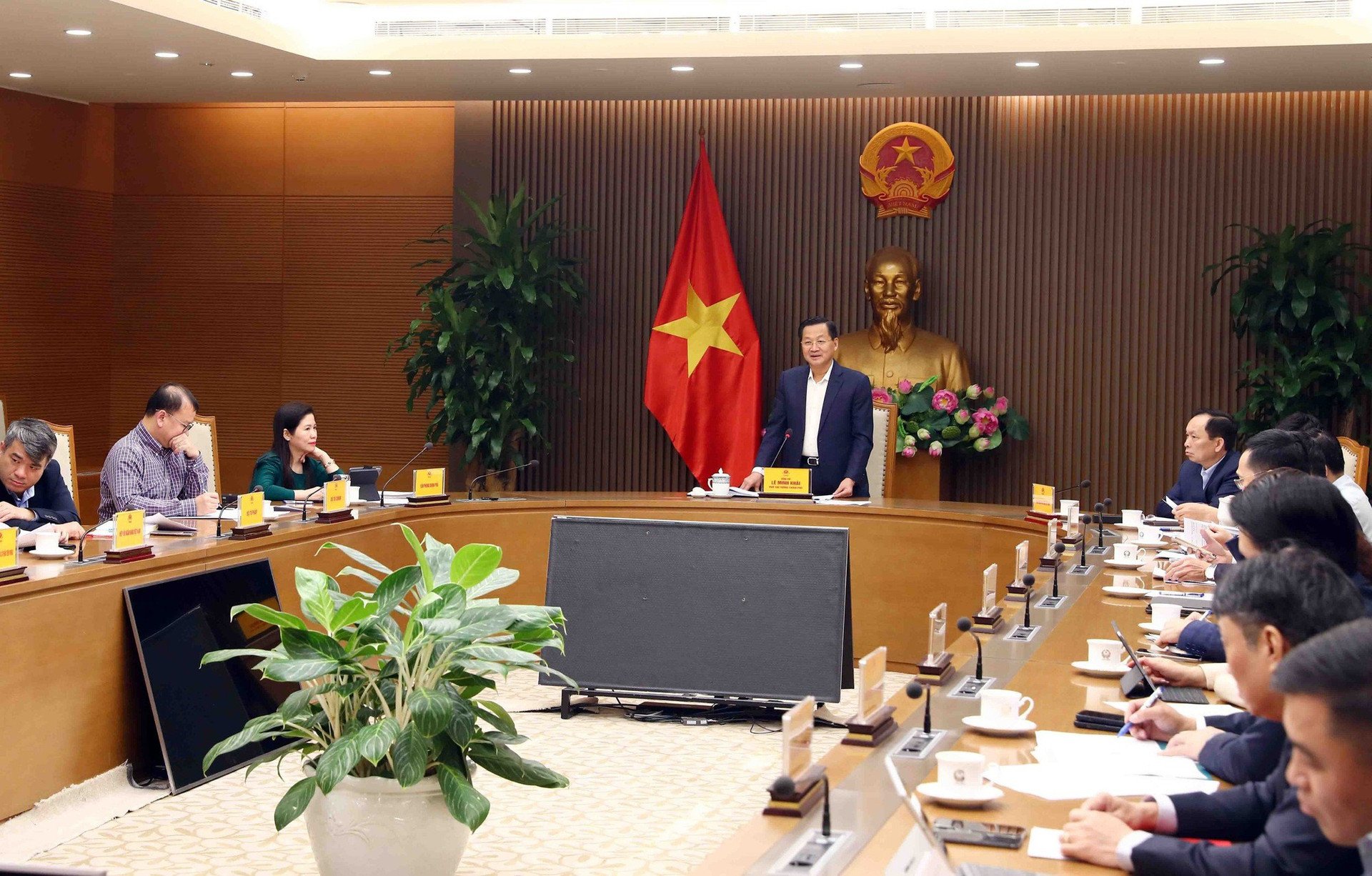

Deputy Prime Minister Le Minh Khai chaired a meeting on credit growth management in late 2023. Photo: VGP/Quang Thuong

Speaking at the meeting, Deputy Prime Minister Le Minh Khai stated that up to now, credit growth has reached about 8.4%, lower than the set plan of striving for an average credit growth of the whole system in 2023 of about 14%.

Recently, Prime Minister Pham Minh Chinh sent a telegram to the Governor of the State Bank of Vietnam on credit growth management in the last months of 2023.

In particular, the Prime Minister requested the State Bank to urgently and comprehensively review the credit granting results of the credit institution system for the economy, each industry and each field; the credit granting results of each credit institution and commercial bank up to the present time in order to take timely, effective and feasible measures to manage credit growth in 2023, ensuring adequate credit capital supply to serve the economy and the safety of the credit institution system, absolutely not allowing congestion, stagnation, delay or untimely. In case of any content beyond the authority, promptly report and propose to the competent authority according to regulations. Report to the Prime Minister on the situation and implementation results before December 1, 2023.

Deputy Prime Minister Le Minh Khai emphasized that "credit must be a continuous flow", the Government and the Prime Minister are very concerned about this issue and requested the State Bank of Vietnam to report and specifically assess the situation, clarify difficulties and solutions in credit management; request ministries, branches and commercial banks to give specific comments and propose appropriate and effective measures in the coming time according to the set goals for the remaining time of 2023 and 2024.

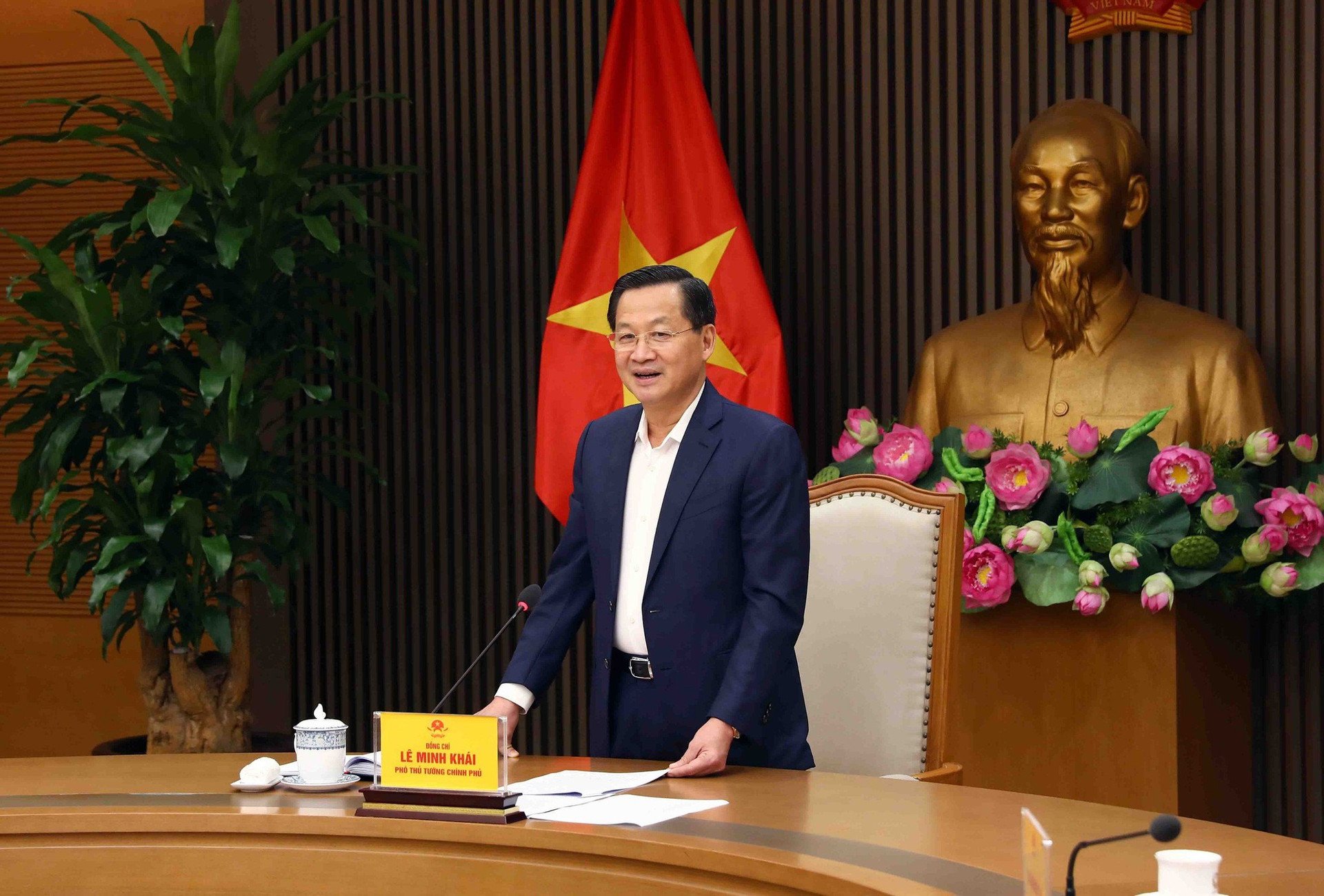

Deputy Governor of the State Bank Pham Thanh Ha presents the report. Photo: VGP/Quang Thuong

According to the State Bank's report as of November 23, 2023, the total outstanding debt of the entire system increased by 8.38% compared to the end of December last year, the level assigned to credit institutions. Accordingly, the remaining room of the entire system for credit institutions to expand credit growth is very large, about 6.2%, equivalent to about 735 trillion VND to provide to the economy.

However, credit growth in recent times has not been high mainly because the economy is still facing many difficulties, the recovery process is still slow, so credit demand has decreased and the capital absorption capacity of businesses and the economy is still weak...

Speaking at the meeting, representatives of banks: Tien Phong, Sacombank, Techcombank, VPBank, MBBank, ... said that the credit growth target set for this year is 14.5% higher than before. However, in the context of general difficulties, credit demand has decreased, although the State Bank of Vietnam has managed quite reasonably, the lending interest rate has decreased significantly compared to 2022, commercial banks have also launched many incentive programs, proactively sought customers, ... but disbursement is still difficult.

From now until the end of the year, banks will continue to closely follow the instructions of the Government, the Prime Minister, and the State Bank, review customers, and strive to promote lending to achieve the highest results and set goals.

Banks also said that currently, banks do not lack capital, but to pump capital into the economy and ensure credit growth targets, the problem lies not only in the management of monetary policy, credit or credit room but also in the economy's ability to absorb capital.

In banking, especially commercial banking, "everyone likes to lend", not being able to lend means "unemployment". But in the current context, all customer segments are affected, so credit disbursement is a "difficult problem".

In fact, when the foreign market declines, the total demand in the country and the world both decrease, businesses have no orders, shrink, not only do not borrow capital but when they sell their inventory, they also return the money to the bank. Those who are able to borrow and repay do not have the need, because if they borrow capital to produce but keep inventory, it is very dangerous. Therefore, for good customers, commercial banks "compete to lend", but there are also groups of customers who need to be cautious to prevent risks.

Believing that credit disbursement requires synchronous solutions from all levels and sectors, and efforts by businesses to overcome difficulties to improve capital absorption capacity, just like "it is impossible to clap with one hand", commercial banks requested competent authorities to continue researching and implementing more comprehensive solutions, especially resolving legal problems related to real estate projects; implementing solutions to stimulate domestic consumption, especially during the upcoming Lunar New Year; promoting disbursement of public investment capital to lead private investment, etc., thereby unblocking the credit "blood vessels".

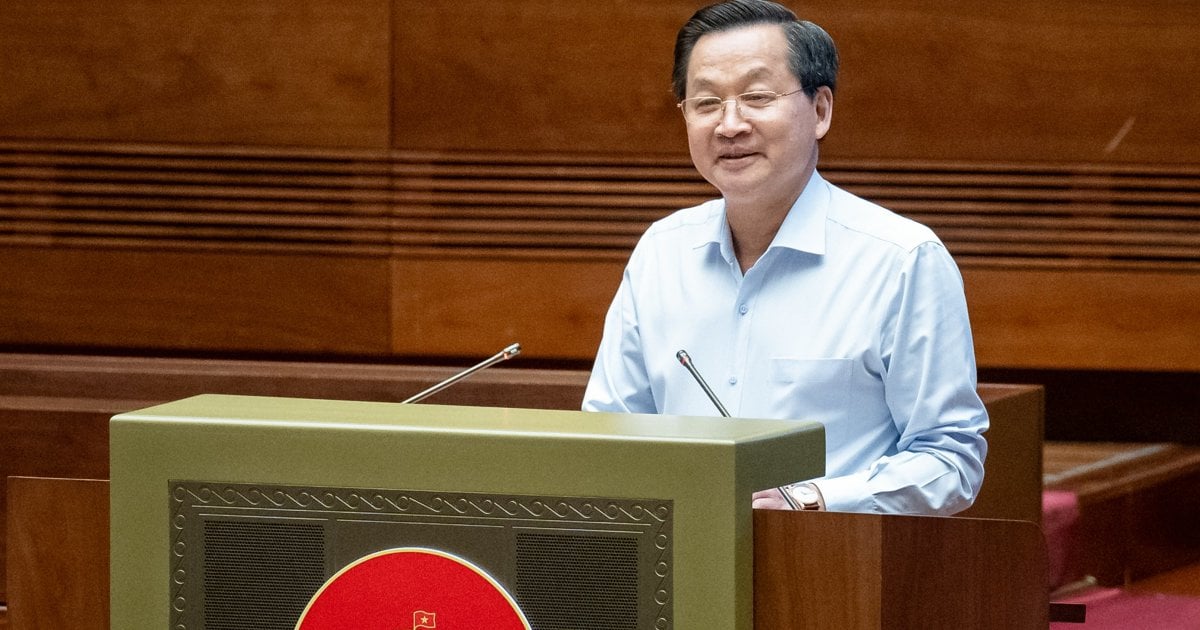

Deputy Prime Minister Le Minh Khai asked the State Bank of Vietnam to study the opinions expressed by commercial banks to promote their advantages and overcome existing problems to better manage credit in the coming time. Photo: VGP/Quang Thuong

Concluding the meeting, Deputy Prime Minister Le Minh Khai highly appreciated the SBV, ministries, and commercial banks for their responsible statements. However, due to limited time, all opinions may not have been expressed. The Deputy Prime Minister requested that commercial banks continue to report so that the SBV and the Prime Minister can grasp the situation, and on that basis, have effective management solutions to meet requirements.

The Deputy Prime Minister requested the State Bank to study the opinions of commercial banks to promote their advantages and overcome existing problems to better manage credit in the coming time.

The Deputy Prime Minister emphasized that although the Government and the Prime Minister pay great attention to the management of monetary policy in general and credit policy in particular to pump capital into the economy and promote production and business, up to now, with only 1 month left until the end of 2023, credit growth has not reached the target set at the beginning of the year of 14.5% (as of November 23, credit growth reached about 8.35%, with room for more than 6%).

Considering that this problem is due to many causes, but it is not possible to summarize everything within the framework of a meeting, the Deputy Prime Minister suggested that at the end of the year, the State Bank needs to analyze and evaluate specifically, in detail, and fully all aspects of credit management, capital absorption capacity, and review all problems to work together to promptly resolve them for better management next year.

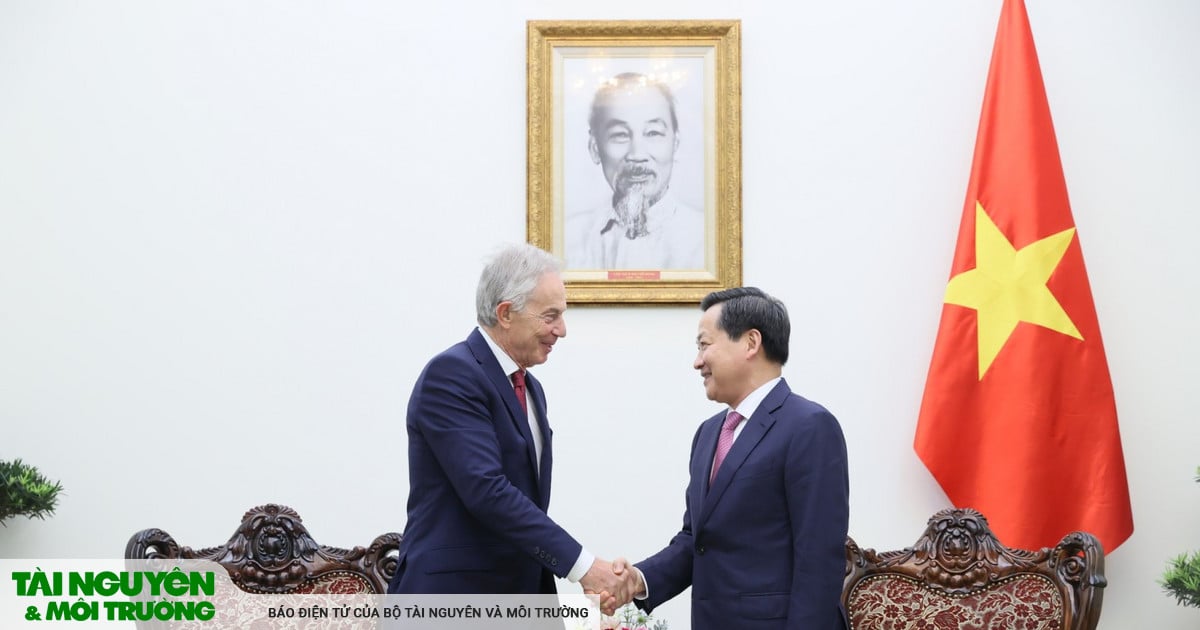

The Deputy Prime Minister requested that the State Bank and banks need to be more proactive and ready to disburse capital promptly when businesses and people have needs and ensure conditions. Photo: VGP/ Quang Thuong

"The State Bank needs to closely follow the actual situation of the economy and the needs of the business community and people, review and "review" regulations for adjustment, in order to operate monetary and credit policies more proactively and flexibly," the Deputy Prime Minister emphasized.

During the remaining period of 2023, the Deputy Prime Minister requested the State Bank to closely follow the directions of the Government and the Prime Minister, make more efforts to find more solutions to manage and provide credit for the economy, ensure macroeconomic stability, control inflation, direct capital flows to priority areas according to the provisions of law and ensure system safety.

Sharing the viewpoint that "you can't clap with one hand" expressed by a representative of a commercial bank in the meeting, Deputy Prime Minister Le Minh Khai also said that "if two hands don't clap together, they can't make a sound", so he suggested that the State Bank and banks need to be more proactive and more ready to disburse capital promptly when businesses and people have needs and ensure conditions.

At the same time, the Deputy Prime Minister also requested ministries, branches and localities, based on the directions of the Government and the Prime Minister, to continue to uphold the sense of responsibility, focus on removing difficulties for businesses and the economy, especially issues related to stimulating consumption, promoting the real estate market, promoting public investment, etc., together with the State Bank and the commercial banking system, to strive to overcome difficulties, well implement the goal of both ensuring capital injection for the economy and keeping the credit system safe, creating momentum for better development in 2024./.

Source

Comment (0)