GMD stock price of Gemadept Corporation has dropped sharply to a P/E valuation lower than the 3-year average.

GMD stock price of Gemadept Corporation has dropped sharply to a P/E valuation lower than the 3-year average.

|

Net selling pressure

GMD’s share price has fallen from over VND70,000 to below VND60,000 per share this week under net selling pressure from foreign investors. GMD is trading at a trailing P/E of 17.9 times, compared to a three-year average of 20.6 times.

Gemadept's pre-tax profit from core business in 2024 is expected to grow strongly by 50% and the profit in 2025 is likely to be higher than expected thanks to the successful divestment of the rubber project. However, GMD's share price has decreased by 14.3% in 3 months due to concerns about growth potential in the context of high operating capacity at major ports, exceeding capacity, while new projects have not yet come into operation.

However, according to experts, Gemadept has an integrated port and logistics system nationwide and large-scale projects in key container hubs with high competitive advantages thanks to its large scale and strategic location. In the long term, Gemadept is one of the main beneficiaries of the strong growth in Vietnam's trade activities.

If foreign investors continue to sell, it will create downward pressure on GMD shares, forming new bottom price zones like what has happened to many large stocks. One factor investors need to note is that supply and demand are influencing stock prices more than fundamental valuation.

Project progress

In a recent analyst meeting, Gemadept’s Board of Directors shared that Nam Dinh Vu Port Phase III, with a total investment of VND2,800 billion, is expected to be fully completed by October 2025, increasing its total capacity to 1.8 million TEUs and 300,000 tons of bulk cargo. However, some items of Phase III, such as container yards and equipment, may gradually come into operation earlier, allowing for a gradual increase in capacity in 2025.

In addition, Gemadept has acquired 48.5% of shares of Hai Minh Port Services Joint Stock Company, a warehouse service provider in Hai Phong, to increase the container yard area serving Nam Dinh Vu port, helping to expand capacity by 30% in 2025 compared to the designed capacity.

Gemalink Port Phase IIA is expected to start construction in late 2025 and be operational by late 2026, with a capacity of 600,000 TEUs and an investment of USD 150 million. As Phase I has been operating at 16% over its design capacity, investment in Phase II is crucial for Gemalink to maintain throughput growth and capture the growing demand in the Cai Mep Thi Vai area.

Gemadept’s management board expects that Cai Mep Thi Vai area will continue to be the main driving force for cargo volume growth through southern seaports thanks to its developed infrastructure and deep draft, allowing it to accommodate the world’s largest ships. The company will continue to seek investment opportunities in port and logistics expansion projects to enhance the ecosystem and increase capacity in the coming time.

With the divestment of rubber plantations having been planned for many years, Gemadept is still negotiating with a number of potential investors. The company recorded the investment in rubber plantations in the unfinished basic construction cost with a value of VND 1,322 billion. If the divestment is successful, it will collect additional investment capital for its main operations.

Growth through output

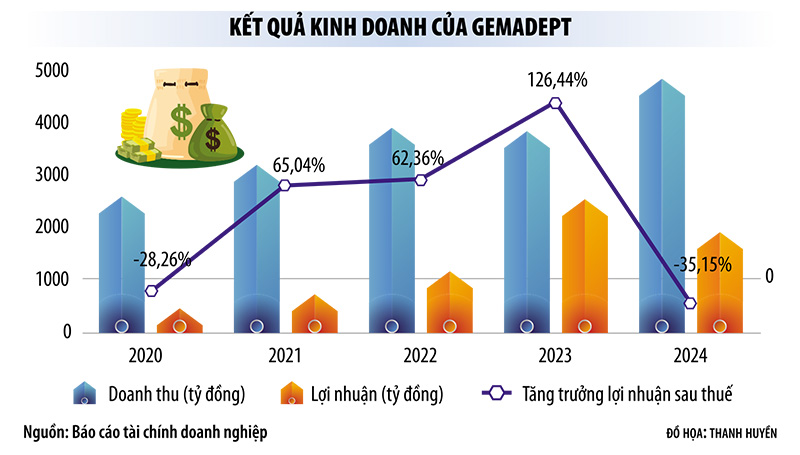

In 2024, Gemadept will achieve net revenue of VND4,800 billion, up 26% thanks to cargo volume through container ports growing 48% higher than expected. Pre-tax profit from core business activities will grow 50%, reaching VND2,000 billion.

The total cargo throughput through Gemadept’s container ports increased sharply by 55% to 4.4 million TEUs. All ports recorded high growth in throughput, including Nam Dinh Vu port with 1.35 million TEUs (up 48%), Gemalink port with 1.74 million TEUs (up 71%), and Phuoc Long port with 1.35 million TEUs (up 45%). Meanwhile, bulk cargo throughput at Dung Quat port increased by 44% to 2.24 million tons.

The impressive growth in output was due to the recovery in demand after the inventory clearance process in the US and EU markets, the contribution of new service routes at Nam Dinh Vu and Gemalink ports, and the high transshipment volume at Gemalink port due to congestion at Singapore port.

In 2025, Gemadept set a cautious output target due to a reduction in service routes from a shipping line at Nam Dinh Vu port and a decline in transshipment volume at Gemalink port as congestion at Singapore port gradually eases.

Gemadept has proposed to the Vung Tau Maritime Port Authority to increase the price of cargo handling services at Cai Mep Thi Vai ports. If the price is increased in the second half of 2025, this will be a factor contributing to revenue growth.

At Nam Dinh Vu port, Gemadept targets 2025 throughput at 1.35 million TEUs (flat compared to last year). For Gemalink port, Gemadept targets 2025 throughput at 1.6 million TEUs (down 8%), reflecting a decrease in transshipment volume as congestion at Singapore port eases.

Regarding new service routes, Gemalink port will receive 4 new service routes in March-April 2025 and is expected to add 2 more routes in the second half of 2025, bringing the total number of service routes at the port to 14, up from the current 8 routes.

However, the possibility of an escalation of the trade war affecting weakening global consumption, leading to a decrease in Vietnam's trade activities and a slowdown in the growth rate of cargo throughput through Gemadept's seaports, is an immediate risk.

Source: https://baodautu.vn/co-phieu-gmd-giam-gia-manh-do-ap-luc-ban-rong-d255794.html

![[Photo] Prime Minister receives a number of businesses investing in Ba Ria-Vung Tau province](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/20/8e3ffa0322b24c07950a173380f0d1ba)

![[Photo] President Luong Cuong receives former Vietnam-Japan Special Ambassador Sugi Ryotaro](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/20/db2d8cac29b64f5d8d2d0931c1e65ee9)

![[Photo] President Luong Cuong receives Ambassador of the Dominican Republic Jaime Francisco Rodriguez](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/20/12c7d14ff988439eaa905c56303b4683)

Comment (0)