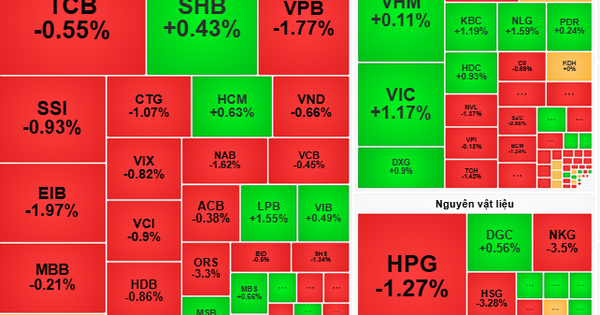

Opening the morning session on September 10, the market was immersed in red and continuously decreased due to strong selling pressure, down to around 1,255 points.

In the afternoon session, the market had many corrections, but at the end of the session, VN-Index still dropped sharply by 12 points, closing at 1,255 points. Order matching liquidity on the HOSE floor decreased, with 601.5 million shares.

The VN30 basket of large-cap stocks fell 13 points, closing at 1,294 points. In the group, only 5 stocks increased in price, including VJC (+1.2%), TPB (+1.1%), MWG (+0.4%), BCM (+0.4%) and VNM (+0.1%).

On the contrary, 24 codes closed in red such as SSB (-6.1%), VRE (-4.5%), TCB (-1.8%)...

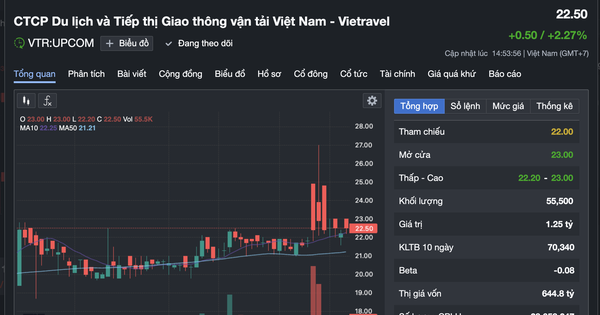

In today's session, VNZ shares of VNG Corporation attracted attention when they continued to fall sharply by VND59,000/share (equivalent to 14.9%), down to VND334,500/share. The matched volume was exceptionally high, more than 80 times higher than in early September 2024, reaching nearly 36,000 units.

VNZ stock price movements over the past month. Source: Fireant

Notably, this is the third consecutive session that this stock has plummeted. Compared to the session on September 6, VNZ shares have "evaporated" more than 35%, equivalent to a decrease of VND 180,500/share, and compared to the beginning of 2024, VNZ shares have dropped sharply by nearly 50%.

Foreign investors continued to net sell on the HOSE floor in the session of September 10 with a value of 385.9 billion VND, in which they sold heavily stocks of MSN (-109.1 billion VND), FPT (-104.7 billion VND), VPB (-78.6 billion VND)...

On the contrary, they bought a lot at VHM (+72.8 billion VND), VNM (+67.9 billion VND), CTG (+50.2 billion VND)...

According to VCBS Securities Company, the market weakened due to lack of demand momentum and cautious investor sentiment, causing the market to continue to fluctuate in today's session.

VCBS recommends that investors stay calm, do not rush to sell and closely monitor market developments, patiently wait for a recovery to have a trading strategy to ensure profits. With the current developments, 1,250 points will be a reliable support zone of the market and there is a high probability that there will soon be a recovery at this point.

According to Dragon Capital Securities Corporation (VDSC), VN-Index is expected to regain its upward momentum in the near future, thereby opening up opportunities to reach the target of around 1,280 points once again.

Investors can expect a short-term recovery of the market and should prioritize stocks that have been stable and have attracted cash flow recently. However, it is still necessary to consider the recovery phase to take short-term profits or restructure the portfolio to minimize risks.

Source: https://nld.com.vn/co-phieu-vnz-cua-cong-ty-cp-vng-giam-manh-lien-tiep-ba-phien-19624091018034203.htm

Comment (0)