Faced with increasing maturity pressure, many real estate businesses are forced to restructure their financial obligations to maintain operations and ensure cash flow.

Faced with increasing maturity pressure, many real estate businesses are forced to restructure their financial obligations to maintain operations and ensure cash flow.

The corporate bond market continues to witness a wave of debt extensions, especially in the real estate sector. Facing great maturity pressure, many businesses are forced to restructure their financial obligations to maintain operations.

One typical case is Century Real Estate Investment and Development Corporation (Cen Invest). Bond code CIVCB2124001, issued in October 2021 with a fixed interest rate of 10.5%/year, initially had a term of 3 years and was expected to mature on October 13, 2024. However, after the second agreement with bondholders at the end of October 2024, Cen Invest extended the settlement date to October 13, 2025.

Previously, this bond was secured by 50 million shares of Century Real Estate JSC (Cen Land, HoSE: CRE) of Cen Group and property rights from the cooperation contract between Galaxy Land and CRE at the Hoang Van Thu urban area project (Hoang Mai, Hanoi). However, with the CRE share price plummeting from over VND25,000/share in early 2022 to below VND7,000/share, Cen Invest had to add collateral.

|

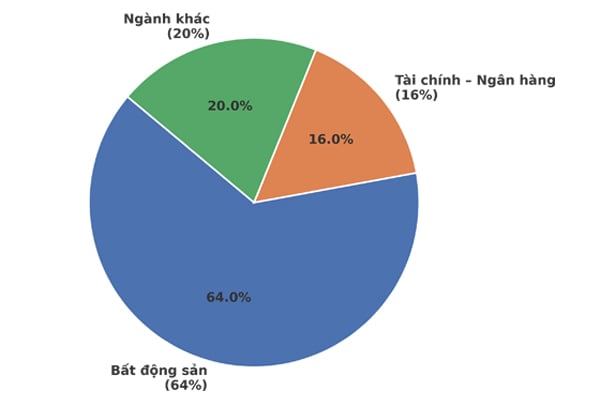

| Bond maturity structure by industry in 2025 according to data from VNDIRECT Research. |

According to a document sent to the Hanoi Stock Exchange (HNX) on February 11, 2025, this enterprise has mortgaged an additional 20.7 million shares of Thanh Dat VN Investment JSC (equivalent to 67.87% of charter capital), the investor of the Khe Cat residential area project in Quang Yen, Quang Ninh, along with property rights arising from the project.

Not only acting as collateral, Thanh Dat VN also commits to guarantee payment for Cen Invest's bonds, and not to incur new loans or use assets to secure other obligations. If it has to sell all shares in Thanh Dat VN to pay off the debt, Cen Invest commits to a minimum price of VND 373 billion, subject to bondholder approval. This transaction will be completed no later than May 31, 2025, and the proceeds after deducting expenses will be transferred to the bond repayment account.

A similar situation occurred at CRE, which has just been approved by bondholders to extend its CRE202001 bond for nearly 9 months. This bond is worth VND450 billion, issued at the end of 2020 with an initial term of 36 months, but has been extended for a total of 22 months. By the end of 2024, the company had repurchased part of the principal debt, reducing the outstanding debt to about VND354 billion.

CRE's bonds are also secured by nearly 59 million CRE shares, along with 50 million Cen Invest shares, property rights from Galaxy Land and some other assets. However, due to the decline in share value, the company had to adjust the payment plan.

According to the document sent to HNX on January 24, 2025, CRE committed to transferring all cash flow from the cooperation contract at Khe Cat project to the debt repayment account for bondholders. At the same time, the bond interest rate was also adjusted down from 12%/year to 10.5%/year from February 2025.

In addition to Cen Invest and CRE, many other real estate companies are struggling to extend their bond debt. For example, Nam An Investment and Trading Joint Stock Company is facing a bond maturity of VND4,700 billion. Nam An is under great pressure due to its difficult financial situation and debt/equity ratio exceeding the safety threshold.

Or at Southern Star Urban Development and Business Investment Joint Stock Company, with 4,695 billion VND in bonds due, this enterprise is in an alarming state regarding its ability to pay.

Similarly, Nam Long Investment Joint Stock Company (NLG) has settled two bonds worth VND1,000 billion in advance to reduce debt pressure, although the original maturity date is March 2029. Hai Phat Real Estate Investment and Trading Joint Stock Company has also completed the early purchase of VND390 billion of bonds, bringing the outstanding bond balance to 0...

According to a report by VNDIRECT Securities Research, 2025 will continue to be a challenging year for the corporate bond market when the total value of matured bonds is estimated at VND203,000 billion, an increase of 8.5% compared to 2024. In particular, the real estate group faces the greatest pressure with more than VND130,000 billion of matured bonds, accounting for 64% of the total maturity value of the whole market and twice as high as in 2024.

A worrying factor is that VND56,000 billion of previously extended real estate bonds will mature in 2025, increasing liquidity pressure for businesses in the context of a sluggish real estate market. Legal clearance for projects is still slower than expected, causing difficulties for real estate businesses.

Not only the real estate industry, financial and banking enterprises also have a significant volume of bonds maturing in 2025, with a value of more than VND 33,000 billion, accounting for more than 16% of the total maturity value.

In general, with increasing debt pressure, real estate businesses must not only find ways to restructure financial obligations but also ensure stable cash flow to overcome this difficult period.

Source: https://baodautu.vn/doanh-nghiep-bat-dong-san-no-luc-gia-han-no-trai-phieu-d246749.html

![[Photo] General Secretary To Lam meets with Chairman of the Federation Council, Parliament of the Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/2c37f1980bdc48c4a04ca24b5f544b33)

![[Photo] Ho Chi Minh City: Many people release flower lanterns to celebrate Buddha's Birthday](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/10/5d57dc648c0f46ffa3b22a3e6e3eac3e)

Comment (0)