The Finnish fund manager said the fund's long-term target for the index remains 2,500 points based on earnings growth expectations for the next 2-3 years and a market valuation of 16 times P/E.

PYN Elite takes profit from CMG and HDB stocks, keeps expectation of VN-Index reaching 2,500 points

The Finnish fund manager said the fund's long-term target for the index remains 2,500 points based on earnings growth expectations for the next 2-3 years and a market valuation of 16 times P/E.

P/E ratio could fall to 10.1x, bringing valuation to “extremely attractive” level

In a letter to investors for the fourth quarter of 2024, just released ahead of the deadline for registration to invest in the fund (December 31), Mr. Petri Deryng, head of Pyn Elite Fund, maintained an optimistic view on the prospects of the Vietnamese stock market in 2025 and the following years.

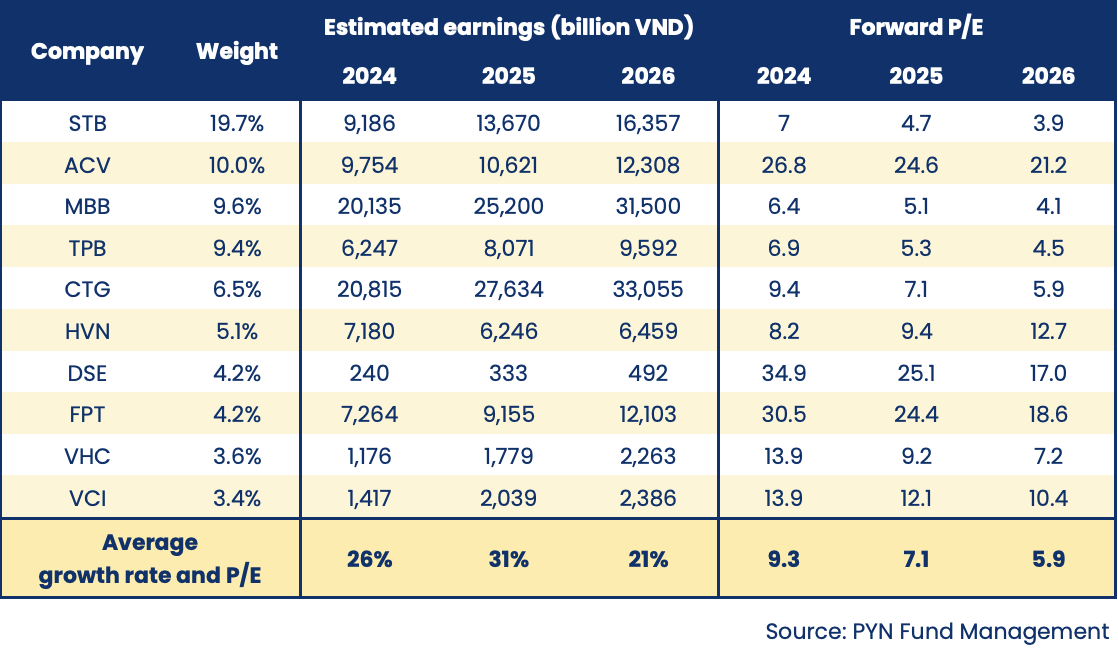

In the view of this foreign investor, the downside risk that worried investors last quarter will no longer be a major issue. Instead, the focus will shift to the strong profit growth of listed companies in Vietnam and the corresponding “extremely attractive” market valuations. With the trend of maintaining strong profit growth of listed companies in Vietnam, the P/E for the Vietnamese stock market will fall to 10.1 according to the profit forecast for 2025.

In the context of global fluctuations, the representative of the investment fund from Finland pointed out the risks affecting the market. Accordingly, the Vietnamese stock market may be negatively affected by global events when the world financial market dominated by the USD also affects the management of the USD/VND exchange rate and domestic interest rates. At the same time, the major escalation of armed conflicts around the world poses risks to global trade. The valuation of technology stocks, Bitcoin, the rather hot upward trend of the S&P 500 and the highly polarized investment flow also pose risks when sudden changes occur, leading to risks for global stock investment activities.

In addition, the fact that Vietnam’s main drivers of economic growth, investment and exports, could be potentially negatively impacted by US protectionist economic policies has raised some concerns. However, Vietnam’s exports to the US increased by +132% during Trump’s first term. The Finnish investment fund believes that a second Trump term would not significantly weaken Vietnam’s trade position.

Mr. Petri Deryng still considers Vietnam's stock market to be a potential market. The total market capitalization of Vietnam's stock exchanges (HoSE, HNX and UPCoM) compared to GDP in 2025 is 57%, which is considered "very reasonable". However, he also noted that the stock market of a fast-growing economy can easily reach a valuation of nearly 100%.

“2025 and beyond look very promising in terms of strong economic growth in Vietnam, and hence, the performance of the Vietnamese stock market. The disentangling of individual external risk factors may sometimes emerge as a more important driver of market sentiment,” said Petri Deryng.

PYN Elite maintains its long-term target of VN-Index at 2,500 points, based on strong earnings growth over the next 2-3 years and a stock market valuation of P/E 16.

Bank stocks are still cheap, take profit on all CMG and HDB stocks

In 2024, the fund's NAV will grow by 18%, exceeding the VN-Index's 12%. According to Mr. Petri Deryng, the fund expects a much stronger market performance, especially as earnings growth accelerated significantly towards the end of the year. However, the VN-Index's trading range of 1,200 - 1,300 points throughout the year has hindered this upward trend.

PYN Elite's outstanding performance was contributed by growth in aviation stocks including Vietnam Airlines (HVN) shares, which were added to the portfolio from April 2024, and shares of Airports Corporation of Vietnam (ACV).

PYN Elite is placing a large weight on financial stocks. In 2024, CTG and MBB stocks generated solid profits. HDB stocks grew particularly well with stock prices increasing by about 60%. Although the theme chosen for the letter to investors in the fourth quarter was "Strong hold", this foreign fund still followed the profit-taking policy when profits were achieved. The Finnish investment fund sold all of its HDB long positions last quarter. However, Mr. Petri Deryng still maintains that bank stocks are still quite cheap and will increase significantly to reach a more reasonable price. In the top 10 stocks with the largest weight on the list, the fund still holds 4 bank stocks with a total weight of more than 45%.

|

| Profit forecast of some businesses in PYN's investment portfolio |

Technology stocks are also the driving force for NAV growth in 2024. Also in the letter to investors, the head of PYN Elite said that the fund has closed all shares in CMG Technology Company, one of the outstanding investments in the 2024 portfolio, when the price increased from the purchase price of VND 17,000/share to VND 55,000/share. Thus, PYN Elite currently has 1 technology stock in the portfolio, FPT, with the latest updated weight of 4.2%.

Source: https://baodautu.vn/pyn-elite-chot-loi-co-phieu-cmg-va-hdb-giu-ky-vong-vn-index-len-2500-diem-d234785.html

Comment (0)