The first two trading sessions of the Year of the Dragon were positive, helping the VN-Index surpass 1,200 points. The stock market surged along with good liquidity, creating an exciting mood for investors expecting a point level of 1,250.

VN -Index returns to 1,200 point mark after nearly 5 months

The first two trading sessions on the stock market in the year of the Dragon were positive, with the VN-Index surpassing 1,200 points in the first session after the Tet holiday, closing the week at 1,209.7 points.

Liquidity has improved well, with HOSE alone reaching over VND17,500 billion/session. The entire market reached about VND20,000 billion/session.

The positive wave from the banking industry is gradually spreading to the entire industry, notably the cash flow into real estate stocks.

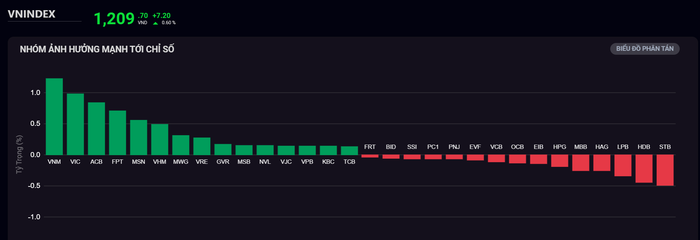

The pair of Vingroup stocks: VIC (Vingroup, HOSE) and VHM (Vinhomes, HOSE) both contributed strongly to the market. VIC contributed nearly 1 point, ranking 2nd, VHM contributed 0.5 point.

Following that, NVL (Novaland, HOSE) and KBC (Kinh Bac Urban Development, HOSE) also increased by more than 1.14% and 1.29% respectively, contributing to the increase of VN-Index.

The heat from the banking group spreads to the market: real estate, retail, consumption,... (Source: SSI iBoard)

Besides the real estate group, VNM (Vinamilk, HOSE) surprised everyone when it had an explosive trading session last weekend. Shares increased by 3.55%, the market price reached 70,000 VND/share, the highest in the past 3 months. Trading volume increased dramatically to over 11 million units, this is also the 2nd largest trading volume in VNM's history, after the record session on June 23, 2023.

This week's comments and recommendations

BSC Securities assessed that VN-Index could head towards the 1,250-point threshold because in addition to the market-leading growth momentum from sectors such as Real Estate, Chemicals, and Insurance, liquidity is gradually returning, creating additional momentum for the market to increase points.

MAS Securities commented that the psychological mark of 1,200 points was officially established after the session on February 16. According to analysis, the threshold of 1,215 - 1,225 points is the area that investors should pay attention to in the short term. Investors should note that this is the area where the VN-Index confirmed entering a downtrend in the downtrend from September to November 2023, the index decreased from 1,250 points to 1,020 points.

However, the possibility of VN-Index falling points still needs to be anticipated. Yuanta Securities believes that the market may face a correction at the beginning of the week when VN-Index trades in the resistance zone of 1,200 - 1,210 points. The short-term trend is still maintained at an upward momentum, short-term investors can continue to hold a high proportion of stocks in their portfolio.

VCBS Securities recommends that investors should be cautious, limit buying stocks at high prices, have a short-term trading strategy, realize stocks that have had good growth and monitor fluctuations to be able to buy stocks at better prices.

Prime Minister requests report on upgrading stock market before June 30

In Directive No. 06/CT-TTg dated February 15, 2024 of the Prime Minister, the Prime Minister requested the Ministry of Finance to preside over and coordinate with the State Bank of Vietnam and the Ministry of Planning and Investment to urgently handle problems in their assigned fields to meet the criteria for upgrading the stock market from a frontier market to a new market, with the deadline for reporting implementation results before June 30, 2024.

At the regular Government press conference on February 1, Mr. Nguyen Duc Chi, Deputy Minister of Finance, outlined the tasks that need to be performed well in 2024 to achieve the goal of upgrading the stock market as soon as possible.

Including: Issues regarding margin requirements before trading; Need for transparency and clarity regarding foreign investors' ownership ratio in enterprises; Transparency of information of enterprises in two languages; Putting the new securities trading system into operation and ensuring the requirements of depository payment transactions.

Hoa Phat is forecast to make a profit of more than 11,000 billion VND in 2024

Along with the positive market trend at the beginning of the year, foreign investors have net bought more than 34.6 million units. Of which, the steel giant Hoa Phat (HPG, HOSE) accounts for the majority of the portfolio of foreign investors net buying since the beginning of 2024 with 27.5 million units (about 800 billion VND).

HPG has been strongly net acquired by foreign investors since the beginning of 2024 (Source: SSI iBoard)

SSI Securities' analysis report said that HPG is forecast to enter a new profit cycle with the expectation of recovery in 2024, especially in the domestic market. HPG's net profit in 2024 could reach VND11.2 trillion, up 64.5% compared to 2023, thanks to the recovery in both consumption output and steel prices.

Investors are advised that, as the stock price only partially reflects the 2024 profit outlook, they can wait for corrections to buy stocks with a long-term vision as steel prices have bottomed out and expect the contribution of the Dung Quat expansion project from 2025.

Hoang Anh Gia Lai continues to fluctuate after a series of positive signals

In 2023, Hoang Anh Gia Lai Joint Stock Company (HAG, HOSE) has set many business records since being listed on the stock exchange: 2023 profit reached more than 1,800 billion VND, the highest in the past 12 years; handled about 20,000 billion VND of financial debt, bringing the asset structure to a relatively safe level;...

Recently, HAG recorded a series of fluctuations:

Ms. Doan Hoang Anh - daughter of Mr. Doan Nguyen Duc (Chairman of the Board of Directors of Hoang Anh Gia Lai Joint Stock Company) sold 2 million shares, reducing her ownership to 9 million shares, with an ownership ratio of 0.97%.

The State Securities Commission approved the registration dossier for private offering of HAG shares. Accordingly, HAG has finalized the plan to issue 130 million private shares at VND10,000/share to raise VND1,300 billion.

Hoang Anh Gia Lai unexpectedly appointed Mr. Nguyen Xuan Thang as General Director to replace Mr. Vo Truong Son after receiving his resignation. It is known that the new General Director, Mr. Nguyen Xuan Thang, was born in 1977, has a bachelor's degree in Business Finance and does not own any HAG shares.

Dividend schedule this week

According to statistics, 10 companies announced dividend rights this week. Of these, 8 companies paid cash dividends, 1 company awarded shares, and 1 company exercised the right to buy.

The highest dividend payout ratio is 35%, the lowest is 5%.

Binh Duong Minerals and Construction Joint Stock Company (KSB, HOSE) exercises the right to buy shares with the ex-right trading date of February 19, dividend payment rate of 50%.

Prosperity and Development Joint Stock Commercial Bank (PGB, UPCoM) awards shares with the ex-right trading date of February 22, dividend payment rate of 40%.

Cash dividend payment schedule of enterprises from February 19 - February 25

* GDKHQ: Ex-rights transaction - is the transaction date on which the buyer does not enjoy related rights (right to receive dividends, right to buy additional issued shares, right to attend shareholders' meeting...). The purpose is to close the list of shareholders who currently own shares of the company.

| Stock code | Floor | GDKHQ Day | Date TH | Proportion |

|---|---|---|---|---|

| VHC | HOSE | 19/2 | 29/2 | 20% |

| HMR | HNX | 19/2 | April 28 | 9.7% |

| USD | UPCOM | 19/2 | 6/3 | 10.4% |

| DTV | UPCOM | 20/2 | April 19 | 15% |

| HTL | HOSE | 20/2 | 8/3 | 20% |

| SVC | HOSE | 21/2 | 29/2 | 5% |

| CCI | HOSE | 21/2 | 8/4 | 13% |

| HGM | HNX | 23/2 | 3/25 | 35% |

Source

Comment (0)