Investment Comments

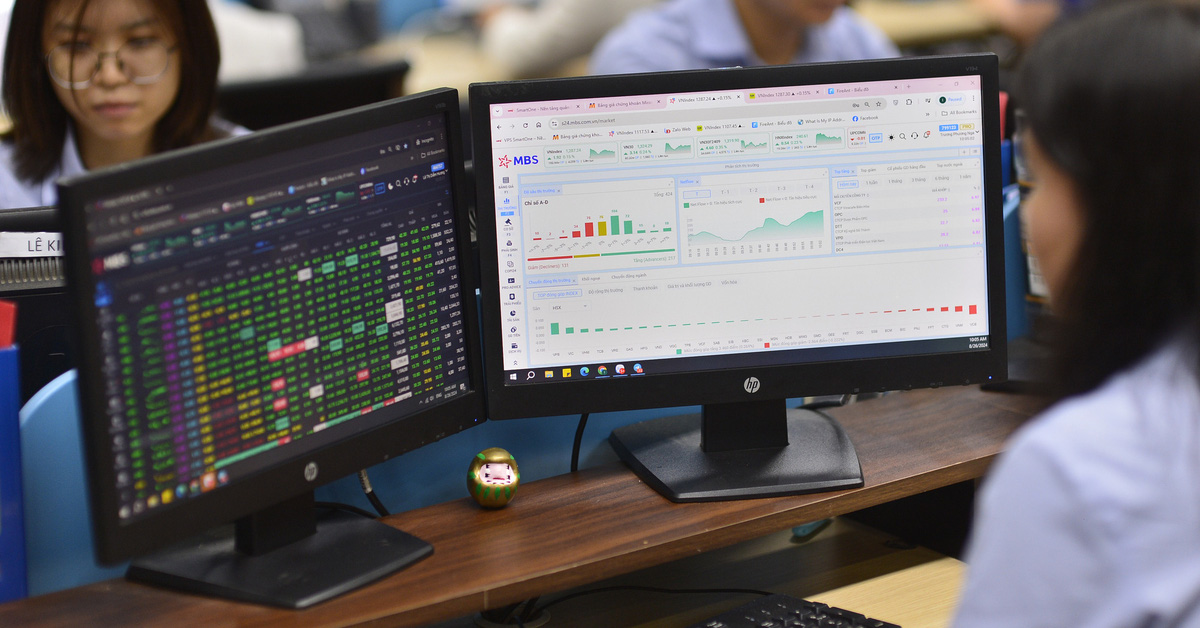

Asean Securities (Aseansc) : The market recorded the first decline after 7 consecutive increases. Supply pressure on most stocks has appeared, however, this level is still considered moderate, not affecting the main uptrend. Stock groups in the session adjusted within the safe range.

However, this is also an early signal that VN-Index will need to accumulate before the next increase.

Beta Securities: In the trading session of February 22, the market is likely to remain divided and support will only point towards the resistance level of 1,250 points, and there may continue to be fluctuations/adjustments.

However, in the current context, the level of deep adjustment is quite low and the stock groups are at risk of differentiation, in which the Real Estate group may still adjust, cash flow is looking for other stocks. The RSI indicator reached 80.06, continuing to maintain an overbought state, showing that short-term risks have a basis to occur.

Therefore, investors can consider taking profits from hot stocks, while redirecting cash flow to stocks with potential price increases and good accumulation bases.

Yuanta Vietnam Securities (YSVN) : The market may continue to fluctuate and maintain the upward momentum in the next session, short-term risks remain low and the market may maintain the upward momentum in the next few sessions.

However, according to YSVN 's observation , new buying opportunities are very limited and investors do not have many choices during this period. Cash flow is still mainly concentrated in large-cap stocks and supply and demand appear to be quite balanced. This also shows that short-term demand is still very good when many large-cap stocks have increased a lot.

In addition, the sentiment indicator continues to rise, showing that investors are still optimistic about the current market developments.

Stock news

- Europe's largest economy is not out of the woods yet, and the difficult period is expected to continue. Germany is likely to fall into recession due to weak external demand, cautious consumers and high borrowing costs hindering domestic investment, the Bundesbank said in its monthly report on Europe's largest economy.

Germany has struggled since the Russia-Ukraine conflict erupted in 2022, pushing up energy costs. Its industry-led economy is in its fourth consecutive quarter of zero or negative growth, weighing on the entire eurozone.

- "No risk of recession," leading economic indicator confirms: Is the world's number one economy about to make a soft landing? According to the latest measurement results released by the research organization Conference Board, the US economy is not expected to fall into recession, although the country's leading economic indicator (LEI) shows that economic output will be flat in the coming months .

Source

Comment (0)