FiinRatings said that this rating is based on many strict assessment criteria, ensuring transparency and independence in the assessment process . ACB achieved a high credit rating thanks to its solid business position, stable capital profile, good profitability and prudent risk appetite. In addition, the Bank's capital mobilization and liquidity are also expected to continue to benefit from the increase in highly stable capital sources, creating favorable conditions for credit growth and liquidity stability.

ACB's factors are rated by FiinRatings from "suitable" to "very good", specifically:

With a business position of 'Good', ACB has consistently maintained its leading position among the top private commercial banks in Vietnam, with a diversified business model and high stability, supported by the prudent development and management strategy of the Bank's Board of Directors. As of the end of the second quarter of 2024, ACB is among the largest commercial banks in Vietnam with a market share of gross outstanding loans (VND 550.2 trillion) and customer deposits (VND 511.7 trillion).

Capital structure/leverage is assessed as “Appropriate” based on the relatively high capital adequacy ratio (CAR) compared to the industry median, the increase in Tier 1 capital in the capital structure as well as recent efforts to improve financial leverage. ACB's capital buffer is assessed as appropriate given the Bank's scale of operations. At the end of Q2/2024, ACB had a CAR of 11.8%, ranking 3rd among joint stock commercial banks of the same size.

Profitability is rated at “Good”, reflected in the Bank’s profitability indicators such as NIM and ROA at levels that are superior to the industry average, supported by a customer lending strategy focusing on SMEs, MMLC, and effective operating cost management.

The risk position is at “Very Good” and the rating has been increased by 02 notches, reflecting the Bank’s relatively cautious risk appetite, demonstrated through (i) a somewhat cautious lending and investment policy, (ii) a target retail customer segment with a relatively low level of concentrated risk, (iii) a credit growth strategy that emphasizes asset quality, and (iv) outstandingly better debt recovery rates and bad debt ratios. The Bank’s internal risk control criteria are assessed by FiinRatings as relatively comprehensive in terms of risk management, with a clear and transparent governance structure.

ACB’s capital and liquidity are rated ‘Good’ thanks to the Bank’s ability to diversify its capital structure and focus on more stable sources of funding compared to the industry average. ACB’s liquidity position is also rated ‘Good’, supported by its ability to mobilize capital that is somewhat superior to the industry average. The Bank’s short-term liquidity sources are sufficient to meet short-term capital needs and the liquidity reserve plan is rated as appropriate compared to reality.

---

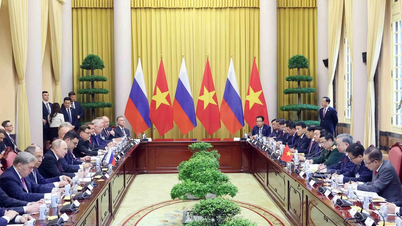

![[Photo] General Secretary concludes visit to Azerbaijan, departs for visit to Russian Federation](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/7a135ad280314b66917ad278ce0e26fa)

![[Photo] Prime Minister Pham Minh Chinh meets with the Policy Advisory Council on Private Economic Development](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/387da60b85cc489ab2aed8442fc3b14a)

![[Photo] President Luong Cuong presents the decision to appoint Deputy Head of the Office of the President](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/501f8ee192f3476ab9f7579c57b423ad)

![[Photo] National Assembly Chairman Tran Thanh Man chairs the meeting of the Subcommittee on Documents of the First National Assembly Party Congress](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/8/72b19a73d94a4affab411fd8c87f4f8d)

![[Photo] Prime Minister Pham Minh Chinh talks on the phone with Singaporean Prime Minister Lawrence Wong](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/8/e2eab082d9bc4fc4a360b28fa0ab94de)

Comment (0)