► Some stocks to watch on October 21

VN-Index is still in an upward accumulation channel.

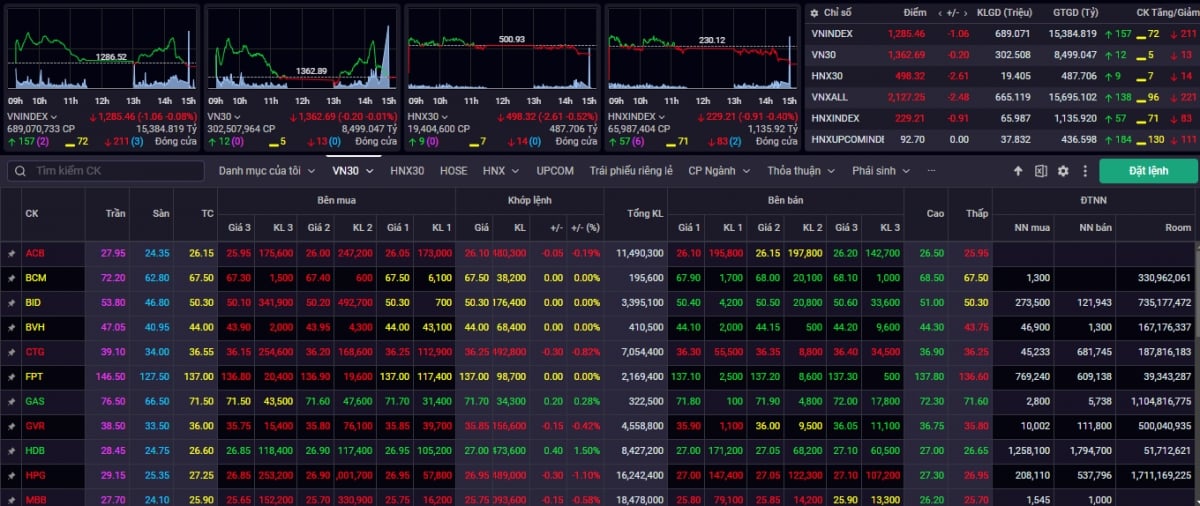

The stock market had a week of sluggish trading, moving in a sideways state with a cautious sentiment on both the buyers and sellers. At the end of the trading week from October 14 to October 18, the VN-Index almost went sideways with a decrease of nearly 3 points, however, investors experienced many ups and downs with 4 out of 5 correction sessions. The beginning of the week was relatively gloomy, the cash flow was narrowed and quiet, causing the red color to cover the market, causing the market to correct for 3 consecutive sessions. The peak was the trading session on October 16 when liquidity hit rock bottom, the market traded in a narrow range and closed just below the 20-day average. The highlight of the buying force last week mainly took place during the derivatives expiration session, helping to regain the points lost at the beginning of the week. The attempt to break out in the last session of the week, like the previous times, did not bring results when selling pressure pulled down the points in the last minutes of the session. Closing the trading week from October 14 to October 18, the VN-Index closed at 1,285.46 points -2.93 points (-0.23%).

Market liquidity was almost flat, down -4.5% compared to the average of 20 trading sessions. Accumulated to the end of the trading week, the average trading liquidity on the HSX floor reached 633 million shares (+10.95%), equivalent to VND 15,811 billion (+3.82%) in trading value.

Most of the trading time was in red, causing 15/21 industry groups to make adjustments at the opening of last week. Putting great pressure on the market and trading sentiment last week were industry groups such as: Oil and Gas (-3.72%), Consumer Goods (-3.01%), Fertilizer (-2.48%),... On the other hand, some industry groups that successfully reversed the trend include: Seafood (+2.45%), Plastics (+1.25%), Aviation (+0.80%), Retail (+0.78%),...

According to experts from Kien Thiet Securities Company (CSI), ending the week with a slight decrease (-0.23%) and lower liquidity (-4.5%) compared to the 20-week average shows that the main trend is still Sideway within a fairly narrow range. The macro situation has many bright spots, combined with the expectation of quite good profit growth of businesses in the third quarter of 2024, so a deep and strong decrease is very unlikely.

“The VN-Index is still in an upward accumulation channel, so investors should continue to hold their portfolios and gradually increase the proportion of profitable stocks in their portfolios when the general market has a correction like last week. We expect the VN-Index to conquer the psychological mark of 1,300 points and move towards the resistance level of 1,320 - 1,330 points in the coming weeks,” said the CSI expert.

VN-Index may escape the current narrowing range accumulation

According to the analysis team of ASEAN Securities Company (ASEANSC), the Banking group maintained its rhythm when cash flow was cautious and there was a slight net withdrawal in other groups, after the information that the State Bank of Vietnam offered 14-day and 28-day treasury bills with a volume of VND12,300 billion, causing negative sentiment on cash flow in the general market in the short term. The index fluctuated but still maintained the main sideway trend, gradually forming a wide buffer zone of 1,270 - 1,290 points right below the resistance of the old peak, forming a more solid growth foundation. The market absorbed the pressure from the selling side well and is expected to move up slowly with the momentum from the Q3 business results announcement season.

“Investors should maintain a medium portfolio weighting, looking for stocks with good fundamentals and positive Q3 business results. We appreciate the medium- and long-term market outlook, however, investors should be aware of potential risks that may come from information from the US stock market in the coming time, so they need to closely observe world markets to confirm how long the uptrend can continue,” ASEANSC experts noted.

Experts from Saigon - Hanoi Securities Company (SHS) assessed that in the short term, VN-Index is growing above the support zone around 1,280 points, the average price of the current 20 sessions. VN-Index is entering the final stage in a narrow price channel below the strong resistance zone of 1,300 points that has lasted since the beginning of the year, above the support zone corresponding to the growth trend line connecting the lowest price zones from August to September 2024 to present. In the next 1-2 weeks, VN-Index may escape the current narrowing range accumulation. In a positive case, VN-Index can still maintain the short-term uptrend, then it can be expected to rise back to the resistance of 1,300 points. However, this is a very strong resistance zone corresponding to the price peaks in June to August 2022 as well as since the beginning of the year. VN-Index can only overcome this strong resistance in the coming time when there is consensus on growth among industry groups.

Medium-term trend, VN-Index grows above the support zone around 1,250 points, towards the price zone of 1,300 points, expanding to 1,320 points. In which, the price zone of 1,250 points is the highest price in 2023, the price zone of 1,300 points - 1,320 points are very strong resistance zones, the peak price in June - August 2022 and the peak price in the first months of 2024. These are fundamental resistance zones, the market can only overcome these strong resistance zones when there are good macro support factors, outstanding business growth results. At the same time, uncertain factors such as geopolitical tensions such as the Russia - Ukraine war, the Middle East cool down.

“In the short term, investors should not chase the trend when VN-Index is heading towards the 1,300 price range in many previous news reports. Investors can wait for the general market, VN-Index to escape the current short-term and medium-term accumulation trend, with the confirmation of consensus growth of many industry groups, before considering increasing new positions. Investors should maintain a reasonable proportion, disbursed positions should carefully select good quality codes, when the market is in the stage of receiving business results information. The investment target is to focus on leading stocks, good fundamentals, good growth in Q2 business results, and positive growth prospects for Q3 business results,” SHS experts recommended.

Source: https://vov.vn/thi-truong/chung-khoan/nhan-dinh-chung-khoan-2110-2510-vn-index-van-dang-trong-kenh-tich-luy-di-len-post1129544.vov

Comment (0)