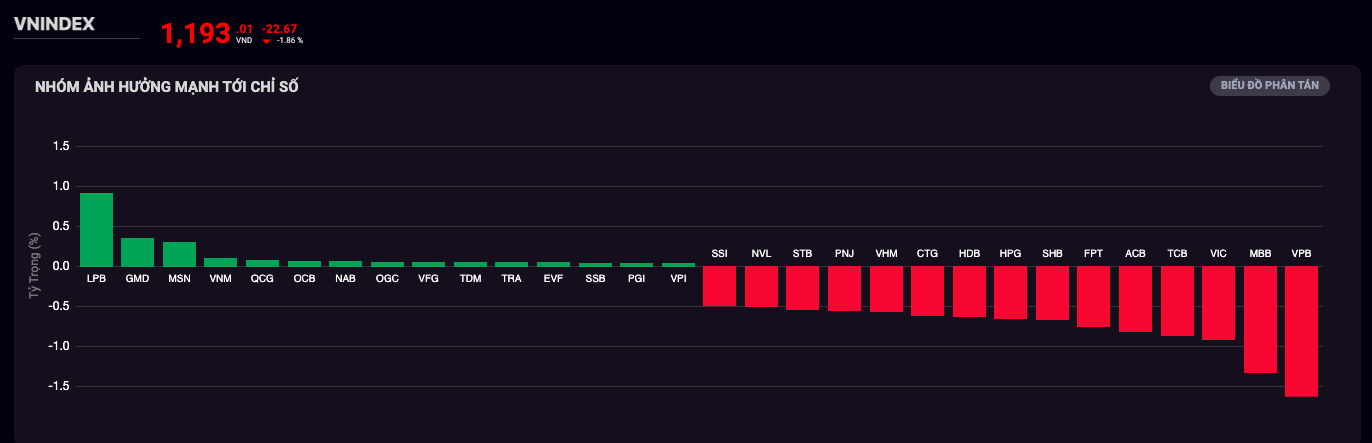

Banking stocks played a major role in causing the VN-Index to fall another 22 points, losing the 1,200 mark. Among the 5 stocks that negatively affected the stock market today, April 17, there were 3 banking stocks: BID, VCB, CTG.

VN-Index decreased for 3 consecutive sessions, losing 80.59 points

The selling side continued to dominate, VN-Index plunged more than 22 points, losing the 1,200-point mark before the holiday. Investors' caution in the expiration session caused liquidity to drop sharply, the market lacked support.

In the previous session, VN-Index experienced a strong fluctuation yesterday (April 16), the index dropped sharply by nearly 25 points to 1,191.73 points, but was able to return to the 1,200 point mark, up to 1,215.7 points.

In today's session, VN-Index suddenly dropped sharply in just the last half hour of the session, closing at 1,193.01 points, down 22.67 points, equivalent to 1.86%.

Market liquidity reached VND 19,106 billion, equivalent to 859 million shares, lower than the average liquidity of the past month.

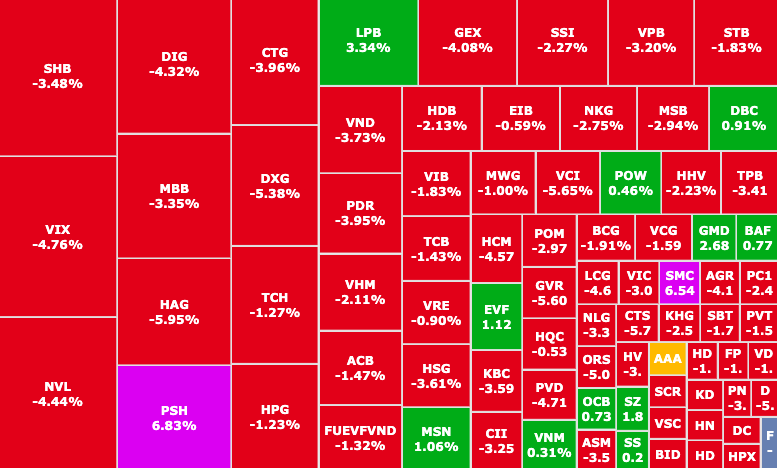

"Red" continues to dominate the market

On the HOSE floor alone, 137 stocks increased, 348 stocks decreased (of which 8 stocks hit the floor) and 57 stocks remained unchanged. Most industries were in red, only 4/25 industries remained green, including: health care, food and beverage, seafood and consulting and support services.

Thus, in the past 3 consecutive sessions (from April 15-17, 2024), VN-Index continuously decreased by 80.59 points (from 1,273.6 points to 1,193.01 points.

Stocks, real estate, banking were sold heavily

A series of banking stocks and the VN30 group acted as a strong drag on the VN-Index, specifically: VPB (VPBank, HOSE) decreased by 3.2%, MBB (MBBank, HOSE) decreased by 3.35%, VIC (Vingroup, HOSE) decreased by 3.02%, TCB (Techcombank, HOSE) decreased by 1.43%, ACB (ACB, HOSE) decreased by 1.47%,...

Banking group continues to play a role in pushing VN-Index to fall deeply (Photo: SSI iBoard)

On the contrary, mainly small and medium-sized stocks contributed to the positive trend of VN-Index, along with some other large stocks: MSN (Masan, HOSE) increased by 1.06%, VNM (Vinamilk, HOSE) increased by 0.31%, QCG (Quoc Cuong Gia Lai, HOSE) increased by 6.71%...

At the same time, some banking stocks rose sharply against the trend. Typically, LPB (LPBank, HOSE) increased sharply by 3.34%, with 15.3 million units matched, leading the group of stocks that contributed positively to the market. This was also LPB's second consecutive strong increase, before that, LPB had increased 4.01% in value on the floor yesterday (April 17).

LPBank has increased strongly in the past 2 consecutive sessions, increasing its value by more than 7% on the stock exchange (Photo: SSI iBoard)

This positive state appeared right after LPBank successfully held the 2024 annual general meeting of shareholders with many new plans: a plan to increase charter capital by an additional VND 8,000 billion, and a proposal to change the name: Loc Phat Vietnam Commercial Joint Stock Bank.

In addition, OCB (OCB, HOSE), NAB (Nam A Bank, HOSE) and SSB (SeaBank, HOSE) also increased slightly, respectively 0.73%; 0.64%; 0.23%,...

Notably, shares of CEO Nhu Loan - QCG (Quoc Cuong Gia Lai, HOSE) have increased continuously for the past 4 sessions, reaching the "ceiling" of more than 6.7% in today's session, reaching a market price of 16,700 VND/share.

In this context, there are many mixed reactions from investors. Some are concerned that the scenario from 8 months ago (late September 2023) will repeat itself, so the market will take a long time to recover. At the same time, many investors took advantage of the bottom of the session that dropped sharply by 60 points at the beginning of the week, but today's session still could not make a profit, and even suffered more losses when the stock continued to fall deeply. Some other investors breathed a sigh of relief because they had time to push their goods and take profits before the market's fluctuations.

Source

Comment (0)