Recently, the Board of Directors of Dat Phuong Group Corporation (HOSE: DPG) announced many decisions related to lending and loan guarantees for its subsidiary - Dat Phuong Son Tra Hydropower Joint Stock Company.

Specifically, on November 21, 2023, Dat Phuong's Board of Directors issued Decision No. 44 on lending Dat Phuong Song Tra Hydropower Joint Stock Company a maximum of VND 500 billion, with a loan term of 1 month, for the purpose of lending to serve production and business activities.

One day later, Dat Phuong's Board of Directors issued Decision No. 48, approving the mortgage of shares and all benefits arising from the number of shares owned by the Company at Dat Phuong Son Tra to secure a medium and long-term loan for the Son Tra hydropower project at BIDV Bank.

The project is invested by Dat Phuong Son Tra. The total mortgage value at face value is nearly 384 billion VND. Dat Phuong commits to unconditionally and irrevocably guarantee to pay the debt on behalf of Dat Phuong Son Tra in case this subsidiary fails to repay the loan to BIDV in full and on time.

According to Dat Phuong's 2022 annual report, Dat Phuong Son Tra Hydropower Joint Stock Company manages and operates Son Tra 1A-1B-1C hydropower plants, and at the same time carries out the final settlement of the Son Tra 1C project.

2022 is the first year that all three Son Tra 1A-1B-1C hydropower plants will be fully operational throughout and the plants will operate stably, achieve high efficiency, and have no serious incidents.

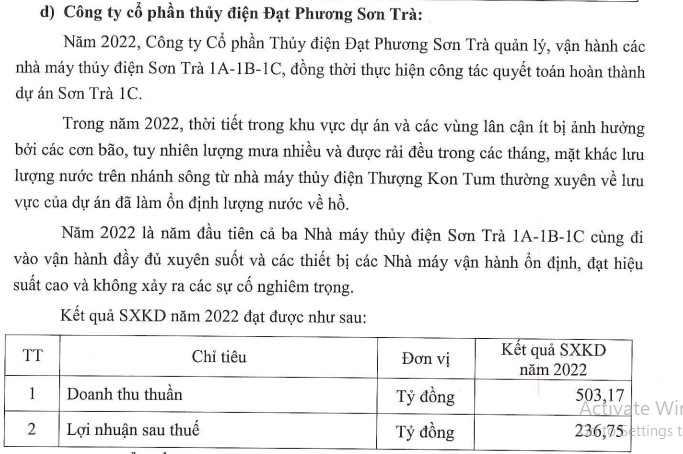

This contributed to Dat Phuong Son Tra Hydropower Joint Stock Company's revenue reaching 503 billion VND, while the company reported a profit after tax of nearly 236 billion VND. Corresponding to every 100 VND of revenue, Dat Phuong Son Tra earned a profit of nearly 47 VND.

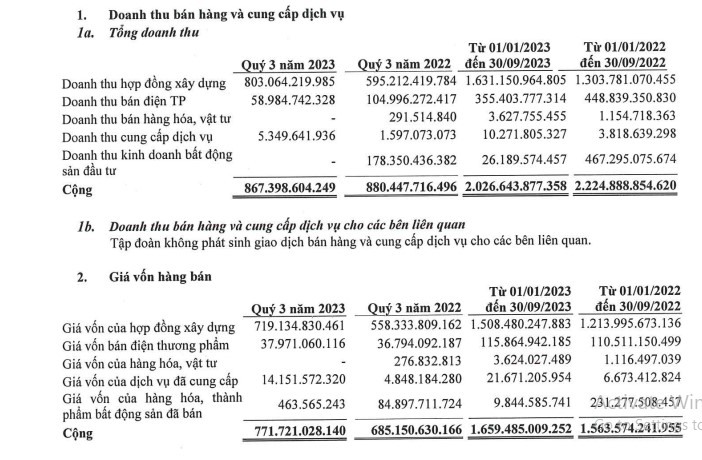

Meanwhile, according to Dat Phuong's recently announced third quarter 2023 financial report, at the end of the first 9 months of 2023, the company's revenue reached VND 2,026 billion, down 9% over the same period.

Looking at Dat Phuong's revenue structure in the period, it can be seen that with 1,631 billion VND, revenue from construction contracts accounts for 80% of Dat Phuong's total revenue. At the same time, Dat Phuong's construction sector in the last period improved, increasing by 25% compared to the same period.

Meanwhile, revenue from selling Dat Phuong finished electricity products in the first 9 months of the year reached 355 billion VND, accounting for 17.5% of total revenue and down 25% compared to the first 9 months of 2022.

However, Dat Phuong's gross profit margin from selling finished electricity products is higher at 67.6%, while the gross profit margin from the construction segment is only 7.5%.

At the end of the first 9 months of 2023, Dat Phuong reported a profit after tax of 168 billion VND, down 55% compared to the same period. It is known that in 2023, Dat Phuong set a plan for a profit after tax of 287 billion VND, thus, the enterprise has only completed 58% of the profit target set after 9 months.

Source

Comment (0)