Besides the businesses that have been successful in their journey of "reaching out to the ocean" such as Viettel, FPT, VinFast, Vinamilk... there are still many businesses that have difficulty competing with international rivals, and the path to investing abroad is still full of thorns.

When talking about Vietnam, many consumers in the world may remember traditional agricultural products such as rice, coffee, pepper, rubber, minerals, etc. However, now, there are businesses reaching out globally, bringing high-tech products to consumers around the world. That is the story of VinFast, an automobile and electric motorbike manufacturer that has been mentioned by many large corporations and world media.

In 2017, Vingroup officially started construction of a complex of automobile and electric motorbike factories in Cat Hai (Hai Phong). After 21 months since the groundbreaking date, the VinFast automobile and electric motorbike factory complex was officially inaugurated. Vinfast's product lines currently include gasoline-powered cars, electric cars and electric motorbikes.

A year later, VinFast, a member of Vingroup, brought two models to the Paris International Motor Show, the world's largest car show. VinFast gradually became a name that the media noticed.

In June 2019, at Dinh Vu Industrial Park (Hai Phong), the automobile manufacturing plant was inaugurated, officially entering the mass production stage. This milestone is considered a turning point for the Vietnamese automobile industry from outsourcing to self-sufficient production. For the first time, Vietnam has a commercial automobile with a domestic brand, putting Vietnam on the map of countries with their own automobile manufacturing industry.

After gasoline cars, VinFast entered the electric car industry. In 2021, the company introduced two electric car models at the Los Angeles Auto Show and put its US branch headquarters into operation there. In November 2022, the company exported the first 999 electric cars to the world.

Entering the US electric vehicle market, a market with a capacity of about 28 billion USD with many incentive policies according to the regulations of the host country, however, VinFast still has to compete with major international electric vehicle manufacturers such as Tesla, Volkswagen, Ford, Daimler, Chevrolet, GM...

The success or failure of the IPO and listing on the US market will demonstrate VinFast's potential and long-term ambitions, and is also considered the first big step for Vietnamese businesses to participate in global playgrounds.

The VinFast listing event on the US stock exchange took place in the US on August 15. VinFast CEO Le Thi Thu Thuy said that becoming a listed company in the US is an important milestone in VinFast's global development journey. It is not simply about listing shares on the stock market, but also a strong belief in VinFast's vision and potential.

According to her, this successful listing opens up access to a large capital market and an important direction for the company's future development. "We hope that VinFast's story will inspire and open up many opportunities for Vietnamese brands to go global," she said.

To compete in the US market, VinFast is in the process of building a factory in North Carolina, expected to be operational from 2025. "With the factory in North Carolina, we expect to be able to streamline costs and provide products at prices that are completely accessible to US customers," Ms. Thuy shared.

This new step of VinFast has many similarities with the journey that the Korean auto giant Hyundai created in the 80s of the last century, the time when they also first set foot on American soil, conquering the most demanding market in the world.

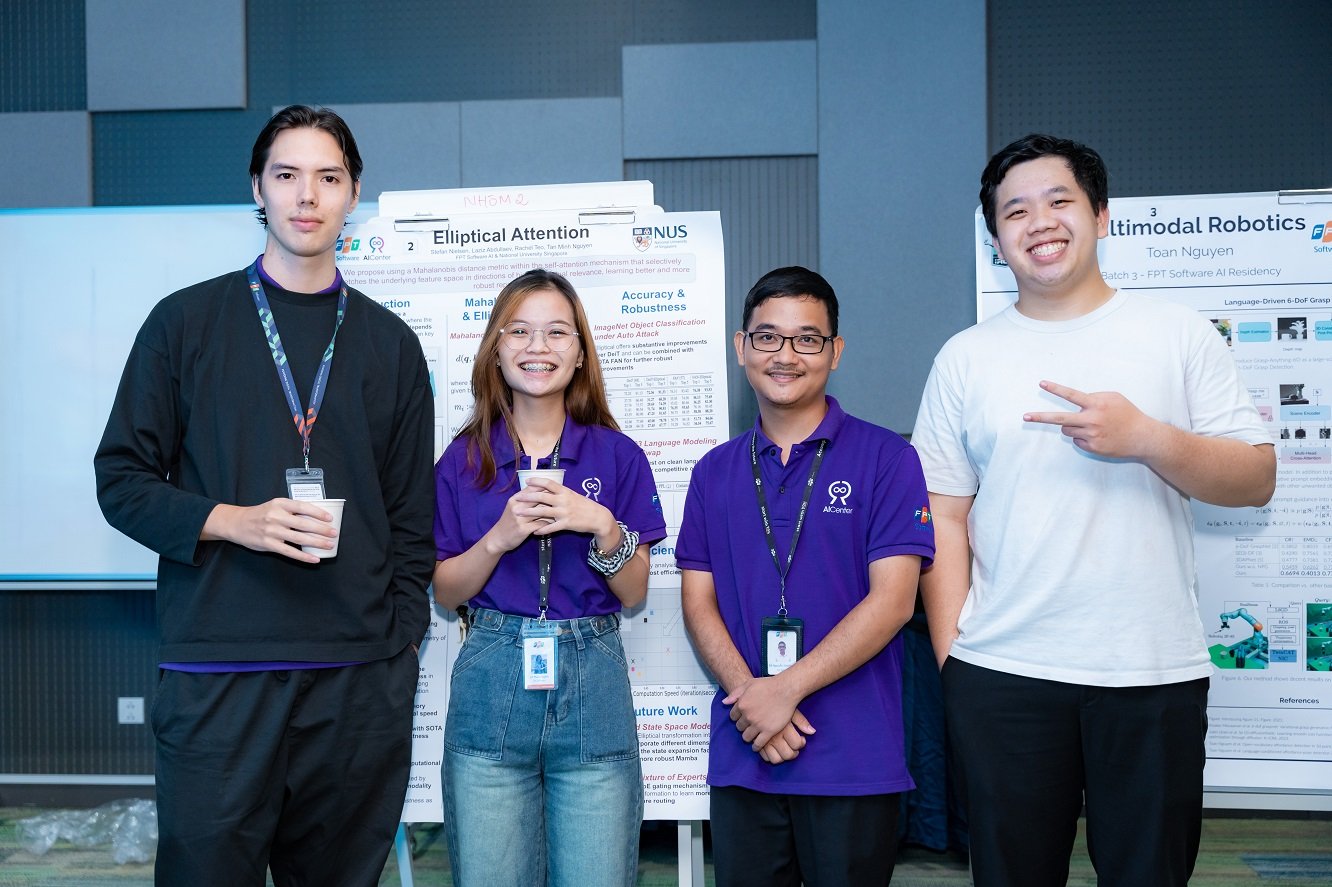

Not only VinFast, many Vietnamese digital technology enterprises have also reached out to the world with remarkable success. One of the outstanding enterprises is FPT Corporation with a large network of headquarters and offices around the world, an important partner of many large corporations such as Microsoft, Amazon, Airbus, etc.

Foreign investment plays an extremely important role in FPT's global strategy. In 2022, FPT achieved revenue of 1 billion USD in foreign markets.

Since 2014, FPT has carried out mergers and acquisitions (M&A) with RWE IT Slovakia to expand its customer base in the public infrastructure sector. This is the first M&A deal in the information technology sector of Vietnam in a foreign market.

In 2018, FPT acquired 90% of shares of Intellinet, the fastest growing digital transformation roadmap consulting company in the US, as rated by Consulting Magazine in 2017.

Earlier this year, the company also announced the acquisition of the entire technology services division, one of the strategic business segments of Intertec International (USA). This deal is part of FPT's strategy to expand its global technology service centers.

In 2023, along with this deal, FPT will expand its presence in Costa Rica, Colombia and Mexico (3 countries with Intertec's technology manufacturing centers).

"Usually FPT M&A consulting companies, because consulting is not our main job, but we do development. We look for companies that are consulting for large companies in the world and "hook in" to develop our market," Mr. Binh emphasized.

Another representative is Viettel Military Industry and Telecommunications Group.

Viettel went abroad early with the establishment of Viettel Global in 2006. After 3 years of efforts to find cooperation opportunities, apply for licenses, and build network infrastructure, in February 2008 Viettel officially opened the market in Cambodia under the Metfone brand (this was Viettel's first foreign market). In 2009, Viettel continued to open in the Lao market under the Unitel brand.

To learn and compete with the "big guys" in the world and to have a larger market, in 2010, Viettel decided to choose poor countries, even the poorest in the world, to invest in because "easy places no longer exist".

In 2011, Viettel launched its service in Haiti. A year later, Viettel continued to launch in the Mozambique market, followed by the East Timor and Peru markets in 2014 and the Cameroon and Tanzania markets in Africa in 2015. Finally, the Myanmar market was invested by Viettel in 2018.

During 17 years of investing abroad, Viettel has opened 10 markets, not to mention representative offices in the US, France, Russia, Japan...

Besides the stories of technology, media, and mining businesses, there are still agricultural production businesses that are making efforts every day, every hour to bring Vietnamese brands to the international market.

That is the story of PAN - the agricultural empire of stock "tycoon" Nguyen Duy Hung. Mr. Hung is known as the founder and operator of Saigon Securities Company (SSI). Although it only entered the agricultural sector in 2013, The PAN Group has clearly shown its ambition to become a leader in the food and agricultural industry.

In 2012, the company began to expand into the agricultural sector by purchasing 2.6 million shares of An Giang Seafood Import-Export Joint Stock Company (AGF), equivalent to 20.2% of the company's equity.

PAN's revenue structure since 2015 has clearly shifted, reflecting changes in business strategy with the main proportion coming from agriculture (47%) and food (38%) and gradually reducing the proportion of revenue from the traditional business sector of building services (15%).

In 2018, Sojitz Group (Japan) spent 35 million USD to buy 10% of shares of The PAN Group. And in 2020, PAN joined hands with Sojitz Group to bring cashew nuts to Japan.

Mr. Nguyen Duy Hung believes that The PAN Group has enough foundation to develop the Farm - Food - Family model. In which, the Farm segment is based on Vinaseed, VFC, PAN Hulic. The food sector includes 4 segments with confectionery (PAN Food, Bibica), seafood (Sao Ta, Ben Tre Seafood Import and Export), dried seeds and fruits (Lafooco), fish sauce (584 Nha Trang).

It is also Trung Nguyen Coffee, which has brought its brand to the US and Singapore markets after many difficulties and hardships. Currently, the group has successfully franchised in Japan and Singapore. At the end of 2022, this business also opened the first Trung Nguyen Legend in China.

That is also ST25 rice with first prize in the World's Best Rice 2019 competition and is gradually becoming popular with consumers around the world.

However, there are still businesses with unsatisfactory business results when entering this field.

Although operating a rubber latex processing factory with a capacity of 25,000 tons/year and tens of thousands of hectares of fruit farms, the business results of Hoang Anh Gia Lai International Agriculture Joint Stock Company are still not optimistic, in 2022, revenue decreased by 40% and a loss of VND 3,566 billion, 3 times the loss in 2021.

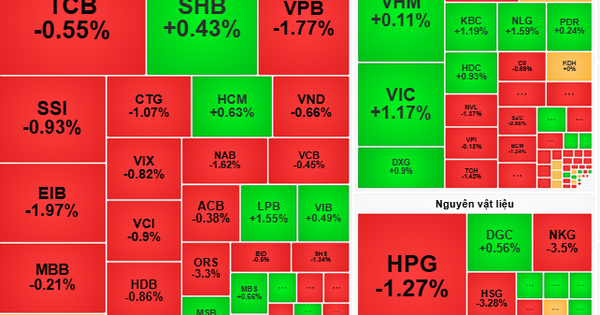

As for the "steel king" Hoa Phat, entering the foreign market during difficult times, the company does not have enough resources to spread out.

At the shareholders' meeting held in March this year, Chairman Tran Dinh Long said that Hoa Phat will stop all new investment activities to focus on the Dung Quat 2 project, including stopping investment in mining projects in Australia.

Previously, in May 2021, the Australian subsidiary of Hoa Phat Group was approved by the Australian Foreign Investment Board (FIRB) to purchase 100% of the shares of the Roper Valley Iron Ore Mine Project. This is Hoa Phat's first step into the market with the world's largest iron ore supply.

According to the Australian Embassy in Vietnam, Australia's total export turnover to Vietnam in 2020 reached 4.4 billion USD. Of which, Hoa Phat accounted for 705 million USD, equivalent to 16%, and was Australia's largest Vietnamese customer.

However, in the current context, Chairman Tran Dinh Long said Hoa Phat will stop all investment activities, including mining projects in Australia.

According to the Chairman of Hoa Phat, because the steel industry cycle is in a recession, the business plan and profits are not as calculated. Hoa Phat has sent a document to the Australian government requesting a temporary suspension and Mr. Long affirmed that this is an extremely correct decision.

Mr. Long shared: "Many people in the business world criticize Hoa Phat for being conservative, but now we have to admit that we are right. To be so stable, we must accept special measures."

Therefore, the Board of Directors decided to temporarily suspend all investment activities, not only in Australia, to focus on Dung Quat 2. "That's all we have," Mr. Long sincerely shared.

However, Mr. Long also expressed that stopping investment in Australia is very "painful" when many employees and their families have gone to Australia and then had to return.

"Hoa Phat is a place of love, first and last, I have to bring it back here to take care of everyone. In particular, there are leaders who are determined to go to Australia, sell their houses, and bring their wives and children. Now that I'm back here, I have to use my own money to lend them money to buy houses again. However, only then can Hoa Phat be like today," said the Chairman of Hoa Phat.

In the real estate sector, since 2016, Hoang Quan Group said it has poured 40 million USD through its subsidiary, Hoang Quan - USA Education Investment Company Limited, to implement The Hailey social housing project in the US.

The Hailey was completed and put into use in October 2021 in Washington State (USA). The project was developed according to the long-term rental housing model, and is the first social housing project in Vietnam invested in the US.

The Hailey Apartment is expected to be worth $50 million after 6 months of operation, with annual revenue of about $3.5 million, and a profit of 11% - higher than the local average of 9%.

With the goal of becoming a billion-dollar enterprise by 2030, in addition to promoting domestic investment, Hoang Quan aims to expand investment in one more country in the world each year within the next 10 years.

However, in the first 6 months of the year, Hoang Quan only recorded 142.4 billion VND in net revenue and 2.2 billion VND in profit after tax, down 32.1% and 85.4% compared to the first half of 2022. In 2023, Hoang Quan Real Estate set a target of 1,700 billion VND in revenue for the whole year and a profit target of 140 billion VND. With the achieved results, Hoang Quan has only achieved 8.4% of the revenue target and nearly 2% of the annual profit target.

According to the Ministry of Planning and Investment, in the first nine months of this year, Vietnam's total investment abroad reached 416.8 million USD, up 4.6% over the same period last year. As of September 20, Vietnam had 1,667 valid investment projects abroad, with a total investment capital of nearly 22.1 billion USD.

Of these, 141 projects were implemented by state-owned enterprises, with a total foreign investment capital of up to 11.67 billion USD, accounting for 52.8% of the country's total investment capital.

Vietnam's investment abroad mainly focuses on the mining industry (accounting for 31.5%) and agriculture, forestry and fishery (accounting for 15.5%). There are 23 countries and territories receiving investment from Vietnam in the 8 months. Of which, Canada is the leading country with 150.2 million USD, accounting for 36.1% of total investment capital; Singapore with 115.1 million USD and Laos with 113.9 million USD...

Speaking to Dan Tri , economic expert Le Dang Doanh, former Director of the Central Institute for Economic Management (CIEM), said that there are currently many Vietnamese enterprises investing abroad, mainly private enterprises. According to him, it is necessary to put it in the context of the digital economy and globalization facing great challenges because the current time is not enough to draw general conclusions.

In addition, Vietnam's overseas investment has only really grown strongly in recent years, most of the projects are strategic and long-term, such as rubber plantations and mineral exploitation. Many projects have just started operating, so they are only in the early stages of generating profits. Large investments need to wait a while longer to see results.

Experts also acknowledge that Vietnamese enterprises currently do not have enough technology and capacity to dominate high-tech market segments. Vietnamese enterprises need to find markets where they can survive and develop, and on that basis, gradually expand.

However, there are also many projects in technology, rubber, coffee, etc. that have been successful, transferring profits back to the country, increasing foreign exchange reserves. "It is necessary to select good projects as well as carefully study the investment environment abroad to increase the success rate," Mr. Doanh commented.

In addition, he also warned about concerns about the "bitter fruit" of investing abroad, because many Vietnamese businesses still do not have enough financial resources and experience to survive in foreign markets with many strict rules and regulations. "If they do not carefully study the global rules of the game, Vietnamese businesses may stumble," the expert added.

![[Photo] Overview of the Workshop "Removing policy shortcomings to promote the role of the private economy in the Vietnamese economy"](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/d1c58c1df227467b8b33d9230d4a7342)

![[Photo] Prime Minister Pham Minh Chinh receives the head of the Republic of Tatarstan, Russian Federation](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/7877cb55fc794acdb7925c4cf893c5a1)

![[Photo] Prime Minister Pham Minh Chinh receives French Minister in charge of Transport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/aa649691f85546d59c3624b1821ab6e2)

![[Photo] Meet the pilots of the Victory Squadron](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/fd30103acbd744b89568ca707378d532)

Comment (0)