The draft Law on Credit Institutions (amended) supplements regulations that credit institutions and foreign bank branches are allowed to intervene early when they are subject to mass withdrawals leading to insolvency and cannot self-recover according to regulations of the State Bank.

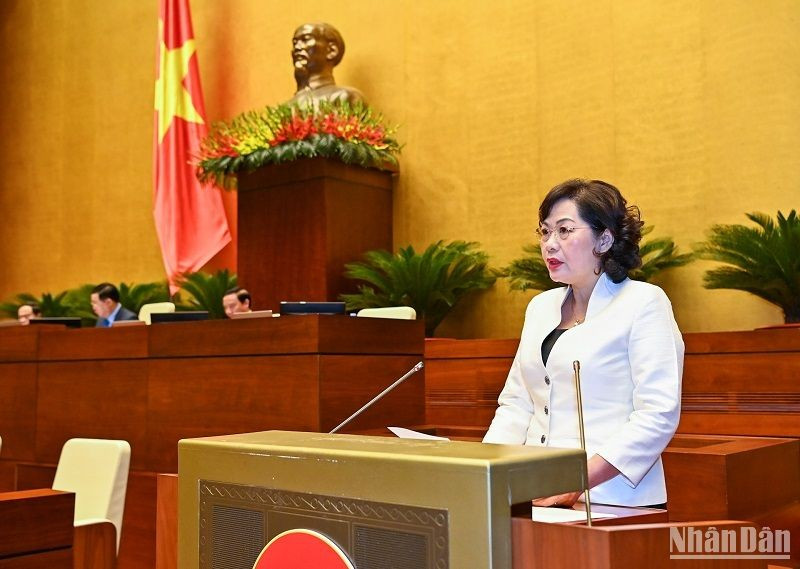

On the morning of June 5, continuing the program of the 5th Session of the 15th National Assembly, Governor of the State Bank Nguyen Thi Hong, authorized by the Government, presented a summary of the draft Law on Credit Institutions (amended).

Control credit activities, anti-manipulation, group interests, cross-ownership

The Governor said that the Law's construction aims to continue creating a legal corridor in the handling of bad debts of the credit institutions After Resolution No. 42 expires after December 31, 2023; ensure publicity and transparency in banking activities; strengthen inspection and supervision activities of the State Bank, with the participation of the Government Inspectorate and the Ministry of Finance to manage and control credit activities, combat manipulation, group interests, cross-ownership, etc.

Based on the experience of several countries and to ensure a timely response mechanism when a credit institution is subject to a mass withdrawal that may affect or threaten the safety of the system, the draft Law supplements regulations on measures to handle incidents of mass withdrawal.

Specifically, Article 144 of the draft Law stipulates that credit institutions and foreign bank branches are allowed to early intervention when falling into one of the following cases: ranking below average or lower according to the regulations of the State Bank; at risk of insolvency, at risk of insolvency according to the regulations of the State Bank; being subject to mass withdrawals when many depositors come to withdraw money, leading to the credit institution falling into a state of insolvency and not being able to self-correct according to the regulations of the State Bank...

Depending on the actual situation, nature and level of risk of the situation requiring early intervention of the credit institution or foreign bank branch, the State Bank shall apply one or several early intervention measures such as: limiting dividend distribution, share transfer, asset transfer; restricting ineffective business activities, restricting large, high-risk transactions; suspending or temporarily suspending one or several banking activities or other business activities showing signs of violating the law; restricting the decision-making authority in business activities of managers and operators, etc.

The Draft Law also inherits the provisions on applying early intervention in the current Law and has amendments and supplements to resolve the shortcomings in the past; supplements the authority of the State Bank at the early intervention stage; stipulates a number of measures currently applied at the special control stage to the early intervention stage, allowing early and remote handling when the weak state of the credit institution has not yet reached a serious level.

More specific regulations on intervention measures when credit institutions are subject to mass withdrawals

Reporting on the review of the draft Law, Chairman of the National Assembly's Economic Committee Vu Hong Thanh said that early intervention as stipulated in the draft Law is essentially dealing with credit institutions that have fallen into difficult situations, even facing the risk of collapse.

According to current regulations, depending on the level of each credit institution, the State Bank will apply appropriate measures such as recommendations, warnings, enhanced supervision, early intervention, and special control.

However, the draft Law has not yet assessed the current situation of implementing enhanced supervision, the difficulties and shortcomings in implementing this measure to propose its inclusion in the draft Law; it has also not assessed and clarified the correlation between measures from enhanced supervision to early intervention and special control, leading to the failure to clarify the nature of "early intervention" in order to have appropriate corresponding measures and tools.

The Economic Committee proposed to review all regulations in the Chapter on early intervention in the direction of minimizing State support or having very specific conditions, especially solutions to support loans from the State Bank, Cooperative Bank, Deposit Insurance of Vietnam, credit institutions with 0% interest rate and special loans without collateral.

For early warning cases, it is necessary to review and legalize cases of enhanced monitoring that have been implemented stably and effectively in practice to properly reflect the nature of "early intervention", and not to turn handling measures in special control cases into early intervention cases.

In addition, it is necessary to increase the responsibility of shareholders/capital contributors, managers and supervisors of credit institutions to prevent weak credit institutions from occurring, and at the same time prescribe strong and drastic sanctions against the above subjects to enhance the effectiveness of policy implementation, ensuring compliance with principles and regulations on handling losses and damages according to the provisions of the Civil Code and the Labor Code; and to define and prescribe appropriate measures to handle credit institutions that are subject to mass withdrawals...

According to Mr. Vu Hong Thanh, the intervention measures in case of mass withdrawal of money from credit institutions are new regulations compared to the current Law. This regulation is necessary and creates initiative to ensure the safety of the system, especially in the context of a number of cases of mass withdrawal of money from banks as in the recent past.

However, the Economic Committee found that the measures mentioned in Article 148 of the draft Law only include support measures from "outside" (mainly from the State Bank) but do not include "internal" measures from credit institutions to quickly overcome the situation of mass withdrawals.

There are suggestions to clarify the relationship and correlation between intervention measures in cases where credit institutions are subject to mass withdrawals (Article 148) and early intervention measures (Article 145) because the case where credit institutions are subject to mass withdrawals is one of the cases where early intervention measures are applied, but currently there are 2 separate measures prescribed.

The Economic Committee finds that mass withdrawals require urgent, quick, and timely handling, unlike cases where weak credit institutions must be intervened upon monitoring. Therefore, it is recommended to review regulations related to early intervention measures and measures for credit institutions that are subject to mass withdrawals; study and provide more specific regulations on intervention measures in cases where credit institutions are subject to mass withdrawals, including measures from the credit institutions themselves and from the State Bank and state management agencies; ensure clear roles and responsibilities of the parties as well as effective and appropriate measures.

Source

![[Photo] Prime Minister Pham Minh Chinh receives Chairman of Skoda Auto Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/298bbec539e346d99329a8c63edd31e5)

![[Photo] Nearly 2,000 people enthusiastically participated in the Olympic Running Day - For the security of the Fatherland](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/33bed26f570a477daf286b68b14474d4)

Comment (0)