The Securities Commission has just fined Saigon - Hanoi Securities Joint Stock Company (SHS). With a long list of violations, the securities company chaired by Mr. Do Quang Vinh must pay nearly 1.4 billion in fines.

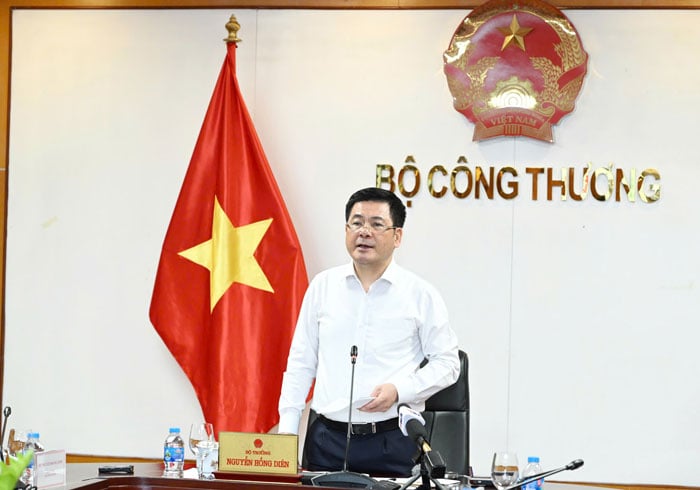

Mr. Do Quang Vinh is the chairman of SHS - Photo: SHS

On the last working day of the year of the Dragon, the State Securities Commission issued a decision to impose administrative sanctions on Saigon - Hanoi Securities Joint Stock Company (SHS).

With a series of violations, SHS had to pay nearly 1.4 billion VND in fines. Notably, there was a violation arising from a thousand-billion-VND transaction with SHB - the bank where Mr. Do Quang Hien (aka Mr. Hien, father of Mr. Do Quang Vinh) is the Chairman of the Board of Directors.

SHS specialized account confusion

The penalty decision clearly stated that SHS failed to manage customer assets separately from securities company assets.

At some point, SHS made a money transfer transaction between the dedicated account and the company payment account. For this violation, SHS was fined 175 million VND.

According to current regulations, before trading, customers must transfer money to the securities company. Dedicated accounts are only for customer transactions.

Securities companies must separately manage each customer's securities trading deposits and separate customers' money from the securities company's money.

Also related to customer money, SHS was also fined for not reporting to the Securities Commission on time as required by regulations on opening a specialized account at a commercial bank to manage customers' securities trading deposits.

In addition, SHS also violated the law by allowing customers to make margin transactions that exceeded the current purchasing power in the customer's margin trading account.

Regarding the violation of regulations on receiving and executing customer trading orders, at some points, SJS allowed some customers to place orders to buy securities when they did not have enough money in their securities trading accounts.

In addition to the fine of VND125 million for the above violation, the Commission also revokes the right to use the securities practice certificate for 1-3 months for securities practitioners who violate regulations on receiving and executing trading orders.

According to the Securities Commission, SHS also coordinated with BIDV and Saigon - Hanoi Commercial Joint Stock Bank (SHB) to provide services to some customers to borrow money to buy securities without the approval of the Securities Commission. This violation is subject to a fine of up to VND250 million.

In addition to violating regulations on lending restrictions, SHS also committed violations when lending money to customers through the form of deposit payment according to contracts for searching and introducing customers to Hanoi Technology Finance Investment Joint Stock Company and contracts for buying and selling shares with Encapital Holdings but did not comply with the signed contracts, with the principal and fees refunded.

SHS must stop taking SHB money to lend customers money to buy securities.

When providing securities services or other services, securities companies must report to the Securities Commission.

However, SHS performed the service of connecting and transferring money from customers who signed securities brokerage contracts to the securities trading accounts of other customers (Fintech) without reporting to the Commission. For this error, SHS was fined up to 225 million VND.

The Securities Commission has also required SHS to stop coordinating with banks such as BIDV and SHB to provide margin services.

In addition, the management agency requires SHS not to provide securities services or other services without reporting, without written opinions or without guidance from competent authorities.

SHS also disclosed incomplete information on related party transactions in the management reports for 2022, 2023 and the first 6 months of 2022, 2023, and 2024.

SHS does not fully state the quantity and total value of transactions in the transaction section between the company and related parties; or between the company and major shareholders, insiders, and related parties of insiders.

SHS also violated regulations on transactions with shareholders, business managers and related persons.

According to the audited financial report for 2022, SHS has transactions to receive loans with a total transaction value of VND 5,381 billion and repay loans with a total transaction value of VND 7,118 billion with SHB (related party), greater than 35% of the company's total asset value on the 2022 financial report.

It is worth noting that the above has not been approved by the general meeting of shareholders.

Source: https://tuoitre.vn/mot-cong-ty-chung-khoan-nhap-nhang-tien-khach-hang-vi-pham-khi-giao-dich-nghin-ti-voi-shb-20250125074716098.htm

![[Photo] More areas of Thuong Tin district (Hanoi) have clean water](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/55385dd6f27542e788ca56049efefc1b)

![[Photo] Prime Minister Pham Minh Chinh and Japanese Prime Minister Ishiba Shigeru visit the National Museum of History](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/93ae477e0cce4a02b620539fb7e8aa22)

![[Photo] Prime Minister Pham Minh Chinh receives Cambodian Minister of Commerce](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/28/be7f31fb29aa453d906df179a51c14f7)

![[Photo] Prime Minister Pham Minh Chinh and Japanese Prime Minister Ishiba Shigeru attend the Vietnam - Japan Forum](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/29/fc09c3784d244fb5a4820845db94d4cf)

Comment (0)