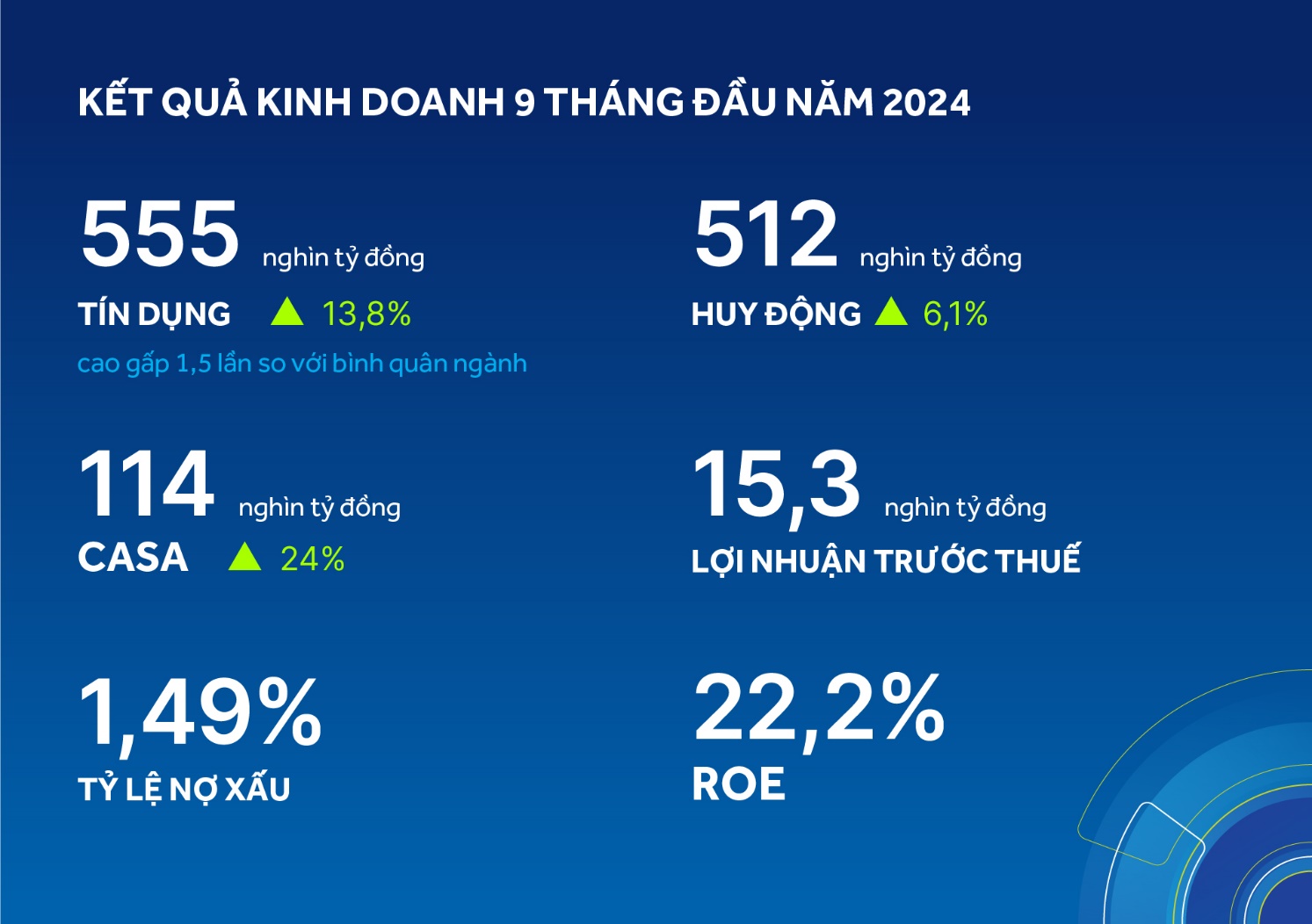

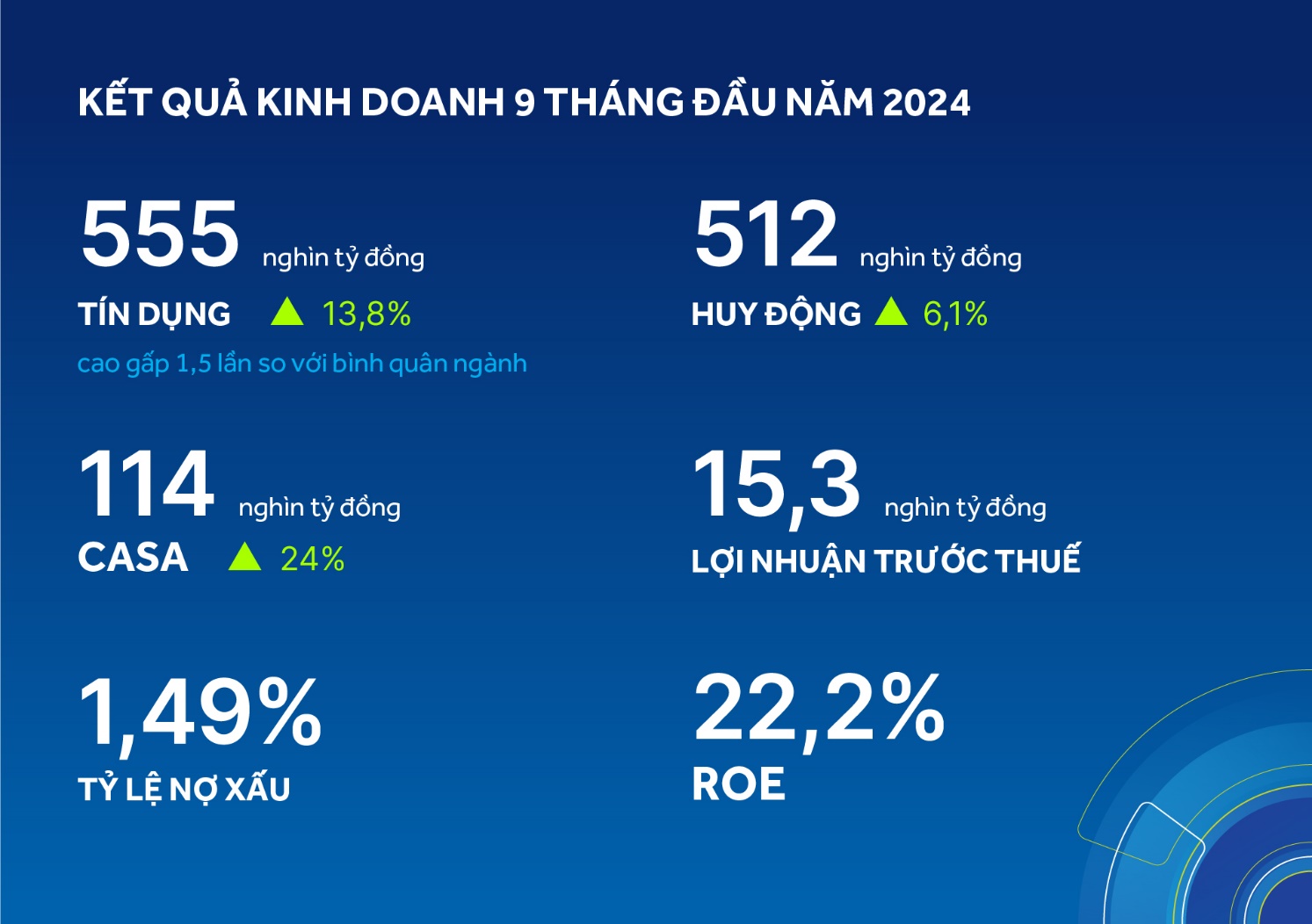

Maintaining its advantage in the retail sector, corporate credit grew strongly . As of September 30, ACB 's credit reached VND555 trillion, mobilization reached VND512 trillion, growth compared to the beginning of the year recorded at 13.8% and 6.1% respectively. Notably, the credit growth rate was 1.5 times higher than the industry average and was the highest net increase in the past 10 years. This also shows that ACB continues to maintain its advantage in the retail sector and implements a balanced growth strategy between individuals and businesses quite well when recording a cumulative credit growth rate of over 15% in the past 9 months. Regarding CASA, ACB has promoted solutions to attract deposits by increasing utilities for customers such as implementing the Wise Ally campaign - providing solutions and utilities for store management for business households; upgrading high-end financial services for priority customers. As a result, ACB's non-term deposits reached VND114 trillion, up 24% year-on-year in 2023, continuing to be one of the retail banks with the highest CASA ratio in the market at 22.2%. ACB's pre-tax profit in the first 9 months of the year was VND15.3 trillion, up slightly by 2% year-on-year, mainly from credit growth, service fees and effective cost management. Considering the 2019-2023 period, ACB is one of the banks with the highest compound growth rate in the industry (about 28%/year) and maintains high growth even in the context of many economic difficulties. ACB's bad debt ratio in the third quarter was 1.49%, among the banks with the lowest bad debt in the market. Provisioning expenses in the third quarter were lower than the average provisioning level in the first two quarters of the year.  ACB strictly complied with the regulations on liquidity safety ratio as prescribed by the State Bank of Vietnam with the LDR ratio of 82.4%, the ratio of short-term capital for medium and long-term loans accounting for 20.7%. The capital safety ratio (individual) by the end of Q3 was at 11.3%, far exceeding the level prescribed by the State Bank of Vietnam. In addition, ACB has made efforts to control and optimize operating costs at VND 8.2 trillion, a slight increase of 3.8% over the same period. The CIR ratio was maintained at a low level of 32.7%. ACB's ROE remained high at 22.2%, continuing to be among the industry's leading groups. As for ACBS, in Q3, it continued to record good business results with pre-tax profit growing by more than 44% over the same period. Accumulated in the first 9 months of the year, pre-tax profit increased by 67% thanks to the growth in income from ACBS's core business activities, including interest income from margin loans increasing 3 times, income from proprietary trading activities increasing 44% and income from brokerage activities increasing 14% over the same period with market share reaching 2.68%, up 0.24%. Promoting digital banking and expanding the provision of credit packages for green capital needs of businesses in the direction of sustainable development. According to the Government's orientation on green growth 2021-2030, ACB is implementing business activities in line with the sustainable development action plan of the banking industry, contributing significantly to ACB's positive business results in the first 9 months of the year.

ACB strictly complied with the regulations on liquidity safety ratio as prescribed by the State Bank of Vietnam with the LDR ratio of 82.4%, the ratio of short-term capital for medium and long-term loans accounting for 20.7%. The capital safety ratio (individual) by the end of Q3 was at 11.3%, far exceeding the level prescribed by the State Bank of Vietnam. In addition, ACB has made efforts to control and optimize operating costs at VND 8.2 trillion, a slight increase of 3.8% over the same period. The CIR ratio was maintained at a low level of 32.7%. ACB's ROE remained high at 22.2%, continuing to be among the industry's leading groups. As for ACBS, in Q3, it continued to record good business results with pre-tax profit growing by more than 44% over the same period. Accumulated in the first 9 months of the year, pre-tax profit increased by 67% thanks to the growth in income from ACBS's core business activities, including interest income from margin loans increasing 3 times, income from proprietary trading activities increasing 44% and income from brokerage activities increasing 14% over the same period with market share reaching 2.68%, up 0.24%. Promoting digital banking and expanding the provision of credit packages for green capital needs of businesses in the direction of sustainable development. According to the Government's orientation on green growth 2021-2030, ACB is implementing business activities in line with the sustainable development action plan of the banking industry, contributing significantly to ACB's positive business results in the first 9 months of the year.  ACB ONE Digital Banking products and services have been promoted. By the end of the third quarter, transaction turnover and the number of online transactions increased sharply, up 32% and 57% respectively compared to 2023. ACB ONE is highly appreciated by customers for its convenient experience, a program to accumulate transaction points to exchange for thousands of types of gifts, and is very suitable for the diverse needs of customers. Recently, ACB ONE has also received very positive feedback from customers when it promptly prevented fraudulent acts with technological solutions to help warn and suspend suspicious transactions. In the third quarter, ACB increased the limit of the Green/Social credit package from VND 2,000 billion to VND 4,000 billion with an interest rate of only 6%/year, with incentives up to 24 months. By the end of September, ACB had disbursed 73% of the Green/Social credit package, accounting for VND 2.9 trillion. Previously, ACB announced the Sustainable Finance Framework, creating standards for operations in the green finance sector. Most recently, at the event "Unlocking capital, welcoming opportunities" connecting banks and businesses organized by the State Bank, Mr. Tu Tien Phat - General Director of ACB - said that the Bank currently allocates about 5,000 billion VND to finance capital for small and medium enterprises, meeting the needs of production, business and import and export. This credit package can increase to 10,000 billion VND or 20,000 billion VND if businesses have a need for green credit capital to meet the requirements of foreign partners. Actively implementing social responsibilities, creating values for the community In the third quarter, ACB has accompanied local and central agencies in social security activities to improve and enhance the quality of people's lives, such as donating VND 80 billion to support the program to support the elimination of temporary and dilapidated houses nationwide launched by the Government; contributing VND 2.2 billion to join hands with the banking system to help people in some northern provinces affected by storms and floods; spending nearly VND 4 billion to sponsor educational activities and care for people in difficult circumstances through a series of community activities called "Journey of I Love Life" in many localities across the country. On October 19, ACB donated VND 10 billion to the Ho Chi Minh City People's Committee to sponsor social security programs in Ho Chi Minh City.

ACB ONE Digital Banking products and services have been promoted. By the end of the third quarter, transaction turnover and the number of online transactions increased sharply, up 32% and 57% respectively compared to 2023. ACB ONE is highly appreciated by customers for its convenient experience, a program to accumulate transaction points to exchange for thousands of types of gifts, and is very suitable for the diverse needs of customers. Recently, ACB ONE has also received very positive feedback from customers when it promptly prevented fraudulent acts with technological solutions to help warn and suspend suspicious transactions. In the third quarter, ACB increased the limit of the Green/Social credit package from VND 2,000 billion to VND 4,000 billion with an interest rate of only 6%/year, with incentives up to 24 months. By the end of September, ACB had disbursed 73% of the Green/Social credit package, accounting for VND 2.9 trillion. Previously, ACB announced the Sustainable Finance Framework, creating standards for operations in the green finance sector. Most recently, at the event "Unlocking capital, welcoming opportunities" connecting banks and businesses organized by the State Bank, Mr. Tu Tien Phat - General Director of ACB - said that the Bank currently allocates about 5,000 billion VND to finance capital for small and medium enterprises, meeting the needs of production, business and import and export. This credit package can increase to 10,000 billion VND or 20,000 billion VND if businesses have a need for green credit capital to meet the requirements of foreign partners. Actively implementing social responsibilities, creating values for the community In the third quarter, ACB has accompanied local and central agencies in social security activities to improve and enhance the quality of people's lives, such as donating VND 80 billion to support the program to support the elimination of temporary and dilapidated houses nationwide launched by the Government; contributing VND 2.2 billion to join hands with the banking system to help people in some northern provinces affected by storms and floods; spending nearly VND 4 billion to sponsor educational activities and care for people in difficult circumstances through a series of community activities called "Journey of I Love Life" in many localities across the country. On October 19, ACB donated VND 10 billion to the Ho Chi Minh City People's Committee to sponsor social security programs in Ho Chi Minh City.  Through community support activities, ACB is contributing to creating sustainable social values under the letter "S" (Society) in the ESG (Environment - Society - Governance) sustainable development strategy as well as in its pioneering role in building a sustainable and responsible financial system. In 2023, ACB contributed VND 5,214 billion to the State budget, ranking in the Top 3 private banks and Top 8 private enterprises with the largest budget contributions of the year. With impressive results from optimizing operational processes to minimize environmental impacts to ensuring transparency in corporate governance, and fully implementing social responsibilities according to ESG, ACB was ranked in the Top 50 typical sustainable development enterprises in Vietnam (for the 3rd consecutive time) awarded by Nhip Cau Dau Tu Magazine in August 2024. Next, ACB excellently achieved a "double" of prestigious awards at the Asia Pacific Enterprise Awards (APEA) 2024, including the Corporate Excellence Award (6th consecutive time) and the Inspirational Brand Award (5th consecutive time) in early October 2024.

Through community support activities, ACB is contributing to creating sustainable social values under the letter "S" (Society) in the ESG (Environment - Society - Governance) sustainable development strategy as well as in its pioneering role in building a sustainable and responsible financial system. In 2023, ACB contributed VND 5,214 billion to the State budget, ranking in the Top 3 private banks and Top 8 private enterprises with the largest budget contributions of the year. With impressive results from optimizing operational processes to minimize environmental impacts to ensuring transparency in corporate governance, and fully implementing social responsibilities according to ESG, ACB was ranked in the Top 50 typical sustainable development enterprises in Vietnam (for the 3rd consecutive time) awarded by Nhip Cau Dau Tu Magazine in August 2024. Next, ACB excellently achieved a "double" of prestigious awards at the Asia Pacific Enterprise Awards (APEA) 2024, including the Corporate Excellence Award (6th consecutive time) and the Inspirational Brand Award (5th consecutive time) in early October 2024.

Source: https://acb.com.vn/ve-chung-toi/9-thang-dau-nam-2024-acb-tang-truong-tin-dung-cao-gap-15-lan-binh-quan-nganh-tich-cuc-ho-tro-cong-dong ACB strictly complied with the regulations on liquidity safety ratio as prescribed by the State Bank of Vietnam with the LDR ratio of 82.4%, the ratio of short-term capital for medium and long-term loans accounting for 20.7%. The capital safety ratio (individual) by the end of Q3 was at 11.3%, far exceeding the level prescribed by the State Bank of Vietnam. In addition, ACB has made efforts to control and optimize operating costs at VND 8.2 trillion, a slight increase of 3.8% over the same period. The CIR ratio was maintained at a low level of 32.7%. ACB's ROE remained high at 22.2%, continuing to be among the industry's leading groups. As for ACBS, in Q3, it continued to record good business results with pre-tax profit growing by more than 44% over the same period. Accumulated in the first 9 months of the year, pre-tax profit increased by 67% thanks to the growth in income from ACBS's core business activities, including interest income from margin loans increasing 3 times, income from proprietary trading activities increasing 44% and income from brokerage activities increasing 14% over the same period with market share reaching 2.68%, up 0.24%. Promoting digital banking and expanding the provision of credit packages for green capital needs of businesses in the direction of sustainable development. According to the Government's orientation on green growth 2021-2030, ACB is implementing business activities in line with the sustainable development action plan of the banking industry, contributing significantly to ACB's positive business results in the first 9 months of the year.

ACB strictly complied with the regulations on liquidity safety ratio as prescribed by the State Bank of Vietnam with the LDR ratio of 82.4%, the ratio of short-term capital for medium and long-term loans accounting for 20.7%. The capital safety ratio (individual) by the end of Q3 was at 11.3%, far exceeding the level prescribed by the State Bank of Vietnam. In addition, ACB has made efforts to control and optimize operating costs at VND 8.2 trillion, a slight increase of 3.8% over the same period. The CIR ratio was maintained at a low level of 32.7%. ACB's ROE remained high at 22.2%, continuing to be among the industry's leading groups. As for ACBS, in Q3, it continued to record good business results with pre-tax profit growing by more than 44% over the same period. Accumulated in the first 9 months of the year, pre-tax profit increased by 67% thanks to the growth in income from ACBS's core business activities, including interest income from margin loans increasing 3 times, income from proprietary trading activities increasing 44% and income from brokerage activities increasing 14% over the same period with market share reaching 2.68%, up 0.24%. Promoting digital banking and expanding the provision of credit packages for green capital needs of businesses in the direction of sustainable development. According to the Government's orientation on green growth 2021-2030, ACB is implementing business activities in line with the sustainable development action plan of the banking industry, contributing significantly to ACB's positive business results in the first 9 months of the year.  ACB ONE Digital Banking products and services have been promoted. By the end of the third quarter, transaction turnover and the number of online transactions increased sharply, up 32% and 57% respectively compared to 2023. ACB ONE is highly appreciated by customers for its convenient experience, a program to accumulate transaction points to exchange for thousands of types of gifts, and is very suitable for the diverse needs of customers. Recently, ACB ONE has also received very positive feedback from customers when it promptly prevented fraudulent acts with technological solutions to help warn and suspend suspicious transactions. In the third quarter, ACB increased the limit of the Green/Social credit package from VND 2,000 billion to VND 4,000 billion with an interest rate of only 6%/year, with incentives up to 24 months. By the end of September, ACB had disbursed 73% of the Green/Social credit package, accounting for VND 2.9 trillion. Previously, ACB announced the Sustainable Finance Framework, creating standards for operations in the green finance sector. Most recently, at the event "Unlocking capital, welcoming opportunities" connecting banks and businesses organized by the State Bank, Mr. Tu Tien Phat - General Director of ACB - said that the Bank currently allocates about 5,000 billion VND to finance capital for small and medium enterprises, meeting the needs of production, business and import and export. This credit package can increase to 10,000 billion VND or 20,000 billion VND if businesses have a need for green credit capital to meet the requirements of foreign partners. Actively implementing social responsibilities, creating values for the community In the third quarter, ACB has accompanied local and central agencies in social security activities to improve and enhance the quality of people's lives, such as donating VND 80 billion to support the program to support the elimination of temporary and dilapidated houses nationwide launched by the Government; contributing VND 2.2 billion to join hands with the banking system to help people in some northern provinces affected by storms and floods; spending nearly VND 4 billion to sponsor educational activities and care for people in difficult circumstances through a series of community activities called "Journey of I Love Life" in many localities across the country. On October 19, ACB donated VND 10 billion to the Ho Chi Minh City People's Committee to sponsor social security programs in Ho Chi Minh City.

ACB ONE Digital Banking products and services have been promoted. By the end of the third quarter, transaction turnover and the number of online transactions increased sharply, up 32% and 57% respectively compared to 2023. ACB ONE is highly appreciated by customers for its convenient experience, a program to accumulate transaction points to exchange for thousands of types of gifts, and is very suitable for the diverse needs of customers. Recently, ACB ONE has also received very positive feedback from customers when it promptly prevented fraudulent acts with technological solutions to help warn and suspend suspicious transactions. In the third quarter, ACB increased the limit of the Green/Social credit package from VND 2,000 billion to VND 4,000 billion with an interest rate of only 6%/year, with incentives up to 24 months. By the end of September, ACB had disbursed 73% of the Green/Social credit package, accounting for VND 2.9 trillion. Previously, ACB announced the Sustainable Finance Framework, creating standards for operations in the green finance sector. Most recently, at the event "Unlocking capital, welcoming opportunities" connecting banks and businesses organized by the State Bank, Mr. Tu Tien Phat - General Director of ACB - said that the Bank currently allocates about 5,000 billion VND to finance capital for small and medium enterprises, meeting the needs of production, business and import and export. This credit package can increase to 10,000 billion VND or 20,000 billion VND if businesses have a need for green credit capital to meet the requirements of foreign partners. Actively implementing social responsibilities, creating values for the community In the third quarter, ACB has accompanied local and central agencies in social security activities to improve and enhance the quality of people's lives, such as donating VND 80 billion to support the program to support the elimination of temporary and dilapidated houses nationwide launched by the Government; contributing VND 2.2 billion to join hands with the banking system to help people in some northern provinces affected by storms and floods; spending nearly VND 4 billion to sponsor educational activities and care for people in difficult circumstances through a series of community activities called "Journey of I Love Life" in many localities across the country. On October 19, ACB donated VND 10 billion to the Ho Chi Minh City People's Committee to sponsor social security programs in Ho Chi Minh City.  Through community support activities, ACB is contributing to creating sustainable social values under the letter "S" (Society) in the ESG (Environment - Society - Governance) sustainable development strategy as well as in its pioneering role in building a sustainable and responsible financial system. In 2023, ACB contributed VND 5,214 billion to the State budget, ranking in the Top 3 private banks and Top 8 private enterprises with the largest budget contributions of the year. With impressive results from optimizing operational processes to minimize environmental impacts to ensuring transparency in corporate governance, and fully implementing social responsibilities according to ESG, ACB was ranked in the Top 50 typical sustainable development enterprises in Vietnam (for the 3rd consecutive time) awarded by Nhip Cau Dau Tu Magazine in August 2024. Next, ACB excellently achieved a "double" of prestigious awards at the Asia Pacific Enterprise Awards (APEA) 2024, including the Corporate Excellence Award (6th consecutive time) and the Inspirational Brand Award (5th consecutive time) in early October 2024.

Through community support activities, ACB is contributing to creating sustainable social values under the letter "S" (Society) in the ESG (Environment - Society - Governance) sustainable development strategy as well as in its pioneering role in building a sustainable and responsible financial system. In 2023, ACB contributed VND 5,214 billion to the State budget, ranking in the Top 3 private banks and Top 8 private enterprises with the largest budget contributions of the year. With impressive results from optimizing operational processes to minimize environmental impacts to ensuring transparency in corporate governance, and fully implementing social responsibilities according to ESG, ACB was ranked in the Top 50 typical sustainable development enterprises in Vietnam (for the 3rd consecutive time) awarded by Nhip Cau Dau Tu Magazine in August 2024. Next, ACB excellently achieved a "double" of prestigious awards at the Asia Pacific Enterprise Awards (APEA) 2024, including the Corporate Excellence Award (6th consecutive time) and the Inspirational Brand Award (5th consecutive time) in early October 2024.

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)