According to analysts, whether the US Federal Reserve (FED) cuts interest rates for the first time in more than four years, whether the reduction is 0.25% or 0.5%, will have an impact on the world's economies, including Vietnam.

Reduce exchange rate pressure, promote exports

Mr. Tran Hoang Son, Director of Market Strategy - VPBank Securities Company (VPBankS), analyzed that the FED's interest rate cut will partly affect exports in terms of exchange rates. At the same time, banks have more room to lower interest rates to help stimulate consumption, boost production, and increase demand for imported goods and raw materials.

"Consumption accounts for about 70% of US GDP, high interest rates make Americans tighten their spending, the number of new houses built is low and house prices are high. When interest rates decrease, in the next 3 to 6 months, consumer demand will increase, pulling up international aggregate demand. Thereby, Vietnam's exports will grow positively in the next 3 to 6 months" - Mr. Tran Hoang Son said.

The most obvious impact of the FED's interest rate cut is the cooling of exchange rates, reducing pressure on both management agencies and businesses. Photo: HOANG TRIEU

Regarding monetary policy, according to experts, when the FED reverses its policy, it will help the State Bank of Vietnam (SBV) have more room to reduce interest rates, especially after Typhoon Yagi. Thereby, it will help businesses recover better.

According to Mr. Tran Minh Hoang, Director of Research and Analysis - Vietcombank Securities Company (VCBS), the FED's first interest rate cut in more than 4 years will help the VND/USD exchange rate cool down quickly, reduce pressure on interest rates, promote import and export activities and contribute to economic growth.

However, VCBS's view is that exchange rate pressure is still constant due to the demand for foreign currency to serve the vibrant economy again, and the national foreign exchange reserve resources are being shared for the goal of stabilizing the gold market. However, the State Bank can still intervene to manage the exchange rate, although there is not much room.

There will be a delay.

Associate Professor Dr. Nguyen Huu Huan, senior lecturer at Ho Chi Minh City University of Economics, also said that overall, whether the FED reduces interest rates to a greater or lesser extent, it will have an impact on the Vietnamese economy, but there will be a delay. To assess whether the US monetary policy is really effective or not, we have to wait a bit longer. "Currently, the USD/VND exchange rate is cooling down, which will help the monetary policy management agency to "breathe easier" - this expert commented.

Meanwhile, Mr. Vu Duc Hai, Director of Currency Trading Division - Vietnam Joint Stock Commercial Bank for Foreign Trade (Eximbank), said that in the second quarter of 2024, the USD in the international market was pegged at a high level, causing the VND to depreciate by about 5% during this period. However, since the beginning of July 2024, domestic and foreign financial markets have always expected that in September 2024, the FED will cut interest rates by 0.25 - 0.5 percentage points.

This has caused the value of the USD in the international market to decrease compared to many other currencies. As a result, the VND/USD exchange rate has cooled down significantly compared to a few months ago. Data from the State Bank of Vietnam shows that the central exchange rate has decreased from 24,600 VND/USD (July 1) to 24,151 VND (September 18). The VND/USD exchange rate at commercial banks has also decreased sharply from 25,464 VND/USD to 24,151 VND/USD.

According to Mr. Hai, in response to the expectation of the FED to reduce interest rates, the State Bank of Vietnam has had a certain reaction. Specifically, in the past month, the State Bank of Vietnam has reduced the OMO interest rate (the interest rate for commercial banks to mortgage government bonds or other valuable papers to borrow capital from the State Bank of Vietnam) from 4.5% to 4%.

"This move shows that the State Bank has gone one step ahead of the FED's interest rate trend. This helps commercial banks have more cheap capital to reduce input costs, thereby creating more room to lower lending rates, creating conditions for businesses to access capital, and promoting economic growth," Mr. Hai commented.

Global impact

Before the Fed made its first rate cut in more than four years, central banks around the world, including the European Central Bank (ECB), the UK, Canada, Mexico, Switzerland and Sweden, had all cut rates. According to CNBC, many policymakers in these countries emphasized that they were ready to go ahead of the Fed to respond to slowing economic growth and reduce domestic inflationary pressures.

Richard Carter, head of fixed-interest research at Quilter Cheviot Investment Management, said the Fed's decision would certainly impact asset prices around the world. Gold, for example, hit a record high this week on expectations of a Fed rate cut. Oil and other commodities, priced in dollars, tend to gain momentum when interest rates fall amid low borrowing costs that can stimulate the economy and increase demand.

Emerging markets are particularly sensitive to these factors, making the Fed's moves even more important to them than to any major economy. It's not just the US that is affected by the Fed's moves, other stock markets are also affected. "The Fed's rate cuts reduce the cost of borrowing in dollars, making liquidity easier for companies around the world," argues Richard Carter.

X.Mai

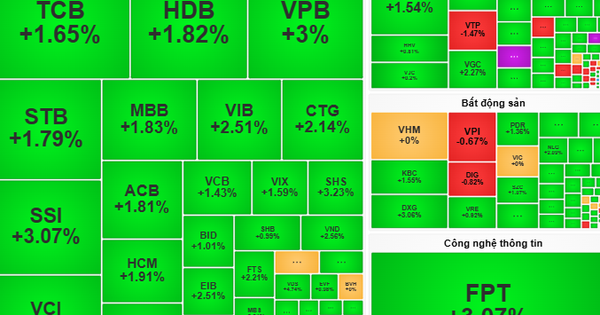

Stocks and real estate will benefit?

According to Mr. Tran Hoang Son, the FED's interest rate reduction will help businesses with high debt such as real estate, manufacturing, and export businesses to reduce financial pressure. Looking back at the 2012-2015 cycle, when the FED lowered interest rates to the lowest level in history, Vietnam had both an interest rate support policy and a VND30,000 billion support package that helped the "frozen" real estate market recover strongly in the 2014-2016 period. Many low-liquidity real estate stocks have improved a lot and their prices have increased many times.

Source: https://nld.com.vn/xuat-khau-co-them-co-hoi-tang-truong-196240918194040659.htm

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)