Reporting at the conference on solving difficulties for the real estate market chaired by the Prime Minister on the afternoon of August 3, Deputy Governor of the State Bank of Vietnam Dao Minh Tu said that the current liquidity of credit institutions is very abundant.

Recently, the State Bank of Vietnam has continuously adjusted down the operating interest rates 4 times in the first 6 months of the year with a reduction of 0.5-2%/year for all types in the context of the world interest rate level continuing to increase and anchor at a high level; that creates conditions for credit institutions to access capital from the State Bank of Vietnam at a lower cost, thereby creating conditions to reduce lending interest rates to support customers.

In early July, the State Bank of Vietnam adjusted up almost all credit growth targets for 2023 for credit institutions with a system-wide allocation of about 14% for all credit institutions.

Regarding the implementation of the 120,000 billion VND Program, the Deputy Governor said that up to now, 9 provincial People's Committees have sent documents announcing the list of projects participating in the Program to the State Bank with 23 projects and 1 provincial People's Committee has announced on the Electronic Information Portal (Phu Tho) with 3 projects; the total loan demand of these 26 projects is about 12,800 billion VND.

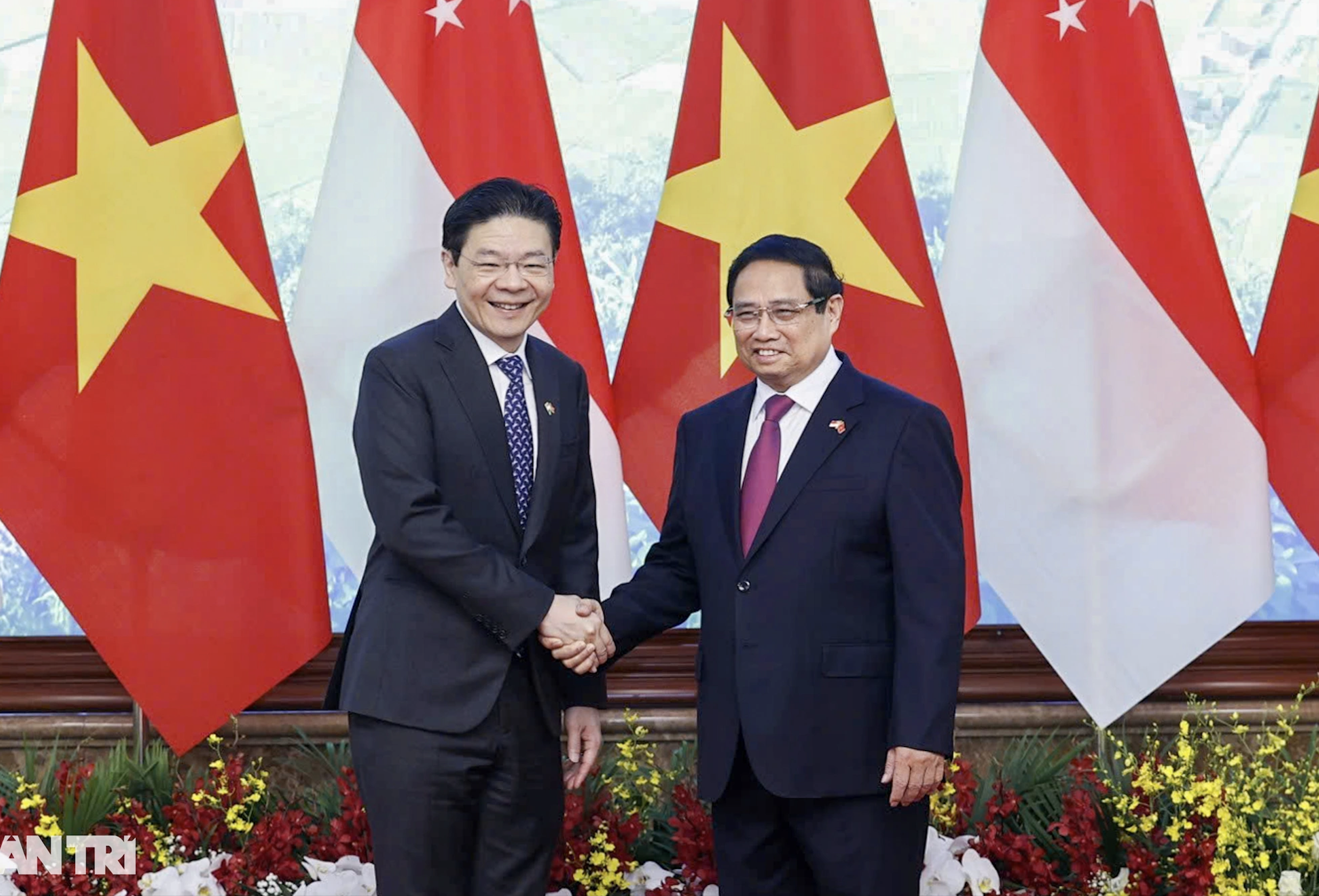

Deputy Governor of the State Bank of Vietnam Dao Minh Tu.

On June 16, 2023, BIDV signed a credit contract to finance a social housing project in Phu Tho province participating in the program with a credit amount of about VND 95 billion and has disbursed VND 20.5 billion. Agribank has also provided credit for a project with a committed credit amount of VND 950 billion, expected to be disbursed in the third quarter. At the same time, commercial banks are currently proactively approaching about 16 projects in the announced list.

“The State Bank of Vietnam’s viewpoint is to closely follow the directions of the State and Government, aiming to support the real estate market to develop healthily and sustainably in the direction of serving the majority of people, especially those with real housing needs, limiting speculation, price inflation, and profiteering,” the Deputy Governor stated.

Regarding the real estate sector, the State Bank will continue to direct credit institutions to prioritize credit for effective projects, social housing projects, worker housing projects, apartment renovation and reconstruction projects; and direct credit to meet people's practical housing needs.

At the same time, continue to strictly control credit risks in the real estate sector, control the level of credit concentration on a number of large customers/customer groups, customers related to major shareholders, and related persons of shareholders of credit institutions.

Continue to direct commercial banks to implement the 120,000 billion VND credit package from capital sources of commercial banks in accordance with the Government's direction.

Representatives of real estate businesses attended the conference (Photo: VGP).

The Deputy Governor recommended and requested the People's Committees of provinces and cities to urgently announce the list of social housing projects, worker housing projects, and apartment building renovation and reconstruction projects. The announced projects must comply with the Ministry of Construction's guidance in Official Dispatch No. 1551/BXD-QLN in both content and form of announcement to avoid the situation like in the past when many projects were announced but the disbursement rate was not high.

The Ministry of Construction compiles and announces a list of projects that meet favorable conditions for commercial banks to look up and consider lending in accordance with regulations (based on the list announced by the Provincial People's Committee). Ministries and branches review, amend or submit to competent authorities to amend legal documents related to current legal problems.

There are effective solutions to promote development and attract diverse sources of investment capital into the real estate market to reduce pressure on short-term bank credit for this market.

“We recommend that real estate businesses and corporations urgently restructure their products, urgently restructure their sources of goods, restructure their resources, capital issues, and market issues, especially in the current period, and also share the difficulties of other sectors in the economy. Not only real estate is facing difficulties, but other sectors are also facing difficulties,” said Mr. Tu .

Source

![[Photo] Prime Minister Pham Minh Chinh holds talks with Singaporean Prime Minister Lawrence Wong](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/04f6369d4deb43cfa955bf4315d55658)

![[Photo] Welcoming ceremony for Prime Minister of the Republic of Singapore Lawrence Wong on an official visit to Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/445d2e45d70047e6a32add912a5fde62)

![[Photo] Head of the Central Propaganda and Mass Mobilization Commission Nguyen Trong Nghia works with key political press agencies](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/3020480dccf043828964e896c43fbc72)

![[Photo] Close-up of old apartment building waiting to be renovated](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/26/bb2001a1b6fe478a8085a5fa20ef4761)

Comment (0)