It is estimated that about half a million billion VND in savings deposits with high interest rates at the end of 2022 and the beginning of this year are about to mature.

Real estate, gold, and investment securities all have potential risks.

Ms. Tran Thanh Thuy (Phuong Liet, Thanh Xuan, Hanoi) said that as a civil servant, she used to save her money in the bank because of its high safety and the interest rate in the past was quite good compared to investing in the stock market, real estate or other business activities.

However, according to Ms. Thuy, in October 2023, commercial banks will sharply reduce deposit interest rates for many terms. " With the trend of deep savings interest rates falling, I am thinking about choosing another investment channel that is more effective than saving at the bank, even though I know that saving at the bank is the safest channel at present ," Ms. Thuy said.

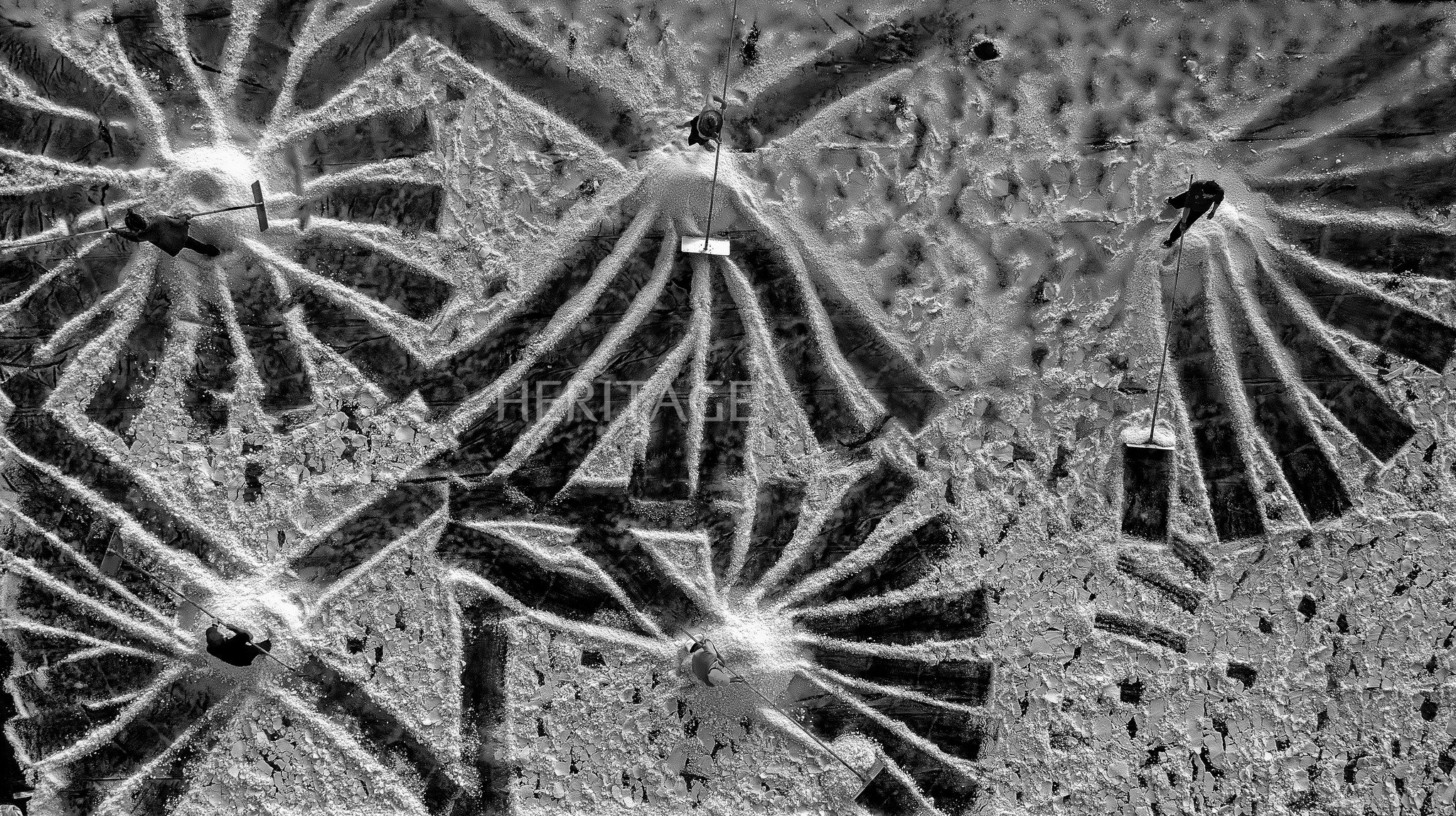

Experts say that real estate is sluggish, so investing at this time is not effective. (Photo: Ha Phong).

Responding to VTC News on the morning of November 5, financial and banking expert Nguyen Tri Hieu analyzed that the reason banks lowered their deposit rates was because recently their high interest rates have attracted most people to deposit money, while banks are running out of money because there are no borrowers.

"Banks' reduction of deposit interest rates is in line with the direction of the State Bank to ensure the flow of money from people and businesses into the consumer market, production and business, stimulating economic development," Mr. Hieu analyzed.

Expert Nguyen Tri Hieu said that looking around, there is no attractive investment channel. For example, stocks once reached more than 1,200 points, but now they have dropped to nearly 1,100 points and there are many fluctuations at this time.

“Therefore, stocks are not a channel for investment at this time. Looking at the real estate channel, this is also not a profitable investment channel at the moment because the market does not have the consumption power. As for the gold channel, it sometimes goes up, sometimes goes down and is very risky because the difference is quite high compared to the world. The foreign currency channel has the potential to increase, but there is no guarantee and people cannot invest,” said expert Nguyen Tri Hieu.

Expert Le Dang Doanh said that the reason banks reduce interest rates is because the Government wants people not to save much, but to stimulate people to use money for shopping and consumption.

“I think the Government wants to stimulate growth and have the momentum to increase public investment, promote consumption and this is a measure to promote growth,” Mr. Doanh said.

Regarding whether people are shifting their investment trends to stocks, real estate, gold, and foreign currencies, Mr. Doanh said that at this time, investing in these channels is not beneficial, and is even very risky.

“The real estate market is facing difficulties. In normal times, real estate only accounts for about 5-6% of GDP. But if we add other sectors such as construction materials, stone, sand, gravel, etc., it is up to nearly 20% of GDP.

If investing, individual investors should invest in clean agriculture, biotechnology, logistics; while businesses should invest in future developing industries such as information technology, science and technology. We should not invest in risky projects because at this time the world economy is stagnant and inflationary,” said Mr. Doanh.

Bank deposit is still a safe choice

Mr. Dang Tran Phuc - Chairman of the Board of Directors of AZfin Vietnam Joint Stock Company - said that in the past, interest rates and securities were considered to be in opposite directions when interest rates increased, securities decreased and vice versa.

“However, in the current period, interest rates are continuously falling but stocks are still not making any sudden changes. Although at times the VN-Index recorded an increase of more than 20%, cash flow is still quite cautious,” said Mr. Phuc.

According to Mr. Phuc, there are still many unpredictable factors in the macro situation, along with lessons from the deep decline of the market in the second half of 2022 with many similarities to the current context, causing investors to no longer invest all in a high-risk channel like stocks.

Although interest rates have decreased, savings are still an effective and safe investment channel.

“Currently, savings interest rates have tended to hit rock bottom with the current economic situation. Credit in the last quarter of the year also often increases rapidly, making it difficult for banks to lower interest rates further.

“The application of the new short-term capital mobilization rate for medium and long-term lending, according to forecasts, will cause the mobilization interest rate to remain stable from now until the end of the first quarter of next year. Therefore, at this time, the safest channel is still to deposit in banks,” said Mr. Phuc.

Agreeing with this view, expert Nguyen Tri Hieu commented that it can be seen that, among the 5 investment channels: stocks, real estate, gold, foreign currency and bank deposits, deposits are still more stable than other channels and are very safe.

“Therefore, the assumption that many people are rushing to withdraw money from banks because of the drop in deposit rates is unfounded at this time, unless interest rates can drop even lower and other investment markets recover, then the situation may change,” said expert Nguyen Tri Hieu.

Expert Le Dang Doanh also said that in this context, people with money should not be too risky in investing in the stock market, real estate or gold, but the most stable long-term investment channel is still saving in banks.

“Bank deposits at the moment do not offer high interest rates or large profits, but looking around other investment channels, no channel is as effective as savings deposits. In particular, savings deposits are also the channel with the highest safety factor,” said Mr. Doanh.

PHAM DUY

Source

Comment (0)