This is the first time ACB has received an award in the Digital Banking category, recognizing the bank's efforts in the digitalization journey, investing in innovation and bringing a more convenient and enjoyable customer experience every day.

The International Finance Awards are held annually by International Finance magazine - the leading business finance magazine in Europe, to honor leading products and businesses in many different fields such as banking and finance, aviation, insurance, energy, services, etc. In addition to the digital banking category award, ACB was also honored in the category of Best Commercial Bank in Vietnam for 2024, marking the 5th year ACB has participated in this prestigious annual award.

On February 21 in Bangkok (Thailand), ACB was named in two categories in the banking and finance sector of the annual awards announced by International Finance Magazine. PHOTO: ACB

IFM's voting panel highly appreciated ACB's digital banking application based on various criteria including: user-friendliness, technology integration, features and performance, security and privacy, business impact, market coverage and accessibility.

The award is also a testament to ACB's strategic investment in technology to enhance user experience. Since February 2022, ACB has officially launched the ACB ONE Digital Banking service with a youthful, dynamic image, constantly creative and innovative in the spirit of "Living lightly, having more fun". ACB ONE was born with the meaning of helping customers take the initiative in time, convenient in all financial transactions so that they have more time to enjoy life (in which ONE is the abbreviation of Online "N" Exciting).

ACB received double awards from International Finance Magazine in 2024. PHOTO: ACB

In recent times, ACB ONE Digital Bank has continuously improved its financial transaction ecosystem such as money transfer, payment, airline ticket purchase, mobile top-up, etc. as well as developed extended features and utilities including online savings, online disbursement, Video call service, card service right on the application. For individual customers who are business owners, ACB ONE also provides a store management solution for shop owners to easily create Loc Phat accounts, do business "hands-free" with the utility of automatically calculating revenue through accounts and QR codes, conveniently sharing balance notifications with employees without revealing account balances, etc.

With that ecosystem of utilities, ACB ONE has received the trust and support of millions of users. By the end of 2024, ACB had 6.7 million individual customers and 305,000 corporate customers registered to use digital banking services.

At the same time, ACB ONE digital banking service is also designed to optimize the experience for each customer segment (individual customers, small and medium-sized enterprises, large enterprises). For corporate customers, ACB ONE BIZ and ACB ONE PRO have become powerful support tools for small and medium-sized enterprises and large enterprises in minimizing procedures and processes, promoting digitalization to increase business performance. It can be mentioned that the salary payment/batch payment feature is simple and convenient, business owners only need to confirm transactions by file to perform thousands of salary payment transactions, payment with just one operation or international money transfer service and foreign currency trading, businesses only need to perform one operation to be able to use two 100% online services, easily buy foreign currency many times with a variety of foreign currencies and attractive exchange rates, along with the privilege of buying foreign currency with a price-holding code of up to 48 hours.

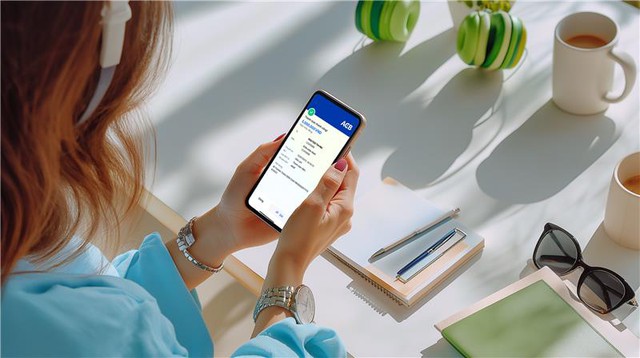

ACB ONE application has become familiar to millions of customers. PHOTO: ACB

With a "customer-centric" orientation, ACB ONE provides an intuitive and easy-to-use interface, helping all customers easily conduct transactions and access financial information conveniently, saving maximum time and effort when accessing banking services. Thanks to that, ACB ONE's platform creates a trustworthy position in the hearts of existing customers and attracts many new users.

In addition, thanks to the constantly innovated and improved service ecosystem, ACB ONE Digital Banking service is becoming increasingly familiar to millions of users, serving daily transactions in life. In addition to features and service products, ACB ONE also focuses on safety, investing in a secure system to maximize customer protection when conducting online transactions.

Continuing the 3-year journey of serving users, from now until May 17, 2025, ACB ONE is implementing the "Dragon Snake Deal" promotion program as a gift of gratitude to customers who have trusted and used the bank's services. Accordingly, each familiar transaction on the ACB ONE application gives customers the opportunity to accumulate bonus points: 368 points when paying for electricity, water, scanning VNPAY-QR from 300,000 VND; top up prepaid phones from 100,000 VND; online savings (term from 1 month), buy airline tickets from 3 million VND and an additional 6868 points when the above 3 types of transactions occur within 1 month. Customers can use these reward points to redeem a series of gifts from only 1, 6, 8 points for dining, shopping, travel, health care services... from popular brands such as KFC, Café Amazon, Gong Cha, PNJ, VITA Clinic, bTaskee, California Fitness & Yoga Center,...

Customers can learn more about the loyalty points program HERE or contact the nearest branch/transaction office or hotline (028)38247247.

Source: https://thanhnien.vn/acb-one-duoc-vinh-danh-la-ung-dung-ngan-hang-so-sang-tao-nhat-viet-nam-2024-185250305164751444.htm

Comment (0)