Depending on each destiny, stocks of different industries have different levels of “compatibility”. BSC also recommends that investors diversify their portfolios into different industries to avoid concentrated risks and choose stocks that they understand well.

Depending on each destiny, stocks of different industries have different levels of “compatibility”. BSC also recommends that investors diversify their portfolios into different industries to avoid concentrated risks and choose stocks that they understand well.

|

| BSC suggests potential 2025 investment portfolio according to the Five Elements theory |

Investors with Water and Metal elements need to pay attention to safety in the Year of Fire.

The theory of the five elements in feng shui is based on five basic types of matter: Kim (metal), Moc (wood), Thuy (water), Hoa (fire), Tho (earth) and the relationships that promote development (mutual generation) or inhibit each other (mutual inhibition) between the five elements mentioned above. In the report on the recommended investment portfolio according to the five elements of feng shui in 2025, BIDV Securities (BSC) has selected securities codes in the recommended portfolio according to fundamental analysis, with additional factors that are suitable in terms of the five elements of feng shui with investors based on the factors of mutual generation and mutual inhibition between pairs of factors including the five elements according to the year of birth of the investor, the five elements of the industry and the five elements of the year.

Accordingly, the Earth element symbolizes nurturing and the earth element is supported by the Fire element, investors of the Earth element receive the strongest support from the five elements of the new year At Ty - 2025 (Phu Dang Hoa). Therefore, 2025 promises to be a favorable year for investors of the Earth element in the investment field. For investors of the Fire element, the new year At Ty will be a relatively favorable year when the five elements of the year further strengthen the stability of the Fire element. Stocks with good fundamentals belonging to the Fire and Wood elements are suitable for investors of the Fire element this year. For investors of the Wood element, 2025 will be a relatively peaceful year because Wood and Fire are two compatible elements when Wood generates Fire. The choice of suitable stock codes for investors of the Wood element will be more diverse with industries belonging to the Water and Wood elements.

For investors of the Metal element, this new year will not be a very favorable year because the Fire element is in conflict with the Metal element. Therefore, for investors of the Metal element, when building an investment portfolio, they need to prioritize safety, and should only choose stocks that are compatible with the Metal element, the Earth element, and have solid fundamentals. Meanwhile, investors of the Water element need to emphasize safety during the investment process because the Water and Fire elements are two elements that have a conflicting relationship.

Diversify portfolio, choose stocks you understand best

According to analysts from BSC, in 2025, the Government sets a high GDP growth target. To achieve this growth, BSC expects the driving force to come from three groups: public investment, export and domestic consumption. Accordingly, corresponding industries such as construction, materials, textiles and retail are also forecast to have good business growth results in 2025. In addition, with the completion of the infrastructure system, the industrial park real estate group is forecast to benefit as Vietnam's FDI attraction continues to improve.

Regarding fiscal and monetary policies, the BSC team expects the State Bank to maintain low interest rates (4.5%) to support businesses in accessing loans, along with stable exchange rates and high credit growth, which will be a strong growth driver for priority sectors such as manufacturing, export and consumption. Some sectors such as fertilizer, steel and consumption also enjoy incentives related to VAT and protection tax, thereby contributing to increasing profit growth of this sector in 2025.

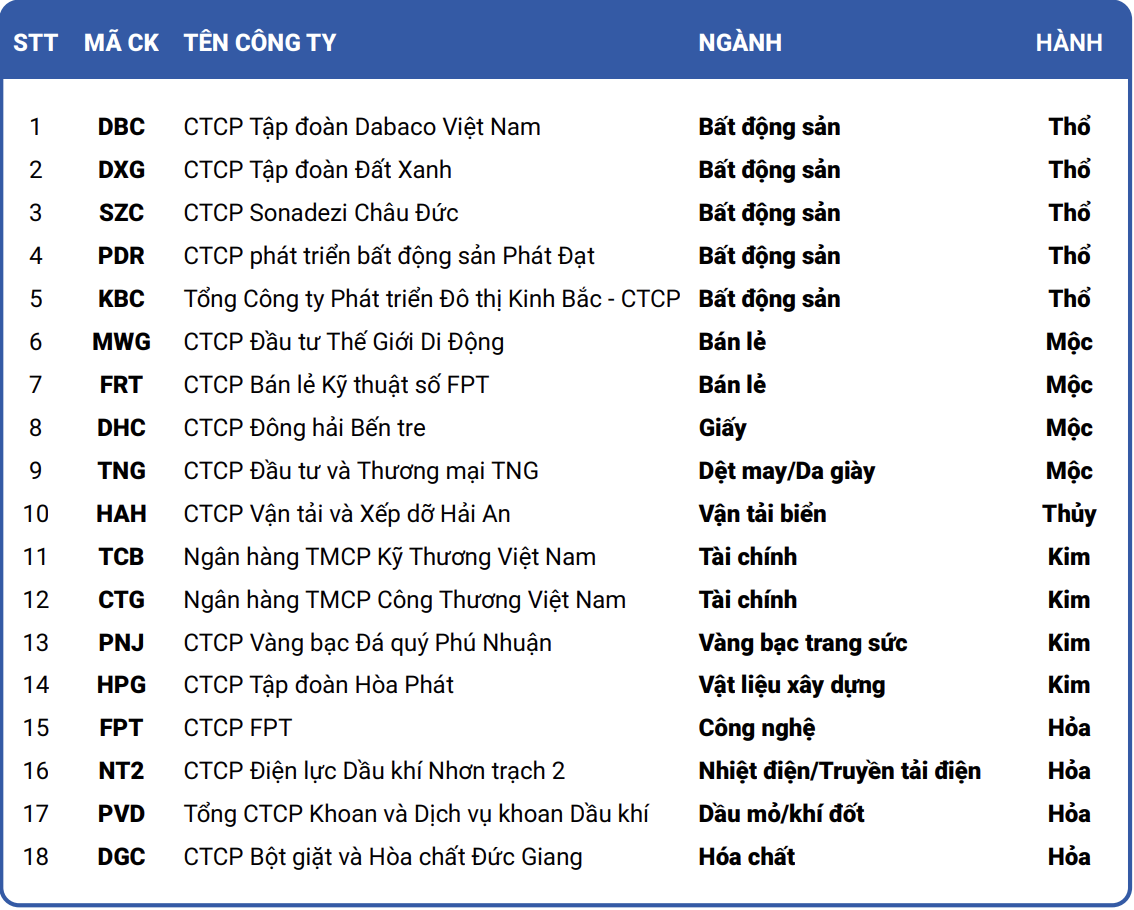

Given the above macroeconomic factors, BSC has built a recommended investment portfolio of 18 stocks, prioritizing industries with high growth rates benefiting from government policies such as retail, public investment or benefiting from the general growth of the economy such as retail, electricity, water, consumer goods, and banking.

Depending on each destiny, stock codes have different levels of “compatibility”. BSC experts also note that investors need to diversify their portfolios into different industries to avoid concentrated risks. At the same time, with the stock market being an unpredictable place, investors should choose the stock codes that they understand best.

|

| List of recommended stocks according to feng shui and five elements in 2025 |

Among the Earth group stocks, BSC assesses that DXG shares are currently at an attractive valuation as the company begins to enter the recovery phase. After two years of not launching new products, DXG's revenue from new real estate projects is expected to recover from 2025, which could mark the company's return. Phat Dat Real Estate Development Corporation with stock code PDR is also assessed by BSC to have a reasonable project development strategy in the provinces with good locations, reasonable selling prices and low competition, expected to bring good profits, with an average growth of up to 53% in the period of 2025-2026. However, the slow recovery of the real estate market could reduce the attractiveness of the valuation of these two stocks.

Meanwhile, Sonadezi Chau Duc JSC's SZC shares are expected to receive positive support from the first quarter 2025 business results with high profits thanks to the Huu Phuoc 1 Residential Area project being eligible for handover. At the same time, Sonadezi Chau Duc's rental area growth is forecast to stabilize at 40-50 hectares/year in the next two years, thanks to the Tripod ecosystem and strong FDI inflows in Ba Ria - Vung Tau, especially in the context of increasingly scarce land funds from existing industrial parks. In addition, in the Earth element, BSC also recommends DBC shares because stable pork prices at high levels help maintain high profits while valuations remain reasonable.

BSC's 2025 stock selection list also includes 4 Wood stocks. Of which, two retail representatives, MWG and FRT, are expected to have positive business results with growth in both revenue and profit. The Bach Hoa Xanh and Long Chau chains are considered the growth drivers of these two giants. Increased competition and an unfavorable economic context are risks to consider when investing in the retail group. With MWG, experts from BSC also noted one-time costs incurred during the corporate restructuring process.

In addition, the Wood element also has two manufacturing stocks, including DHC of Dong Hai Ben Tre and TNG. The story of DHC is that the Giao Long 3 factory is operating, which is expected to help increase market share and profits in the long term. However, the risk of poor exports causing a decrease in demand can also negatively impact this stock. For TNG, orders in 2025 are forecast to continue to grow but there is still a risk of slow recovery in demand. In addition, the company can reduce costs when interest rates decrease and exchange rates can be more stable than last year.

BSC only selected one stock in the Thuy element, which is HAH stock of Hai An Transport and Stevedoring JSC. The strong improvement in freight rates compared to the same period last year will support time chartering activities. As for self-exploitation activities, BSC also emphasized that the company has just opened a new service route in a joint venture with ONE shipping line. At the same time, HAH stock is currently priced reasonably at the beginning of the recovery period.

For Kim stocks, BSC recommends Techcombank, VietinBank, PNJ and Hoa Phat. The valuation of TCB shares ( projected P/B at 1x) shows attractiveness, CTG shares (projected P/B at 1.1x) are also much lower than the group of state-owned banks. Techcombank has a strong growth in demand deposits (CASA), along with improved NIM when the real estate market recovers, but interest rate competition is also a risk that can affect profit margins. The risk when investing in PNJ comes from the possibility of complex fluctuations in the gold business. However, BSC expects the profit margin of this jewelry company to improve thanks to stable input materials and effective marketing campaigns.

Regarding Hoa Phat, BSC expects the domestic steel industry to recover. When the Dung Quat 2 project is put into stable operation, it will help increase profits to VND30,000 billion/year, 2.5 times higher than in 2024. However, BSC's report also emphasized that pressure from Chinese steel sources will significantly affect HPG's business results if anti-dumping tax is applied slowly.

Fire stocks recommended by BSC for investment in the year of the Snake include FPT, NT2, PVD and DGC. These companies are expected to benefit from new investments, new business areas or fully depreciated existing factories. As with FPT, the AI business segment is expected to come into operation in 2025 and start to contribute significantly in 2026. At the same time, FPT's business results are expected to continue to grow strongly this year. However, the economic recession is a risk that could affect the decline in technology investment in key markets.

The investment highlight of NT2 shares also comes from profit growth, but thanks to the comparison with the low base level of 2024 due to lack of gas. In addition, the fact that the plant will be fully depreciated in the third quarter of 2025 will also have a positive impact on profits.

For PVD, the new rigs coming into operation from the fourth quarter of 2025 will be the driving force for profit growth from 2026. At the same time, the rig utilization rate remains high with 5/6 rigs working. The O Mon Block B project is both an opportunity to benefit and a risk if upstream projects are delayed, affecting the demand for rig rental.

Meanwhile, at Duc Giang Detergent and Chemical Joint Stock Company, the Nghi Son Duc Giang project recorded new progress in implementation. However, the project progress has been delayed, expected to contribute revenue from 2026. DGC's profit growth in 2025 is expected to reach 9% as chemical demand continues to show a recovery trend. DGC's strong financial situation with the cash ratio of total assets currently maintained at over 70% keeps the company ready for expansion and M&A opportunities. The company may face some risks in case of strong fluctuations in selling prices and demand for phosphorus or incidents related to the environment and tax policies.

Source: https://baodautu.vn/goi-y-danh-muc-dau-tu-2025-tiem-nang-theo-thuyet-ngu-hanh-d243764.html

Comment (0)