, the total import-export turnover of the whole country reached 730.2 billion USD, an increase of 9.1% (equivalent to an increase of 61.2 billion USD) compared to 2021. Of which, export was 371.3 billion USD, an increase of 10.5%, equivalent to an increase of 35.14 billion USD; import was 358.9 billion USD, an increase of 7.8%, equivalent to an increase of 26.06 billion USD.

Last year, Vietnam's trade in goods with Asia reached 475.29 billion USD, of which exports in 2022 reached 177.26 billion USD, up 9.5%, accounting for 47.7% of the country's turnover; imports reached 298.03 billion USD, up 9.6%, accounting for 83% of the country's turnover. Among the 5 continents, Vietnam only had a trade deficit with Asia.

Major partners in this continent include China, Korea, Japan, ASEAN region...

Last year, import and export with ASEAN reached 81.14 billion USD (export 33.86 billion USD, up 17.7%, import 47.28 billion USD, up 14.9%), trade deficit from this market was 13.42 billion USD.

Two-way trade with China reached 175.65 billion USD (exports 57.7 billion USD, up 3.3%, and imports from China 117.95 billion USD, up 7.2%), trade deficit with China 60.25 billion USD.

With Korea reaching 86.38 billion USD (export 24.29 billion USD, up 10.7% and import 62.09%, up 10.5%), Vietnam had a trade deficit of 37.8 billion USD from this market.

Two-way trade with Japan reached 47.6 billion USD (exports 24.23 billion USD, up 20.4%, imports 23.37 billion USD, up 2.6%), trade surplus of nearly 1 billion USD.

Textiles anxiously "wait" for signals from the US market

According to experts, the US market is showing signs of improvement in the last months of 2023, which could reduce the pressure on suppliers to reduce exports.

Based on historical statistics of US garment imports over the past 20 years, the Vietnam Textile and Garment Group believes that although textile imports in the first 6 months of 2023 decreased by 23% compared to the same period, they still reached 38 billion USD, equivalent to the normal import level before the Covid 19 pandemic.

|

| Vietnam's textile and garment export turnover to the US is expected to reach 8 billion USD in 2023. (Source: Finance Magazine) |

In the absence of any major shocks to the global economy and the US economy maintaining monthly job growth of around 200,000 new jobs, and average hourly earnings still increasing by over 4%, it is expected that in the last 6 months of 2023, US textile and garment imports will increase by 10% compared to the first 6 months of 2023, reaching about 43 billion USD, so that the whole year's garment import turnover will reach 80 billion USD (down about 20% compared to last year).

Agreeing with this view, Mr. Truong Van Cam - Vice President of Vietnam Textile and Apparel Association commented: The order situation from now until the end of the year will improve and it is expected that Vietnam's textile and garment export turnover to the US will reach 8 billion USD in 2023.

The US textile import market may be improving, however, suppliers are advised to monitor issues of concern to US importers that may affect order placement.

First , inflation and the outlook for the US economy. Some comments say that the US economy can avoid a recession when the job market is still strong, the unemployment rate remains at 3.5%, but the demand for consumer goods in general, including textiles, will only really recover when interest rates start to decline.

Second , after more than a year of the Forced Labor Protection Act (UFLPA) being implemented, according to statistics from the US Customs Service (CBP), by the end of June 2023, 812 shipments of textiles, footwear, and leather goods worth 34 million USD were detained for investigation related to the UFLPA. Although in terms of value, the shipments under investigation account for a very small proportion of the nearly 60 billion USD of textiles, footwear, and leather goods imported into the US, the risk of the US importer's responsibility to prove that there is no violation is very high. This requires all members of the supply chain, from fiber suppliers, textiles to garments, to be responsible for working with importers/buyers to prove that goods exported to the US do not violate the UFLPA.

Third, regarding production costs, wage costs in textile and garment producing/exporting countries are on the rise, and compliance costs with regulations such as the UFLPA continue to increase production costs and sourcing costs for major US fashion brands.

Fourth , the US continues to look for alternative sources of supply from China. Statistics show that in the first 6 months of 2023, China's market share of cotton imports fell below 10% and this trend is sure to continue next year.

In addition, other issues such as “Compliance with trade-related regulations” and “Investment and technology updates” in the context of increasing digitalization in the fashion business, from product design, order management to supplier tracking, are also concerns of US buyers.

To take advantage of the opportunity of the US market showing signs of improvement in the last months of the year to boost exports, Mr. Do Manh Quyen - Head of Trade Branch, Vietnam Trade Branch in Houston, USA said: Enterprises need to redefine their domestic production and business planning strategies, clearly identify the market and products, promote understanding of regulations and barriers to exporting to the US market; improve the quality of goods as well as production technology.

In addition to finding large distribution channels, it is necessary to find niche markets for export because large distributors have the obstacle of disconnecting when they reduce demand, which causes the export activities of enterprises to fall into a state of disruption. At the same time, trade promotion activities should seek out businesses and local people to sign consulting contracts to have the opportunity to resolve inventory and retail goods.

Source

Comment (0)