The dividend story always attracts investors every shareholder meeting season, however, bank shareholders have mixed feelings: some are happy, others are disappointed waiting for the signal.

Happy to wait for "sweet fruit"

As the annual general meeting of shareholders (AGM) season approaches, bank shareholders are once again excited to reap the sweet fruits of dividends. For many stock investors, this is one of the most anticipated parts of the year.

Ms. Hong Ngoc (46 years old, Dong Da district, Hanoi) eagerly shared: "I mainly invest in stocks to wait for dividend payments like this. This year, ACB paid as high as 25%, and finally the year's results are ready to be reaped."

Dividends are a portion of a company's after-tax profits distributed to its shareholders. Dividends can be paid in cash or shares or both.

With positive business results, the general banking group is quite generous in paying dividends, many banks have a rate as high as 20%.

Techcombank (TCB, HOSE) has proposed a dividend payout ratio of 15%, expected to be implemented in the second and third quarters of 2024. In addition, TCB has submitted a plan to issue shares from equity to reward shareholders at a rate of 100%.

In addition, VIB (VIB, HOSE) offered a total dividend payout ratio of 29.5% (12.5% cash dividend and 17% bonus shares). ACB, HDBank and Nam A Bank all have a dividend payout ratio of 25% (including cash and shares).

Profit of thousands of billions still not paying dividends

"I have been waiting for several years but still haven't seen the bank come up with a plan to pay dividends, while profits are still increasing steadily. This makes me quite confused and frustrated. I don't know how much longer I can be patient," said Ms. Phuong Mai (27 years old, Thanh Xuan district, Hanoi).

Ms. Mai's mood is the reality of many investors today, because despite profits, even "huge" profits, some banks still decide not to pay dividends in 2024.

"The stock market last year was very volatile, I was only looking forward to paying dividends so I patiently stayed, but in the end the bank announced that they would not pay dividends," Hai Yen (28 years old, Thai Binh) sighed and shared.

Sacombank (STB, HOSE) is a typical case of a bank that, despite high profits, still decided to delay paying dividends. Thus, for the past 9 years, Sacombank has continuously "forgotten" dividends to shareholders.

According to the announcement of the 2023 profit distribution plan in the General Meeting of Shareholders document, after deducting taxes and setting aside funds, the remaining profit last year was VND5,717 billion. Retained profits from previous years were recorded at VND12,671 billion. Thus, the total accumulated retained profits of the bank are at VND18,387 billion.

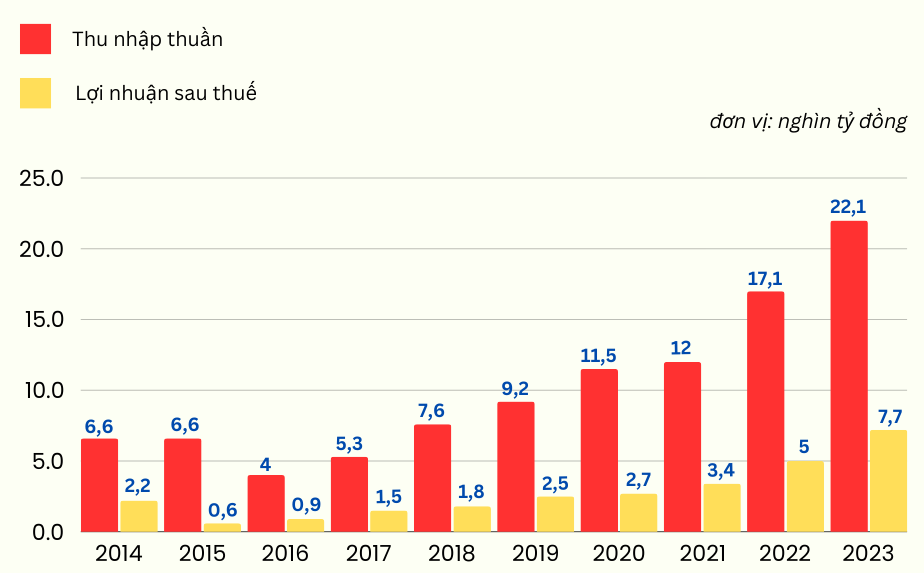

The 2023 financial report shows a positive business situation at STB, completing 104% of both revenue and profit, respectively VND 22,072 billion and VND 7,719 billion, a significant increase over the same period.

Business performance at Sacombank over the past 10 years

Business results still increase steadily at Sacombank (Source: Financial Statements Summary)

Previously, at the 2023 Annual General Meeting of Shareholders, answering shareholders' questions about dividends, Sacombank Chairman of the Board of Directors, Mr. Duong Cong Minh, said that Sacombank is a special bank, subject to restructuring, so it cannot pay dividends yet.

Next is ABBank (ABB, HOSE) announced not to pay dividends this year after going through a not-so-positive economic year, with profits falling 66.6% compared to the same period last year.

Specifically, at the 2024 Annual General Meeting of Shareholders, ABBank proposed to retain all remaining undistributed profits to supplement capital to implement plans and strategies and create internal accumulation to increase charter capital in the future. This means that shareholders this year will not receive dividends. ABB's total undistributed profits are currently VND 1,840.7 billion.

The Chairman of ABBank's Board of Directors gave the reason that the bank needs to spend money to invest and build a foundation, so he hopes that shareholders will be patient to reap the "sweet fruit" because the strategy cannot be done quickly, it requires time and patience.

TPBank (TPB, HOSE) also announced that it has no proposal to pay dividends this year.

In particular, LPBank (LPB, HOSE) also announced that it will not pay dividends for the next 3 years in the documents of the General Meeting of Shareholders on April 17. The main reason is to build a foundation and strengthen financial capacity by using profits to supplement capital for business operations. The total remaining profit reached more than 4,345 billion VND.

In addition, Saigonbank (SGB, UPCoM) shareholders are worried that SGB will not pay dividends this year, because SGB did not mention the profit distribution plan in the 2024 Annual General Meeting of Shareholders documents.

Source

Comment (0)