The “explosive” business results in the fourth quarter helped Nam Long make up for the losses in the first and third quarters. Thereby, helping the company complete its business target for the whole year of 2024.

Nam Long's Q4/2024 profit increased 1.7 times, completing the 2024 full-year target

The “explosive” business results in the fourth quarter helped Nam Long make up for the losses in the first and third quarters. Thereby, helping the company complete its business target for the whole year of 2024.

Nam Long Investment Joint Stock Company (HoSE: NLG) has just announced its consolidated financial report for the fourth quarter of 2024 with quite positive business results.

Specifically, in the last quarter, Nam Long recorded net revenue of more than VND 6,368 billion, net profit of VND 497 billion, a sharp increase of 3.9 times in revenue and nearly 1.7 times in profit compared to the same period last year.

Nam Long said this was a “booming” quarter in terms of sales for the company. The company has handed over many key projects such as Akari City (HCMC), Can Tho, Southgate (Long An), Izumi (Dong Nai). Revenue from project handovers reached VND6,957 billion. Of which, revenue from Akari City accounted for the largest proportion, reaching 74%.

Accumulated for the whole year of 2024, Nam Long achieved nearly 7,200 billion VND in net revenue and more than 512 billion VND in net profit, corresponding to an increase of 126% in revenue and 6% in profit over the same period.

Thus, the company exceeded the revenue plan by 8% and the profit plan by 1%.

|

Nam Long's inventory at the Akari project has dropped sharply from VND1,700 billion to more than VND300 billion. |

Positive business results also help Nam Long's operating cash flow to be quite abundant. By the end of 2024, operating cash flow will return to positive after two consecutive negative years, reaching nearly VND1,203 billion.

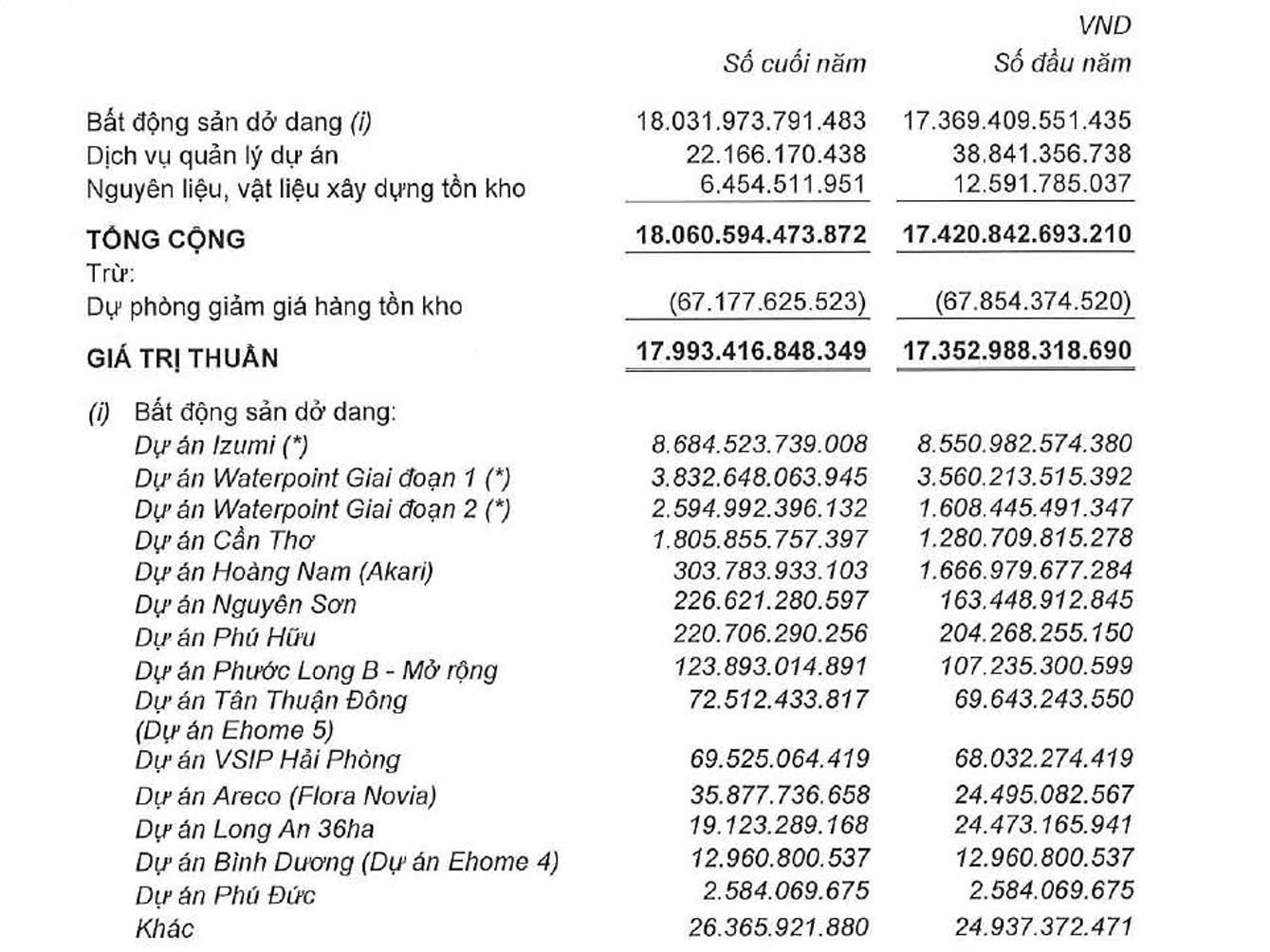

Total assets also increased by 6% compared to the beginning of the year, recording over VND 30,300 billion. Accounting for a large proportion of total assets is inventory of nearly VND 18,000 billion, a slight increase compared to the beginning of the year, mainly real estate projects under implementation such as Izumi (VND 8,684 billion), Waterpoint phase 1 (VND 3,832 billion) and phase 2 (VND 2,594 billion), Can Tho project (VND 1,800 billion)...

The company is also holding more than VND3,000 billion in short-term prepayments from buyers. At the same time, it has a deposit of more than VND4,000 billion at the bank with an original term of less than 3 months with interest rates ranging from 2.9 - 5.5%/year.

As of December 31, 2024, Nam Long has VND 6,961 billion in financial debt. Of which, outstanding credit debt is nearly VND 2,400 billion, outstanding bond debt is more than VND 3,600 billion.

Nam Long's credit loans have interest rates ranging from 4 - 9.5%/year, secured by land use rights and remaining receivables of construction contracts. Meanwhile, the bonds issued by Nam Long have interest rates of 6.5 - 10.11%/year, secured by shares of the project enterprise and land use rights.

Regarding the capital mobilization plan, Nam Long plans to close the shareholder list right after the 2025 Lunar New Year holiday to get opinions on the plan to offer shares to existing shareholders according to the 2025 business plan and other issues.

The consultation is expected to take place in February 2025, and the document will be sent to shareholders no later than February 12. The specific issuance volume has not yet been announced.

Source: https://baodautu.vn/loi-nhuan-quy-iv2024-cua-nam-long-tang-17-lan-hoan-thanh-muc-tieu-ca-nam-2024-d242720.html

Comment (0)