In the context of global digital transformation, technology has become a core factor helping the economy develop strongly. However, in order for Vietnamese technology enterprises to make a breakthrough, a more flexible financial system and capital market are needed. This was the content discussed at the seminar "Creating capital market leverage for Vietnamese technology companies to make a breakthrough in the digital age" held on March 19, organized by Nhan Dan Newspaper in collaboration with the Institute of Digital Economy Development Strategy (IDS).

The seminar was attended by Deputy Chairman of the National Assembly's Economic and Financial Committee Pham Thuy Chinh; Deputy Minister of Science and Technology Hoang Minh; Director of IDS Tran Van; Director of Ho Chi Minh City Economic Development Institute Truong Minh Huy Vu; Chairman of the IDS Scientific Council, former Deputy Chairman of the Economic Committee, former Head of the Prime Minister's Advisory Group Nguyen Duc Kien; experts, representatives of domestic and international investment funds, representatives of a number of technology enterprises.

|

| Mr. Le Quoc Minh, Member of the Party Central Committee, Editor-in-Chief of Nhan Dan Newspaper, Chairman of Vietnam Journalists Association chaired the Discussion |

The "key" for Vietnam to develop

In the era of global digitalization, science, technology and innovation are not only the driving force but also the key for Vietnam to develop. Resolution No. 57-NQ/TW of the Politburo, issued on December 22, 2024, clearly affirmed: Science, technology, innovation and digital transformation are "top priority breakthroughs" in the country's new growth model. However, to realize this goal, a strong financial system is needed, in which the capital market plays a central role - not only providing financial resources but also creating confidence for investors, helping to develop domestic private enterprises, developing an international financial center and contributing significantly to double-digit growth under the direction of the Party and State leaders.

Speaking at the opening of the seminar, Mr. Le Quoc Minh - Member of the Party Central Committee, Editor-in-Chief of Nhan Dan Newspaper said that the goals of Resolution No. 57 are quite high and challenging but still feasible because Vietnam has had more than 10 years of implementing policies on technology startups and innovation, and has nurtured the first generation of startups capable of competing in the international market. That shows that when we started implementing Resolution No. 57, we had a favorable start, which is fundamental in both theory and practice.

In addition, experience from developed countries shows that after the initial incubation period, large domestic technology enterprises hold key positions in the innovation ecosystem. Leading technology countries such as the United States, China and Singapore all have developed capital markets, allowing technology startups to raise public capital through initial public offerings (IPOs), thereby creating “unicorns” - companies valued at more than 1 billion USD.

In our country, Mr. Le Quoc Minh assessed that although the startup ecosystem has developed strongly, the number of "unicorns" is still limited due to obstacles in support mechanisms, especially in clearing capital flows. By the end of 2021, Vietnam had 4 recognized technology "unicorns": VNG, MoMo, VNLife (VNPay) and Sky Mavis - making Vietnam the 3rd in Southeast Asia, after Singapore and Indonesia.

According to Ms. Nguyen Ngoc Anh, General Director of SSI Asset Management, Vietnam has the potential to become a leading destination for foreign investment in technology. Compared to countries in the region such as Indonesia, Singapore, and Thailand, Vietnam has many competitive advantages in attracting investment. However, to surpass these countries, it is necessary to pay attention to the change in investment appetite of global funds in emerging markets.

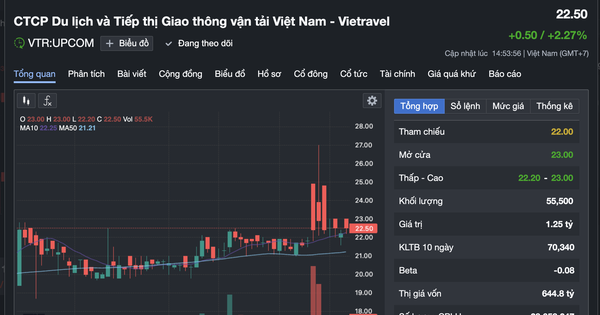

Foreign investors are interested in the Vietnamese technology market, but they have difficulty finding companies to invest in due to IPO barriers. In fact, the listing conditions on the Vietnamese stock exchange require companies to have two consecutive years of profits, which has invisibly become a major barrier for technology startups.

"Investors are still concerned about risk factors such as IPO mechanisms and divestment strategies. They expect policies to create a more stable market, thereby helping them plan strategies and build more solid, long-term business models," said Ms. Nguyen Ngoc Anh.

Meanwhile, according to the Institute for Digital Economic Development Strategy (IDS), Dr. Tran Van, Vietnam currently has a number of technology companies with the potential to compete internationally, but these businesses cannot grow due to barriers to raising capital to develop their scale. Specifically, according to the provisions of the Securities Law No. 54/2019/QH14 in 2019, to conduct an IPO on the Vietnamese stock exchange, businesses must ensure profits for 2 consecutive years before registering for an IPO and have no accumulated losses. This regulation is very difficult to implement for technology startups. Because in the initial investment phase, businesses often suffer temporary losses due to high investment costs for research and development.

|

| Vietnam aims to become a center for digital technology industry development |

Need for breakthrough policies in capital markets

To turn Vietnam into a center for digital technology industry development, with at least 5 digital technology enterprises reaching international stature by 2030 as set out in Resolution No. 57-NQ/TW of the Politburo on breakthroughs in science, technology, innovation and national digital transformation. Deputy Head of the Economic and Financial Committee Pham Thuy Chinh said that institutions must go one step ahead, creating a foundation for innovation. The National Assembly will continue to perfect legal regulations to support technology enterprises in accessing the capital market.

According to experts, in order for Vietnamese technology enterprises to make a breakthrough, there needs to be breakthrough policies in the capital market. Solutions such as easing IPO conditions, building a separate trading floor for technology enterprises and attracting talent will be important steps to help Vietnam become a center of innovation in the region. To clarify this issue, the Director of the Institute for Digital Economic Development Strategy (IDS) analyzed that all forms of capital mobilization can only meet a certain stage when the scale of start-up enterprises is still modest. During the development process, start-ups all aim to raise capital from the public (IPO) and consider this a measure of success and a milestone marking the maturity of the start-up, becoming a complete enterprise that fully contributes to the country's socio-economic development.

This expert believes that Vietnam can learn from international markets. Currently, countries such as China, the US, and Singapore have established more flexible mechanisms to support technology startups in IPOs, helping them raise capital more effectively. In the immediate future, we can consider the possibility of allowing technology businesses to conduct IPOs and list without being bound by the condition of “no accumulated losses” right on HOSE/HNX, or testing within the framework of the International Finance Center under construction in Ho Chi Minh City and Da Nang.

Participating in the discussion, experts also agreed on the need for breakthrough policies so that technology enterprises can mobilize domestic capital, ensuring the quick and effective implementation of Resolution No. 57 of the Politburo.

Sharing important lessons from successful capital raising deals in the international market, Ms. Nguyen Ngoc Anh, General Director of SSI Asset Management, commented that a stable macroeconomic foundation and an attractive business environment help Vietnam be ready to seize new opportunities. To fully realize its GDP growth potential, Vietnam needs to improve the efficiency of its capital market. “IPOs in Vietnam are still facing difficulties due to the current listing regulations being inflexible and not suitable for the characteristics of innovative, unprofitable enterprises that need easier access to capital to promote growth,” Ms. Nguyen Ngoc Anh noted.

Source: https://thoibaonganhang.vn/thi-truong-von-tao-don-bay-cho-doanh-nghiep-cong-nghe-but-pha-trong-ky-nguyen-so-161547.html

Comment (0)