According to experts, gold prices are at a historical peak and in an overbought state, investors need to consider carefully before deciding to 'put money down'.

Is the increase in gold price a concern?

Sharing with VietNamNet reporter, Mr. Nguyen Quang Huy, Executive Director of the Faculty of Finance and Banking, Nguyen Trai University, said that domestic and world gold prices continue to maintain a strong upward trend, approaching a record high. The main reasons come from economic and geopolitical factors and the gold buying trend of large financial institutions.

“Major central banks around the world are continuously buying gold to increase foreign exchange reserves and prevent risks from unpredictable fluctuations in the global economy. This trend reflects a strategic shift to protect assets from the risk of devaluation of fiat currencies, inflation and financial instability,” Mr. Huy analyzed.

At the same time, the trade war between the US and several major countries is showing signs of tension again, directly affecting the global supply chain. The Middle East continues to face complex developments, affecting energy prices and market sentiment. The conflict between the US and Haiti has become more tense, causing money to flow to gold.

According to the expert, when instability increases, investors tend to seek safe havens, of which gold is always considered the top choice. Demand for physical gold, especially gold rings and SJC gold, has increased sharply in many countries, including Vietnam.

Associate Professor Dr. Nguyen Huu Huan, Ho Chi Minh City University of Economics, pointed out that the increase in world gold prices was mainly due to the impact of US President Donald Trump's policies, causing concerns about inflation and recession in the US. Unstable geopolitical issues in the world further supported the increase in gold prices.

It is normal for domestic gold prices to increase following world gold prices. Unlike before, world gold prices did not increase much, but domestic gold prices still increased sharply and the difference was up to several million VND per tael.

"Domestic gold prices increase following world prices, not due to market manipulation or control, so there is nothing to worry about," Mr. Huan said.

In the context of strong fluctuations in gold prices, there are opinions that Decree 24/2012/ND-CP should be adjusted to increase gold supply in the market.

Regarding this issue, Mr. Nguyen Quang Huy acknowledged that the State Bank may research and consider carefully and in the direction of ensuring national monetary security and preventing gold-ization among the people.

Accordingly, policies will aim to stabilize the financial market, avoid negative impacts on the monetary system; limit gold hoarding, ensure cash flow into the economy; gradually change the mindset of gold accumulation among people, encourage the conversion of capital into production and business, contributing to creating growth momentum for the economy.

When gold prices cool down, what should investors pay attention to?

Mr. Nguyen Quang Huy further analyzed that the world gold price is at a record high, exceeding 3,000 USD/ounce. Forecasts from major financial institutions are still positive but also note the possibility of adjustment due to overbought status, RSI exceeds 70 ( meaning the market is overbought, this pushes the price higher than the equilibrium threshold - PV).

Therefore, in the short term, gold prices may fluctuate strongly, depending on macroeconomic developments and central bank decisions.

Domestically, according to Mr. Huy, gold prices will continue to stay high if world prices continue to increase. However, exchange rate fluctuations and management policies may affect the level of increase.

Meanwhile, Associate Professor Dr. Nguyen Huu Huan predicts that gold prices will continue to fluctuate and may set a new record due to concerns about political instability.

“However, the gold price will not increase continuously, there will be a period of adjustment, especially when the price is at a high level. In the near future, there will be a number of investors taking profits when they reach their expectations. If you want to invest in gold, you need to wait for a strong market correction to buy. If you buy after the price of gold is increasing, the risk of it turning around and falling is very high, so you should limit buying gold when the price is at its peak,” Mr. Huan noted.

Regarding the current gold price movement, Mr. Nguyen Quang Huy commented that gold prices are at a historical peak and in an overbought state, investors need to consider carefully before making a decision. Avoid the FOMO (fear of missing out) mentality that leads to buying gold at high prices without a risk management strategy.

“The State Bank can apply tools to regulate gold supply and demand to stabilize the market. Investors need to update information promptly and avoid following the crowd without a clear strategy,” Mr. Huy advised.

At the same time, we should not focus all our resources on gold but should allocate them reasonably to other investment channels, such as stocks, bonds, real estate, savings, etc. In particular, we should consider investment opportunities in the fields of production, business, and startups to take advantage of the economic recovery momentum and strong FDI flows into Vietnam.

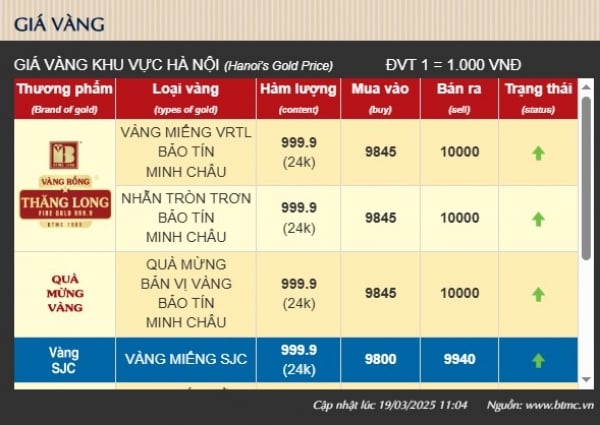

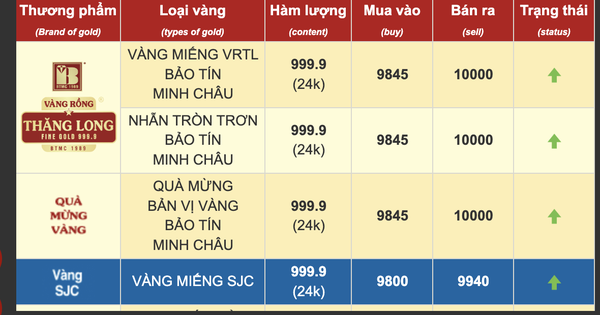

Gold price today March 19, 2025 increases continuously, SJC and gold ring close to 100 million VND

After 1 year, the price of gold rings is shocking: Nearly 30 million VND/tael more expensive

Gold prices surge, experts warn of signs of gold shops pushing risks onto customers

Source: https://vietnamnet.vn/gia-vang-lap-dinh-ky-luc-100-trieu-luong-co-bat-thuong-tang-tiep-hay-ha-nhiet-2382233.html

Comment (0)