► Some stocks to watch on October 18

VN-Index grows above the support zone around 1,280 points

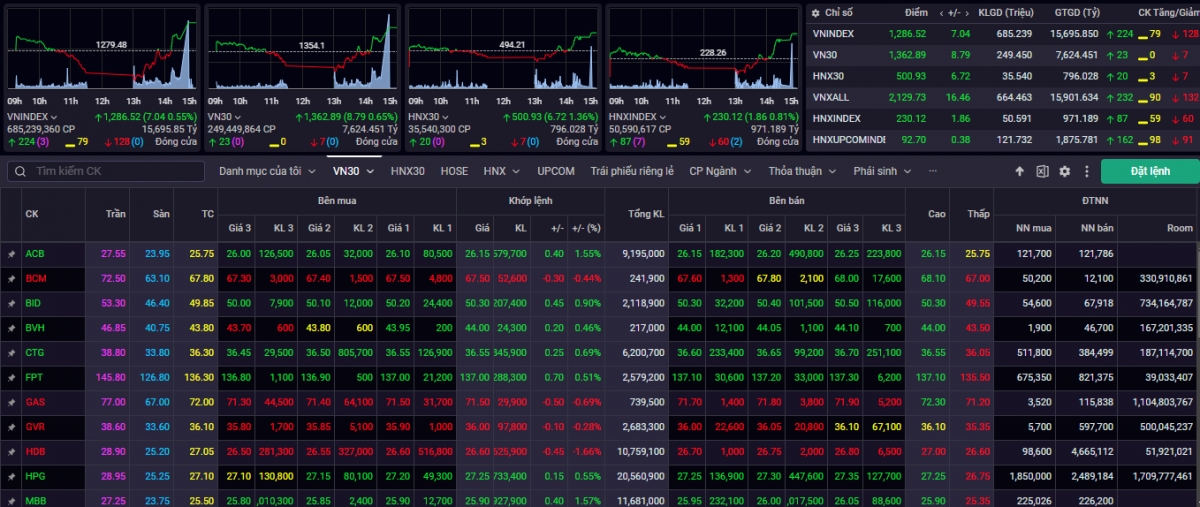

After 3 consecutive sessions of decline, VN-Index on October 17 closed in green at 1,286.52 points (+7.04 points, equivalent to +0.55%), notably, trading during the session was mostly gloomy in terms of liquidity. In the early afternoon, VN-Index dropped the most to 1,271.86 points, after which active buying power began to improve, cash flow focused mainly on the Real Estate and Banking groups. Similarly, HNX-Index ended the session positively at 230.12 points (+1.86 points, equivalent to +0.81%). Market breadth was tilted towards buyers with 183 stocks increasing in price, 110 stocks decreasing in price, and 65 stocks remaining unchanged at HOSE. HNX traded with 84 stocks increasing in price, 59 stocks remaining unchanged and 59 stocks decreasing in price.

Liquidity on both exchanges increased compared to the previous trading session when the matched volume increased by 28% at HOSE and by 49.83% at HNX. The banking group traded positively, typically with STB (+2.98%), MSB (+3.94%), TPB (+2.29%), EIB (+1.90%)... The most active industry group contributing to the market's increase today was Real Estate with DXG codes increasing by a dramatic margin (+6.98%), PDR also increasing by a dramatic margin (+6.85%), DIG (+5.25%), NTL (+2.98%), NVL (+2.45%), CEO (+6.21%), HDC (+4.35%)...

According to experts from Saigon - Hanoi Securities Company (SHS), in the short term, VN-Index is growing above the support zone around 1,280 points, the average price of the current 20 sessions. VN-Index is performing quite close to expectations when it soon recovered to the price zone of 1,270 points, to continue to maintain narrow fluctuations in the price zone of 1,280 - 1,300 points. VN-Index at the price zone of 1,300 points is still a very strong resistance corresponding to the peak zone from the beginning of 2024 to the present, as well as the highest price zone in June - August 2022. The index may overcome this strong resistance zone in the coming time when the macro situation and the prospects for the third quarter business results of enterprises continue to remain positive.

Medium-term trend, VN-Index grows above the support zone around 1,250 points, heading towards the price zone of 1,300 points, expanding to 1,320 points. It is expected that VN-Index will surpass the price zone of 1,300 points to head towards price zones higher than 1,320 points. In which, 1,300 points - 1,320 points are very strong resistance zones, peak prices in June-August 2022 and peak prices in the first months of 2024. These are fundamental resistance zones, the market can only overcome these strong resistance zones when there are good macro support factors, outstanding business growth results. At the same time, uncertain factors such as geopolitical tensions such as the Russia-Ukraine war, the Middle East cool down.

“In the short term, investors can consider disbursing when they continue to face correction pressure, however, it is still not recommended to buy when the VN-Index is heading towards the 1,300 point price range. Investors should maintain a reasonable proportion, and disbursements should carefully select good quality stocks, when the market is in the stage of receiving business results information. The investment target is to target leading stocks with good fundamentals, good growth in Q2 business results, and positive growth prospects for Q3 business results,” said an SHS expert.

The market is likely to continue its upward momentum.

According to the analysis team of ASEAN Securities Company (ASEANSC), the Real Estate and Banking sectors led the green, helping the general market make a strong comeback in the afternoon session on the derivatives expiry day, after persistent retreats in recent sessions. The positive reaction of the market at this short-term support level helped the index maintain its long-term uptrend, bringing about a positive sentiment, supporting the index's ability to rebalance and move towards testing the old peak area.

“Investors should closely follow the general trend and maintain a moderate portfolio weight, while looking for stocks with good fundamentals and positive Q3 business results. We appreciate the medium- and long-term market outlook, however, investors should be aware of potential risks that may come from information from the US stock market in the coming time, so it is necessary to closely observe world markets to confirm how long the uptrend can continue,” ASEANSC experts noted.

Meanwhile, experts from Yuanta Vietnam Securities Company (YSVN) said that the market may continue to increase in today's session, October 18, and the VN30 index may test the resistance level of 1,374 points. At the same time, the market is still in a short-term accumulation phase and there are signs that this accumulation phase will soon end in the next few sessions. In addition, the sentiment indicator increased slightly after 2 sessions of weakness, showing that investors have reduced their pessimism about the current market developments. The positive point is that cash flow has increased into Midcap stocks, specifically real estate stocks.

“The short-term trend of the general market remains neutral. Therefore, investors can continue to hold stocks at 40-50% of their short-term portfolio and should only consider buying new stocks with a low proportion,” YSVN experts recommended.

Source: https://vov.vn/thi-truong/chung-khoan/nhan-dinh-chung-khoan-1810-thi-truong-co-the-tiep-tuc-da-tang-post1129166.vov

Comment (0)