On the morning of September 18, continuing the 26th session, the National Assembly Standing Committee reviewed the implementation by relevant agencies of 21 fields mentioned in 4 resolutions on thematic supervision, 1 resolution on questioning during the 14th term and 2 resolutions on thematic supervision, 3 resolutions on questioning during the 15th term.

Speaking to clarify related contents, Deputy Prime Minister Tran Luu Quang said that the warnings stated in the report summarizing the examination contents of the National Assembly agencies are very necessary for the Government to continue implementing in the coming time.

" Generally speaking, these issues can be summed up in three words: "slow", "debt" and "missing", we will pay close attention ", Mr. Tran Luu Quang admitted.

Deputy Prime Minister Tran Luu Quang. (Photo: Nguyen Toan).

The Deputy Prime Minister stated that from now until the end of the year, the Government will focus on resolving problems within the authority of the Government and ministries. In particular, the Government will report some specific issues to the National Assembly Standing Committee for resolution.

" In the coming time, we will focus on easing access to credit to help organizations and individuals access capital to improve production and business, contributing to promoting development, " said the Deputy Prime Minister.

Another issue mentioned by Mr. Tran Luu Quang is that the Government will promote disbursement of public investment capital.

The Deputy Prime Minister cited a report from the Ministry of Planning and Investment saying that, up to now, the disbursement is basically better than 2 years ago. However, the Government leader expressed concern because there are many problems.

" For example, road construction is stuck with land filling and a series of things like that. We will strive to achieve the best possible disbursement results, because it will directly affect the country's GDP growth rate ," Deputy Prime Minister Tran Luu Quang emphasized.

Previously, presenting the inspection reports of the National Assembly agencies on the banking sector, Deputy Head of the National Assembly Office Nguyen Thi Thuy Ngan said that the requirements in Resolution No. 134/2020 and Resolution No. 62/2022 have basically been seriously and fully implemented.

In particular, solutions to attract foreign currency and increase state foreign exchange reserves have been actively implemented. Inspection and supervision activities have been strengthened and innovated. Cross-ownership and cross-investment issues in the credit institution system have been effectively handled. Bad debt handling has achieved positive results. Credit growth has been quite reasonable, credit quality has been improved.

" However, the completion of the law on restructuring credit institutions and handling bad debts is still slow. There is a lack of preferential policies to encourage investors to participate in handling secured assets and buying and selling bad debts. Finding and negotiating with commercial banks to accept compulsory transfers of weak banks still faces many difficulties ," said Ms. Nguyen Thi Thuy Ngan.

In a report explaining the current situation of cross-ownership, manipulation, and back-and-forth in the banking sector, State Bank Governor Nguyen Thi Hong said that this is an issue that the Central Party, the National Assembly, and the Government are very concerned about and requested the State Bank to complete legal documents as well as implement them in practice to overcome the problem.

" On file, cross-ownership between banks has been resolved. That is, on personal files, which organizations hold what percentage of shares in the banking system through lending activities has been shown ," said Ms. Nguyen Thi Hong.

Governor of the State Bank Nguyen Thi Hong. (Photo: Nguyen Toan).

However, the Governor of the State Bank acknowledged that in reality, organizations and individuals can own shares or have their names used to own shares, or even establish businesses in the ecosystem to lend capital to banks.

" Through investigation of recent cases, this is an issue that the State Bank is very concerned about," said Ms. Nguyen Thi Hong, adding that when drafting the law on credit institutions, these issues were considered the focus.

However, according to the Governor of the State Bank, there are still concerns during the consultation process, for example, whether this regulation can thoroughly handle and prevent cross-ownership and back-door ownership.

" If we wait for a regulation to thoroughly handle this, it will never happen. Not only laws on credit institutions but also in other fields, there must be regulations to make business operations transparent ," said Ms. Hong.

Referring to concerns about the law's provisions affecting the stock market and increasing costs and procedures, Ms. Nguyen Thi Hong said that the priority issue when drafting the law is to ensure the safety of the banking system. Therefore, the analysis and assessment of the impact requires a bigger picture, which is the role of credit institutions and banks in the economy.

English

Source

![[Photo] Prime Minister Pham Minh Chinh receives the head of the Republic of Tatarstan, Russian Federation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/7877cb55fc794acdb7925c4cf893c5a1)

![[Photo] Meet the pilots of the Victory Squadron](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/fd30103acbd744b89568ca707378d532)

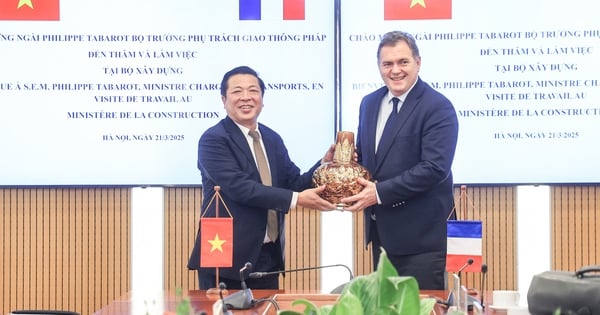

![[Photo] Prime Minister Pham Minh Chinh receives French Minister in charge of Transport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/aa649691f85546d59c3624b1821ab6e2)

Comment (0)