VIS Rating believes that, after a series of regulatory reforms and the implementation of the new securities law, the corporate bond market is back on track.

“The corporate bond market is back on track”

VIS Rating believes that, after a series of regulatory reforms and the implementation of the new securities law, the corporate bond market is back on track.

Assessing Vietnam's credit environment in 2025, VIS Rating believes that after significant improvement in 2024, Vietnam's credit conditions will enter a stable state in 2025.

The credit rating agency said that focusing on policies and measures to support the economy will boost domestic business and consumption activities.

Public spending, FDI and exports are key to maintaining Vietnam’s strong economic outlook and achieving its GDP growth target of 7.0-7.5% by 2025. However, with foreign exchange reserves at their lowest level in five years at the end of 2024, the State Bank of Vietnam has limited room to manage exchange rate fluctuations. If foreign currency outflows increase and the VND depreciates further, interest rates could rise and hurt domestic business growth.

Increased investment in public infrastructure will boost business activities of enterprises in the construction, materials and transportation sectors. New policies to address legal barriers and improve land planning will promote the development of new real estate projects and increase homebuyers' confidence.

Retail sales in 2025 could increase by 10-12% compared to 2024 as civil servants' wages increase and household incomes recover. Improved business and consumer confidence will boost lending demand. The main uncertainty in VIS Rating's base case is that the US policy direction under the new Trump administration could have a negative impact on exporting countries, including Vietnam.

Overall, funding conditions will remain stable in 2025. Banks have solid funding and liquidity to increase new lending to domestic businesses and individuals.

VIS Rating believes that, following a series of regulatory reforms and the implementation of a new securities law, the corporate bond market is back on track, marked by steady growth in new issuance value for both public and private issuances.

Investor confidence will continue to improve, thanks to tighter bond issuance regulations and higher information transparency requirements. Bond issuance to repay old debts will be less difficult than in previous years, even if interest rates are adjusted up due to competition for bank deposits.

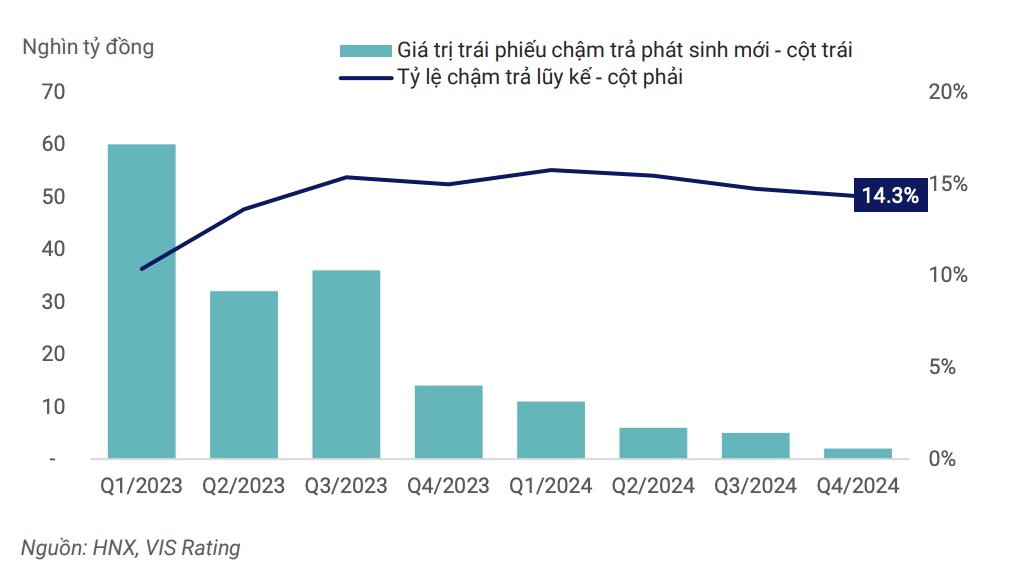

The delinquent bond ratio will gradually stabilize to a new normal level in 2025, reflecting a strong macroeconomic and business environment, and a gradually improving legal framework and market infrastructure to manage default risks.

|

| The market-wide delinquency rate peaked in Q1/2024 and is declining. |

A strong economy will help improve cash flow, debt repayment capacity, and refinancing needs. Tighter regulations on corporate bond issuance and investment, information transparency, and the use of credit ratings to warn of investment risks will help improve the depth of the corporate bond market in the new development stage. Along with that, issuers and investors will be more confident in applying new financial instruments to restructure debt and/or avoid late bond payments.

However, risks remain. VIS Rating said that although corporate cash flows continue to recover, high leverage and weak liquidity remain major weaknesses in debt repayment capacity.

Real estate, construction and building materials businesses still have high debt leverage. The average debt/EBITDA of listed companies in these industries is nearly 9 times, higher than the general average of 3.6 times. The dependence on short-term debt for long-term investment has led to a sharp increase in corporate bond defaults in 2022-2023. When the financial market ran out of liquidity, businesses without cash flow from operations were unable to find sources of restructuring loans to pay for maturing bonds.

Even with improved cash flows, leverage will remain high as businesses often borrow more to restart expansion projects. Until businesses improve their debt management policies, liquidity risk will remain a key risk to monitor.

Source: https://baodautu.vn/thi-truong-trai-phieu-doanh-nghiep-dang-tro-lai-dung-huong-d245064.html

Comment (0)