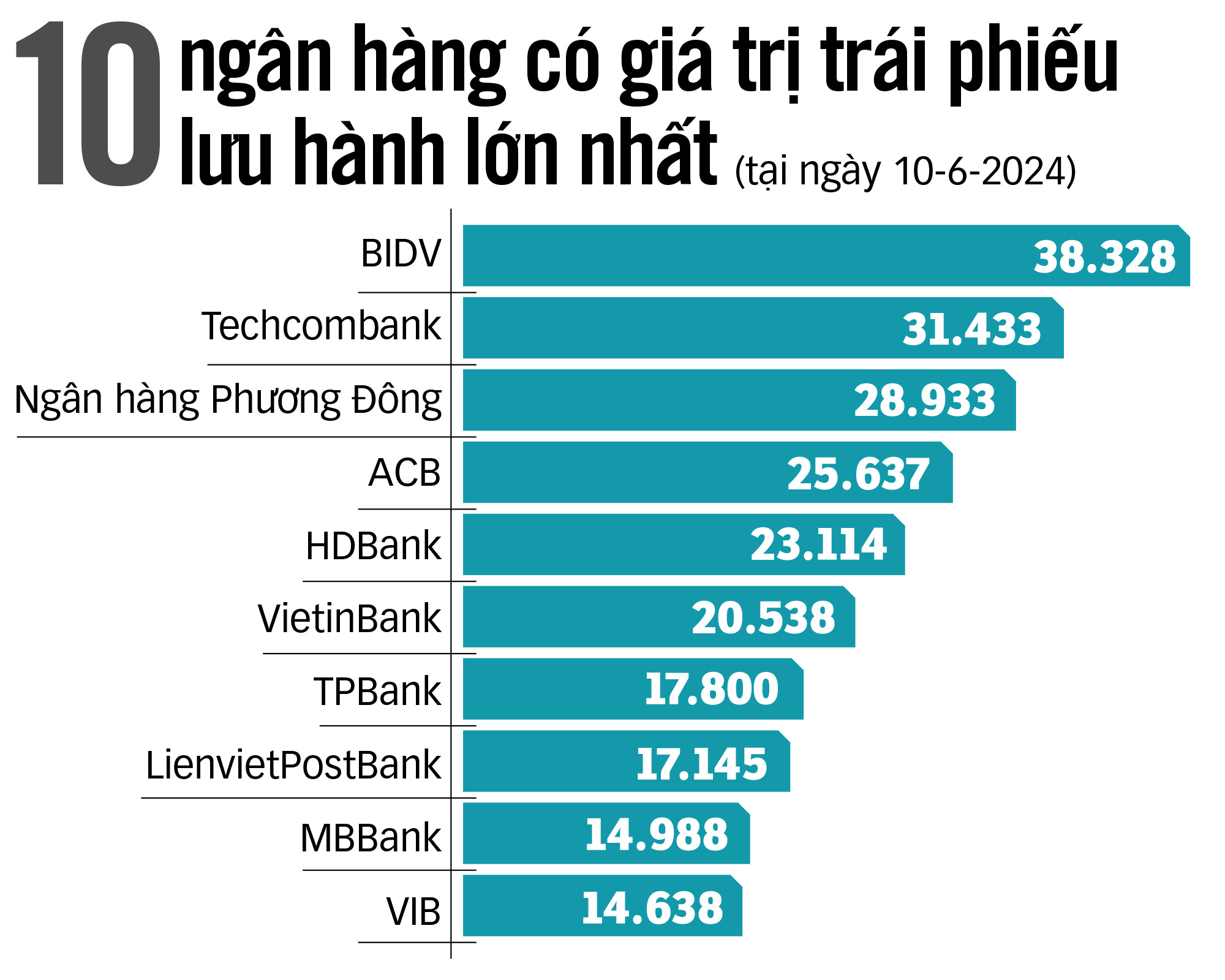

Many banks currently have very large circulating bond values on the market - Photo: QUANG DINH

Credit growth is forecast to accelerate in the second half of this year.

Accelerate borrowing through bonds

Recently, when real estate has tended to decline in bond issuance value, banks have recorded very good growth when mobilizing through this channel.

Ms. Le Minh Anh - analyst of the MB Securities (MBS) research department - said that from the beginning of the year to mid-June, banks have surpassed real estate to become the industry group with the highest issuance value with about 54,000 billion VND, an increase of 147% over the same period last year.

"There was a complete absence of bond issuances from the real estate sector during the month, while the banking sector accounted for 94% of the total issuance value," MBS experts commented.

According to Ms. Le Minh Anh, stricter regulations on the ratio of capital disbursed for medium and long-term loans encourage banks to issue more bonds to supplement the structure of long-term capital sources.

In addition, in a low interest rate environment, banks also have the incentive to buy back and issue bonds with more attractive interest rates. This explains why banks are both the leading group of new issuances and the main units buying back issued bonds.

Not only in the primary market, the amount of secondary bank bonds traded through the floor also increased dramatically in May with an increase of more than 80% (compared to the previous month), maintaining an attractive position compared to other industries.

Many analysts believe that bank bonds will have a busier year than previous years as credit improves.

Mr. Nguyen Quang Thuan - Chairman of Fiingroup - assessed that credit growth in the first 5 months of this year was very low and only at 3.8% as of June 15. However, more positive signs have appeared in the second half of this year.

One of the data points to a sharp increase in imports of capital goods. As exports pick up again as economies recover in major markets, the capital needs of manufacturing firms will improve.

To achieve credit growth of 15-16% for the whole year of 2024, banks must have capital. However, according to Mr. Thuan, the capital safety ratio of banks is still "thin" for this credit growth target. Therefore, while waiting for the increase in equity capital, issuing bonds (tier 2 capital) is an easier activity for banks to carry out.

Circulating value: billion VND - Source: Fiinratings - Graphics: N.KH.

Banks need huge capital

Mr. Phan Duy Hung - Director of Visrating Analysis - also said that banks will need to increase the issuance of long-term bonds to supplement capital sources and ensure capital safety to comply with regulations on operational safety ratios.

Bond issuance to support credit growth is further promoted in the context of slowing deposit growth due to declining business conditions in the 2021-2022 period.

According to data from Visrating, banks issued VND196 trillion in bonds in 2023, significantly higher than the VND104 trillion in 2019. Banks used this capital mainly to support long-term loans, meeting the prescribed ratios: controlling the ratio of short-term capital for medium and long-term loans below 30% and the loan-to-deposit ratio at 85%.

According to Visrating’s estimates, the banking industry will issue more than VND283 trillion worth of Tier 2 capital-raising bonds in the next three years. Accordingly, about 55% of new Tier 2 capital-raising bonds will be issued by state-owned banks because their Tier 2 capital will be significantly reduced.

In simple terms, banks will need to issue new Tier 2 capital raising bonds to replace the depreciated bonds and increase capital adequacy, as long as Tier 2 equity does not exceed 100% of Tier 1 equity (mainly consisting of charter capital, reserves and undistributed profits).

Associate Professor, Dr. Vo Dai Luoc - former director of the Institute of World Economics and Politics - said that compared to many other industries, especially real estate, bank bonds are considered quite safe. Therefore, although credit institutions issue bonds with relatively long terms, about 3 - 5 years with interest rates of 5 - 6%, they still attract investors.

The expert believes that issuing long-term bonds in the context of low interest rates as present is suitable for banks. Accordingly, banks can limit the risk of increased input capital costs when interest rates tend to increase again.

Regarding the impact on the general market, the push for issuance in the banking group has contributed to the recovery of bonds after many violations that have caused a loss of confidence. However, Mr. Luoc believes that the bond channel needs to be better promoted by other sectors, including real estate. If it is mainly a playground for banks, the effect of this capital mobilization channel has not been fully exploited, creating a spillover effect in the process of economic recovery.

In addition, the expert also reminded investors that for bonds issued by any organization, including banks, they need to be fully aware of the risks of late payment and other commitments.

Corporate bonds "wobble" before exchange rates and interest rates

Vietnam's corporate bond market is facing significant challenges as the USD/VND exchange rate and savings interest rates have both increased recently.

According to records, the Vietnamese Dong has depreciated by about 5% against the USD since the beginning of the year. At commercial banks, the USD price has reached 25,473 VND for sale, while in the free market, this figure has exceeded 26,000 VND for the first time, creating a new record.

At the same time, savings interest rates have also begun to show signs of increasing again. Specifically, 12-month term interest rates increased from 4.6% at the end of February to 4.8% at the end of June, according to data from Wigroup.

Experts from Fiinratings warn that this trend could increase risks for corporate bonds with floating interest rates. However, on the contrary, this could also be a driving force for businesses to increase the issuance of long-term bonds with fixed interest rates.

Source: https://tuoitre.vn/ngan-hang-thanh-trum-phat-hanh-trai-phieu-20240629235048392.htm

![[Photo] Prime Minister Pham Minh Chinh chairs Government Conference with localities on economic growth](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/2/21/f34583484f2643a2a2b72168a0d64baa)

Comment (0)