On the afternoon of March 20, in Dak Lak, the State Bank of Vietnam (SBV) held a conference on “Promoting bank credit, contributing to economic growth” in region 11 ( Dak Lak, Gia Lai, Kon Tum, Dak Nong and Lam Dong) . SBV Deputy Governor Doan Thai Son and Mr. Truong Cong Thai - Vice Chairman of Dak Lak Provincial People's Committee co-chaired the conference.

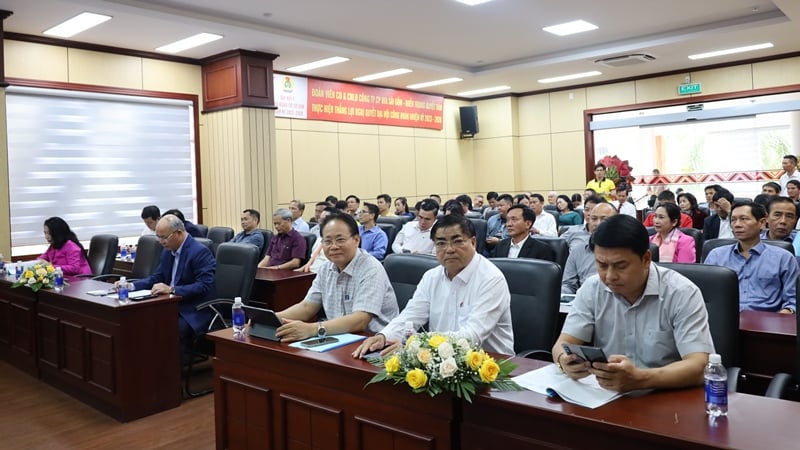

Conference delegates

Attending the Conference were leaders of the Provincial Party Committee, People's Committee, People's Council, National Assembly Delegation of provinces in Region 11 (Dak Lak, Gia Lai, Kon Tum, Dak Nong and Lam Dong); Leaders of relevant Departments/sectors, mass organizations, associations, enterprises and cooperations in the area. On the Banking side, there were also representatives of some units, Departments, Central State Bank Departments and the Board of Directors, key officials of the State Bank of Region 11; Directors of branches of credit institutions in the area.

Deputy Governor of the State Bank of Vietnam Doan Thai Son gave a speech at the conference.

Speaking at the Conference, Deputy Governor Doan Thai Son said that over the past time, the whole industry has made efforts to complete the Law on Credit Institutions 2024 and guiding documents, creating a legal framework for credit institutions to deploy new credit granting operations, convenient for customers; Proactively and flexibly operating monetary policy; requiring credit institutions to strictly implement the direction of the Government, the Prime Minister and the State Bank on stabilizing deposit interest rates and reducing lending interest rates.

Up to now, the State Bank has completed the restructuring of the apparatus. The whole sector has thoroughly grasped and closely followed the direction of the Central Government and the Government, urgently reviewed and restructured the system, on schedule and on schedule, ensuring the efficiency, effectiveness and efficiency of the apparatus. The banking sector has proactively and resolutely implemented the policies of the Party and the Government, orientations and solutions to deploy key and breakthrough tasks and solutions to promote economic growth and accelerate the disbursement of public investment capital, ensuring the national growth target of 8% or more in 2025.

Mr. Nguyen Kim Cuong - Acting Director of State Bank of Vietnam, Region 11 Branch, reported at the conference.

In addition, the State Bank focuses on innovating credit management measures. In 2025, the State Bank will set a credit growth target of about 16%, higher than previous years and from the end of 2024; Directing credit institutions to simplify lending processes and procedures, and flexibly accept appropriate forms of collateral to increase customers' access to capital; Facilitating the implementation of policy credit programs for the poor, policy beneficiaries, and ethnic minority households; Coordinating with localities to strengthen connections and dialogues between banks and businesses to remove obstacles in people's and businesses' access to credit.

The policy to support businesses is implemented on the principle of sharing difficulties and accompanying people and businesses with the banking industry's own resources. Therefore, credit institutions have adjusted their plans, business targets, and profits to have conditions to support people and businesses.

Deputy Governor Doan Thai Son highly appreciated the achievements of the banking sector in Region 11. As of February 28, 2025, the total outstanding credit balance of Region 11 reached over VND 590 trillion, an increase of 0.54% compared to the end of 2024, accounting for about 3.75% of the total outstanding balance of the whole economy. The credit structure is consistent with the economic development orientation of the region, such as: credit for the trade and service sector accounts for more than 54%, agriculture, forestry and fishery accounts for about 33%. Credit is focused on priority sectors according to the policies of the Government and the State Bank: Loans for agricultural and rural development account for 62% of the total outstanding balance of the region; in which some key agricultural products such as coffee account for 73% of the national outstanding coffee balance, pepper accounts for 47% of the national outstanding pepper balance, rubber accounts for 12% of the national outstanding rubber balance.

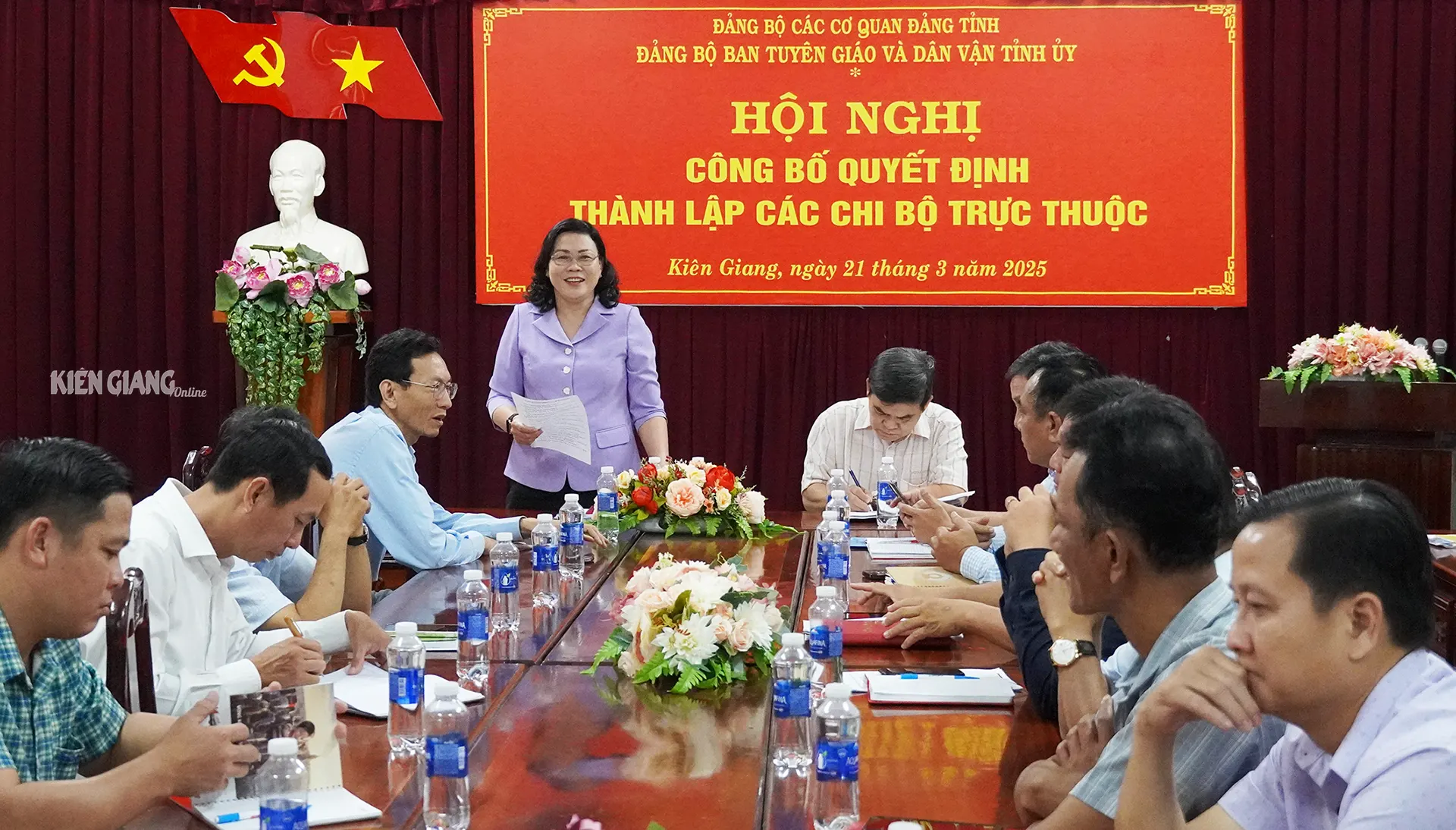

Mr. Truong Cong Thai - Vice Chairman of Dak Lak Provincial People's Committee spoke at the conference

At the Conference, delegates focused on exchanging and discussing a number of main contents such as: Results of general credit activities nationwide and credit in region 11 in the first months of 2025, including credit for priority areas, a number of credit programs; lending interest rate policy; the ability to effectively expand credit in 2025 to contribute to promoting sustainable economic growth; difficulties and obstacles; orientations on credit activities in the coming time...

Mr. Huynh Van Dung - Chairman of Dak Lak Province Business Association proposed credit solutions to help businesses grow rapidly.

To promote credit growth in the region, in the coming time, the State Bank will propose solutions to continue to closely follow the direction and socio-economic programs of localities in the region, synchronously implement solutions on monetary and credit policy management, focusing on directing credit institutions to implement solutions to reduce deposit and lending interest rates; promote credit growth from the beginning of the year, direct credit to production and business sectors, priority sectors, growth drivers; strictly control credit for sectors with potential risks; build credit products for sectors and fields in line with the business strategy and resource balancing ability of credit institutions;

Focus on credit investment in key projects and works, green credit, credit serving the development of strong sectors of the region and locality; Strengthen administrative reform, create favorable conditions for people and businesses to access bank credit capital; continue digital transformation, provide technology products in both credit and payment; promote consumer credit and strengthen policy communication.

Mr. Le Duc Huy - Chairman of the Board of Members of Simexco Dak Lak 2-9 Import-Export Company Limited spoke at the conference.

In addition to the solutions of the Banking sector, it is necessary to have the coordination of relevant Departments, Boards, Branches, Associations and Unions in the Region to deploy effective and synchronous solutions and policies that will help people and businesses in the Region stabilize production and business, develop sustainable socio-economy, and contribute to the implementation of economic growth targets set by the Government and localities.

Sharing at the conference, Mr. Nguyen Kim Cuong - Acting Director of the State Bank of Vietnam, Region 11 Branch said: The network of credit institutions in Region 11 has been expanded from urban centers to districts, mountainous areas, remote areas, meeting the needs of using financial, monetary, banking services and serving the goals of local socio-economic development. The whole region has 32 credit institutions operating with 115 level 1 branches, 05 branches of the Social Policy Bank and 51 People's Credit Funds (PCFs); with nearly 1,175 level 2 branches, transaction offices of commercial banks and the Social Policy Bank in the area.

Bank credit has been directed to production sectors, priority sectors and economic growth drivers (consumption, investment, export) under the direction of the Government and the State Bank of Vietnam, in which credit to rural agriculture always plays a leading role in accordance with the conditions and socio-economic development situation in the provinces in the Region.

Through the conference, the State Bank will promptly grasp the credit situation and banking activities in each region and promptly remove difficulties and obstacles arising for credit institutions, businesses and people in order to boost bank credit growth right from the first months of 2025, contributing to the entire political system striving to achieve the economic growth target of 8% or more in 2025.

Speaking at the conference, Mr. Truong Cong Thai - Vice Chairman of Dak Lak Provincial People's Committee requested the State Bank of Region 11 to continue implementing solutions to manage monetary policy and banking activities with the aim of controlling inflation, stabilizing the macro economy, supporting economic growth in the locality; Coordinate with local departments, branches and sectors to promote the program of connecting banks and enterprises to enhance information, grasp needs, promptly handle difficulties and problems in credit relations, create favorable conditions for people and businesses to access credit capital; Continue to consolidate and develop the banking network and services in accordance with the socio-economic development needs of localities; continue to accompany and support Dak Lak province and other provinces in the region to successfully achieve the set goals.

Source: https://daklak.gov.vn/-/-ay-manh-tin-dung-ngan-hang-gop-phan-tang-truong-kinh-te-vung-tay-nguyen

![[Photo] Prime Minister Pham Minh Chinh receives French Minister in charge of Transport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/aa649691f85546d59c3624b1821ab6e2)

![[Photo] Prime Minister Pham Minh Chinh receives the head of the Republic of Tatarstan, Russian Federation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/7877cb55fc794acdb7925c4cf893c5a1)

![[Photo] Overview of the Workshop "Removing policy shortcomings to promote the role of the private economy in the Vietnamese economy"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/d1c58c1df227467b8b33d9230d4a7342)

![[Photo] Meet the pilots of the Victory Squadron](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/fd30103acbd744b89568ca707378d532)

Comment (0)