In recent times, the Provincial Branch of the Vietnam Bank for Social Policies (VBSP) has implemented many solutions to mobilize financial resources to create capital sources to ensure loans to beneficiaries to promote the effectiveness of social policy credit; this is one of the major and meaningful policies of the Party and State to achieve the goal of sustainable poverty reduction, new rural construction and social security.

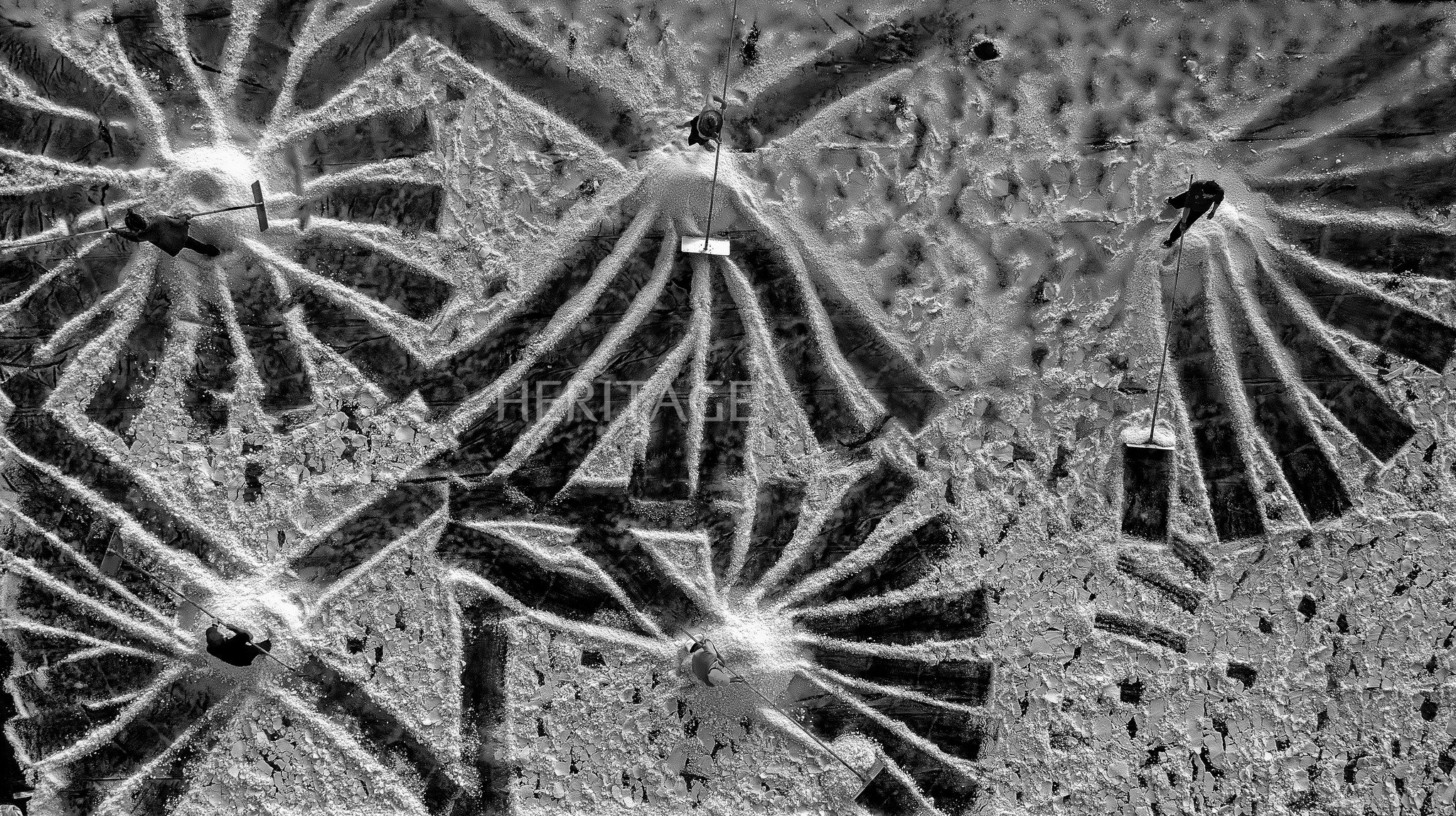

People transact at the Social Policy Bank transaction point located in Gio An commune, Gio Linh district - Photo: TU LINH

Director of the Provincial Branch of the Vietnam Bank for Social Policies, Tran Duc Xuan Huong, said that in order to achieve high results in mobilizing financial resources, the Provincial Branch of the Vietnam Bank for Social Policies always closely follows the goals and directions of the Vietnam Bank for Social Policies and flexibly applies mechanisms and policies on capital mobilization according to State regulations for implementation.

In addition, the branch also coordinated with the Provincial Vietnam Fatherland Front Committee to promote the campaign "Day for the Poor" launched by the Presidium of the Central Committee of the Vietnam Fatherland Front and the movement "For the Poor - No one is left behind", the peak month "For the Poor"; to call on organizations and individuals inside and outside the province and abroad to contribute resources to support the poor and supplement capital for the VBSP to implement social policy credit programs.

At the same time, coordinate with grassroots organizations, savings and loan groups (TK&VV) to actively participate in mobilizing savings deposits from residents, contributing to increasing financial resources for the bank. Along with that, the Board of Directors of the Social Policy Bank at all levels proactively advises the People's Council and People's Committee at the same level to pay attention and prioritize a portion of the budget to entrust through the Social Policy Bank to supplement capital sources, meeting lending needs.

In order to increase financial resources, the branch has deployed savings deposit and withdrawal services at the transaction center and all transaction points to promptly meet the deposit needs of the people. Since then, it has received more and more attention, attracting organizations and individuals to participate in depositing savings at the Social Policy Bank.

In 2023, the total capital mobilized from resources will reach VND 4,777.3 billion, an increase of VND 889.9 billion compared to 2022. Of which, the central capital source is VND 3,887.8 billion, accounting for 81.4% of the total capital source, an increase of VND 816.2 billion compared to 2022.

In particular, capital mobilized from the population and savings and credit groups reached 705.3 billion VND, accounting for 14.7% of total capital, an increase of 47.4 billion VND compared to 2022. Of which, savings mobilized through organizations and individuals was 475.5 billion VND; deposits mobilized through savings and credit groups was 229.8 billion VND. The capital source from the local budget entrusted for lending reached 184.2 billion VND, accounting for 3.9% of the total capital source of the VBSP, an increase of 26.3 billion VND compared to 2022.

With a large amount of additional capital, social policy credit programs are implemented continuously, stably and effectively by the bank. Ms. Dao Thi Lai in Hao Son village, Gio An commune, Gio Linh district is one of many cases that benefited from preferential credit capital to invest in production effectively and escape poverty. In 2019, Ms. Lai's family received a loan of 50 million VND from the Social Policy Bank Transaction Office of Gio Linh district from the poor household lending program. With this policy capital, she invested in pig farms.

Thanks to that, her family's income has improved. Every month, in addition to paying interest as prescribed, she also sets aside a certain amount to participate in savings through the Savings and Credit Group. By the end of this year, her family will pay off this loan and request to borrow more capital from the capital source of the program to support job creation, job maintenance and expansion to create more income for the family and escape poverty sustainably.

Head of the Savings and Credit Group in Hao Son village, Nguyen Thi Hoai, said that the group has 44 members, with a total outstanding debt of more than 2 billion VND. Many policy beneficiaries have timely access to loans, and have been instructed by bank staff on how to borrow and how to use the capital for the right purpose and effectively. In particular, the members of the group have formed the habit of accumulating monthly savings for group members to reserve for interest and principal repayment when due. To date, the group has had more than 165 million VND in savings from group members, thereby contributing to increasing the mobilized capital for the bank.

Thanks to the capital of the VBSP, many young people have been able to borrow capital to solve employment problems. In 2023-2024, the Provincial People's Committee has allocated 3 billion VND from the local budget entrusted through the VBSP to support rural youth and demobilized youth to borrow capital to start a business. Mr. Ho Van Muoi, in A Dang village, Ta Rut commune, Dakrong district, said that in 2019, he was discharged from the army and returned to his hometown.

With the natural terrain advantage in A Dang, Mr. Muoi decided to buy a field to grow cajuput trees and raise cows. Recently, he wanted to expand his production and business, so the Dakrong District Social Policy Bank Branch lent him 100 million VND for 5 years to expand the forest area and raise cows. With the loan, he planted 2 more hectares of cajuput trees and bought 5 cows to raise.

Thanks to being guided in farming and animal husbandry techniques along with his attention to learning and studying, Mr. Muoi's work initially progressed well. Every month, he regularly paid 500,000 VND including interest and savings to the bank.

According to Ms. Tran Duc Xuan Huong, in recent times, the local government has built and integrated many models, programs, and projects for socio-economic development and sustainable poverty reduction in the locality in association with the use of social policy credit capital; directed and implemented well the investigation and identification of poor and near-poor households as a basis for implementing credit policies; and strengthened the propaganda work on social policy credit for the people.

Along with that, the active professional solutions, the capital mobilization work of the VBSP has brought about clear results, creating changes in the awareness and actions of all levels, sectors and the whole society to join hands to create additional capital sources, helping the provincial VBSP to ensure the Government's lending programs achieve the highest results.

In particular, the bank promotes the linkage of social policy credit with activities supporting science and technology transfer, agricultural, forestry and fishery extension programs, vocational training, and local economic development models to improve the efficiency of using social policy credit capital more and more effectively.

Tu Linh

Source

Comment (0)