(CLO) 2024 is the year that the Hanoi apartment segment will witness a rapid increase in price. In the coming time, this segment will hardly decrease, but the growth rate will slow down somewhat.

Over the past 20 years, apartment prices in Hanoi have been increasing continuously. A report by the Vietnam Association of Realtors (VARs) shows that if in the period 2000 - 2010, apartment prices in Hanoi fluctuated around 10 - 20 million VND/m2, then in the period 2010 - 2020, apartment prices increased to 20 - 50 million VND/m2. In particular, from 2020 to now, apartment prices have increased significantly to around 50 - over 100 million VND/m2 depending on the area.

At the Hanoi Apartment Market Conference: "What are the living and investment options?" held on December 10, Associate Professor, Dr. Dinh Trong Thinh, an economic expert, said: 2024 is the year that the Hanoi apartment segment will witness a rapid increase in prices.

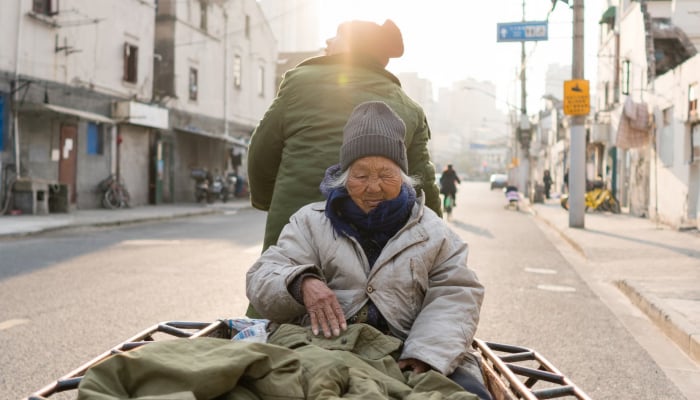

Associate Professor, Dr. Dinh Trong Thinh at the Workshop. (Photo: ST)

Synthesis from market reports of research units shows that apartment prices have increased from an average of 40 million/m2 in 2022 to more than 70 million/m2 by the end of the third quarter of 2024. There are no more projects on the market priced below 60 million/m2, many mid-range projects even have prices above 100 million VND/m2.

“Apartment prices are increasing in both the primary and secondary markets, and even old projects are no exception. During the fever, prices increase daily and weekly. It is worth noting that, despite high prices, liquidity is still good and there are still buyers,” said Associate Professor Dr. Dinh Trong Thinh.

On a positive note, this shows that the market sentiment in Hanoi is surprisingly improving. The pent-up demand for housing and investment has been unleashed as there are many drivers to restore the confidence of customers and investors in the market. The booming demand, while supply remains scarce, has pushed prices up.

“In the coming time, according to our assessment, apartment prices will hardly decrease, however, the price increase up to this point has slowed down somewhat, following a more stable trend, no longer in a feverish state like many previous months,” said Mr. Thinh.

Meanwhile, Mr. Ngo Huu Truong, Deputy General Director of Hung Thinh Corporation, said that real estate has long been considered a valuable asset, especially in Asian countries, where the mentality of "land and houses are savings" is very common.

In Vietnam, in the past 3 years, Mr. Truong said that there are 3 factors leading to the increase in housing prices.

Firstly, the legal completion time is long, accordingly the project approval process in Vietnam often takes a long time, from site clearance to completion of legal procedures. This increases investment costs, thereby pushing up real estate prices.

Second, according to current regulations, land auctions must follow market prices. This makes the input value of projects higher, leading to an increase in real estate prices.

Third is the impact of inflation and exchange rates. Although inflation in Vietnam is well controlled, the increase in the price of gold and USD compared to VND has created upward pressure on real estate prices, because many investors use these assets as a basis for accumulating value.

“Therefore, I think it will be very difficult for real estate prices to decrease in the coming period,” said Mr. Truong.

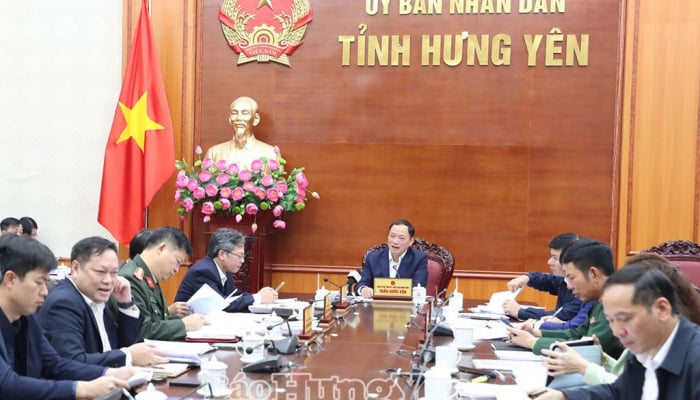

Overview of the Workshop. (Photo: RT)

Agreeing with this opinion, Mr. Nguyen Van Ngoc, Chairman of the Board of Directors and General Director of RB Group Joint Stock Company, said: In Hanoi, the price of apartments with real use value (for living or renting) has recorded a sharp increase in recent years.

Areas such as Dong Anh and Hoai Duc, although in the suburbs, still recorded an increase from 30-40 million VND/m2 to 70-80 million VND/m2.

The main factors that push up real estate prices include: New land price list pushing prices up; increased construction material costs and investors upgrading utilities to meet buyers' needs.

“In my opinion, real estate prices in Vietnam are forecast to continue to increase, but the growth rate may slow down due to signs of slowing purchasing power. The reasons include: Limited new supply due to the need for more time to resolve legal problems, and high new prices increasing transaction and investment costs,” said Mr. Ngoc.

Source: https://www.congluan.vn/nam-2024-chung-cu-tai-ha-noi-tang-nhanh-vuot-bac-ve-gia-post324942.html

Comment (0)