The announcement of a series of ambitious projects by American technology companies shows their expectations for investment opportunities in Vietnam in the coming time.

The Vietnam-US cooperation relationship has been upgraded to a Comprehensive Strategic Partnership, creating expectations and momentum for breakthrough developments in bilateral relations in the coming time, especially in the field of technology cooperation. The results of cooperation in the field of digital technology between Vietnam and the United States after Prime Minister Pham Minh Chinh's visit to the US are expected by both sides. VietNamNet introduces articles on this topic.

During President Joe Biden's visit to Vietnam from September 10-11, 2023, leaders of a series of US technology companies announced ambitious investment projects in Vietnam: Artificial Intelligence (AI) projects of Nvidia and Microsoft; Projects to build new semiconductor design centers in Ho Chi Minh City by Synopsys and Marvell, plans to open a chip packaging facility of Amkor worth 1.6 billion USD in Bac Ninh in October 2023...

Prime Minister Pham Minh Chinh's visit to the US from September 17-23, 2023 also attracted the attention of leaders of US corporations, including SpaceX, Coca-Cola, Pacifico Energy... Minister of Planning and Investment Nguyen Chi Dung said that during the trip, the Prime Minister worked with many leading US technology corporations such as Synosyp, Meta, Nvidia... because science and technology is a pillar in the joint statement of the two countries. The US supports Vietnam in developing the semiconductor industry, focusing on issues such as technology transfer, training of human resources involved in chip design,...

With a busy schedule of activities, the working trip of Prime Minister Pham Minh Chinh and the Vietnamese high-ranking delegation to the US in September 2023 was a great success, achieving all the set goals and tasks at a high level. In the photo: The delegation participated in the Vietnam - US business forum.

Supply chain shift expectations

As tensions in the US-China trade relationship began to emerge in 2018, American businesses of all sizes began looking to shift production to emerging markets like Vietnam and India. American businesses decided to diversify their suppliers.

As the Covid-19 pandemic has spread, American businesses have become increasingly serious about adopting a “China + 1” strategy, which means expanding manufacturing centers outside of China to reduce dependence on a single manufacturing base.

According to a Rabobank report, an estimated 28 million jobs in China will be directly dependent on exports to the West by 2022. American businesses of all sizes have begun shifting production to emerging markets such as Vietnam and India in response to tariffs and geopolitical uncertainty.

The restructuring of global supply chains and new developments in Vietnam-US relations have made Vietnam emerge as a key player in this transition.

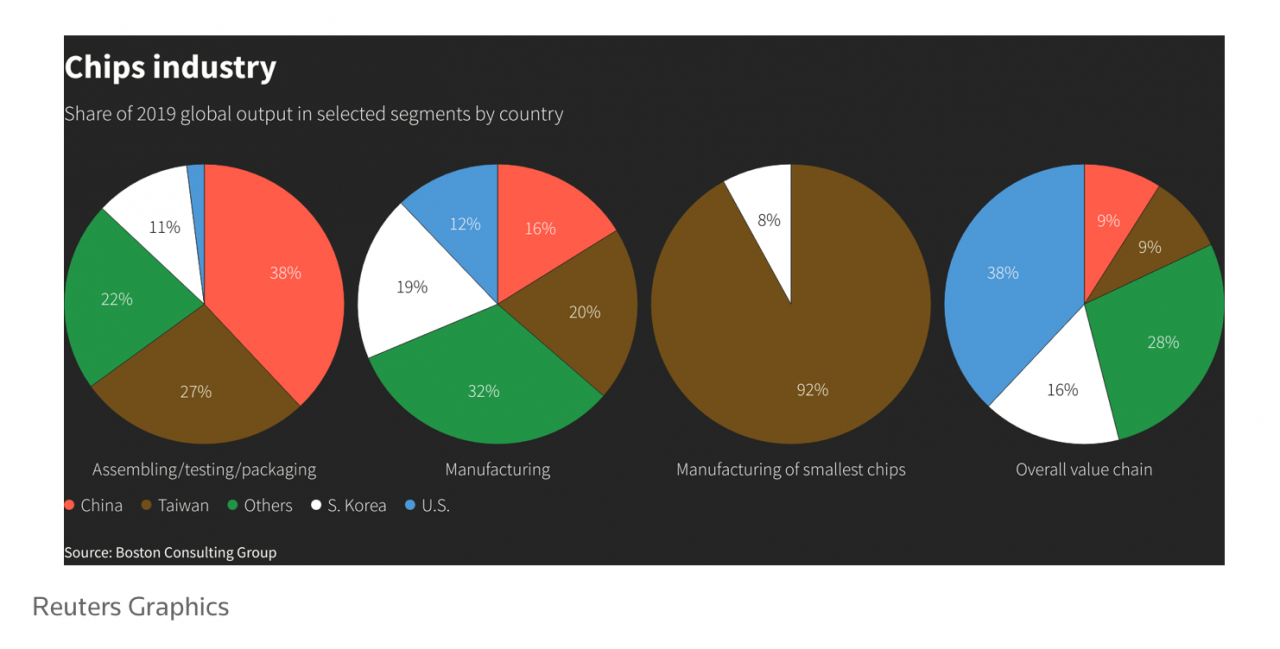

Diversifying the semiconductor supply chain is one of the top priorities of the administration of US President Joe Biden.

For the US, upgrading relations with Vietnam to the level of Comprehensive Strategic Partnership offers an opportunity to strengthen the industrial network in Vietnam, meeting the needs of the US market, in line with the shift. For Vietnam, this is an opportunity to attract large-scale investment, especially in the technology sector, to strengthen its industrial base.

Vietnam's economy has grown significantly in recent years. In the first eight months of 2023, Vietnam attracted about $18 billion in foreign investment, marking an 8% increase compared to 2022. Major international companies such as Samsung, LG and Foxconn - a major supplier to Apple, have established manufacturing facilities in Vietnam.

According to Michael Every - global strategist of Rabobank, relatively low wages and young population have given Vietnam a solid workforce and consumer market, promoting investment activities in Vietnam.

Alicia García-Herrero, chief economist at Natixis, said foreign companies are “flocking” to Vietnam. Compared to many other countries in the region, Vietnam has a clear advantage because it was the first country in the region to build “multi-sector” supply chain capacity many years ago.

Expect investment opportunities in key technology areas

During his recent visit to Vietnam, President Joe Biden announced the possibility of cooperation with Vietnam in the field of semiconductor chips. The US recognized Vietnam's important potential in building a semiconductor supply chain, especially the ability to expand production capacity in stages of production that cannot be transferred to the US.

Intel Corporation - the leading US semiconductor chip maker - has committed to invest 1.5 billion USD to build a factory near Ho Chi Minh City, which will be the largest single assembly and testing facility in the world.

Ted Osius, President of the US-ASEAN Business Council, recently predicted: “Vietnam’s importance will increase”, “we will see an acceleration when it comes to cooperation in the technology sector in Vietnam”.

Semiconductors open up potential for development cooperation between Vietnam and the US in the coming time.

When Vietnam began to encourage semiconductor and other high-tech industries in the early 2010s, it realized that it would first need to develop “supporting industries” that produce materials and components for other finished products. More importantly, success in key industries such as semiconductors was not the main goal, but merely a “support” for the overall development of Vietnam’s electronics industry. In doing so, Vietnam hoped to follow the model of the “East Asian Tigers” in attracting lower-value manufacturing, with the goal of moving toward a technologically advanced future.

Notably, in 2015, Vietnam passed two major tax incentives to attract investment in high-tech industries in Vietnam.

First, Vietnam offers a preferential corporate income tax rate of 10% for 15 years. This incentive applies to investments in both research and infrastructure for high-tech sectors, of which semiconductors are a priority.

Second, Vietnam provides for exemption and reduction of property tax (land rent). Companies and research organizations that build scientific research facilities are exempt from property tax for the entire land lease term if the facility is used for research, business incubation or prototyping.

In addition, to encourage companies to hire Vietnamese engineers, the standard 10% value-added tax (VAT) on services is reduced to 5% VAT for high-tech activities. Eligible activities include research, consulting, technology transfer and technical training... These are very attractive incentives for foreign high-tech companies looking for investment opportunities in key technology sectors in Vietnam in the near future.

Expectations of the ability to maintain high economic growth rates

The International Monetary Fund (IMF) predicts that Vietnam's growth rate will slow down, from 8% (2022) to 5.8% (2023) due to the impact of declining export value. However, when compared to the average global growth forecast of 3%, Vietnam's economic growth rate is still significantly faster than many major economies in the world, such as the US, China and Europe.

In a recent research report, investment management, insurance and financial services company Natixis (France) affirmed: "When the rest of Asia is in recession, Vietnam will still be one of the fastest growing economies."

That prospect is highly appealing to foreign corporations looking for bright spots in a gloomy economic environment. That interest was evident in March 2023, when the US-ASEAN Business Council led the largest-ever American business delegation to Vietnam, including 52 American companies, including major corporations such as Netflix and Boeing.

Despite concerns about the level of infrastructure development and human resources in Vietnam, American businesses are choosing and expecting Vietnam to become a capable partner to replace production activities in China. This is an opportunity for Vietnam to assert itself on the world technology map.

Comment (0)