Bondholders swallow "bitter fruit"

Ms. P. Lam (HCMC) said she used 5 billion VND to buy bonds in lot SGL-2020.02 issued by Saigon Glory Company Limited (a subsidiary of Bitexco, hereinafter referred to as Saigon Glory). The purpose of the issuance is to implement the project The Spirit of Saigon - Office, commercial, service, apartment, 6-star hotel right in the center of District 1, HCMC, opposite Ben Thanh market.

However, Ms. Lam said that she had only been paid the bond interest twice, each time more than 100 million VND, and had not received any further payments. Even after the due date, Saigon Glory had to pay the bond principal, but she had not received any notice from this investor. The principal was not received, and the interest had also "disappeared", Ms. Lam said that this affected her work and family life.

"Saigon Glory once sent a document asking for permission to extend the bond but I did not agree. However, since then, the company has not responded. The company did not pay interest or principal and did not notify me. 5 billion VND is a large amount of money for my family, I can ignore the interest but Saigon Glory must return the principal to me," said Ms. Lam.

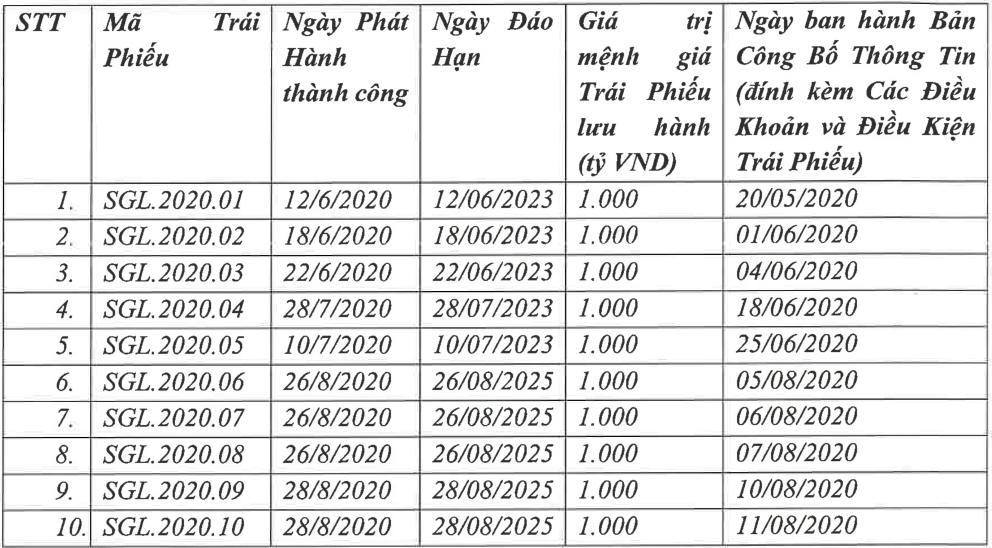

Information on bond lots issued by Saigon Glory Company (Photo of meeting minutes).

The bond lot that Ms. Lam bought is just one of 10 bond lots that Saigon Glory has issued with a total value of 10,000 billion VND. Of which, 5,000 billion VND matures in June-July this year, but Saigon Glory has been slow to fulfill its obligation to pay both principal and interest. The remaining 5,000 billion VND will mature in August 2025.

With Saigon Glory's delay in fulfilling its payment obligations, this project is being proposed for a solution to handle secured assets.

Proposal for handling secured assets

Representing the bondholder (Tan Viet Securities Joint Stock Company), the bank that manages the collateral assets is Techcombank, Mr. Vu Quang Bao - General Director of Saigon Glory - had a recent meeting on October 6 at the headquarters of Tan Viet Securities (Hanoi).

The meeting minutes were agreed upon by Tan Viet Securities and the collateral management bank, while Saigon Glory proposed to remove the content on the value of the collateral of the bond and did not agree to sign the confirmation in the minutes.

According to the minutes, since June this year, Techcombank has requested Saigon Glory to re-evaluate the collateral assets five times but has received no response. Last September, the bank advanced the costs to conduct the re-evaluation.

Specifically, the value of the collateral assets, which are future real estate of Tower A (not yet completed), is revalued at VND 4,653 billion according to the Valuation Certificate dated August 30, 2023 of DPV Company Limited (the franchise partner using the brand of Colliers Real Estate Services and Investment Management Group in Vietnam).

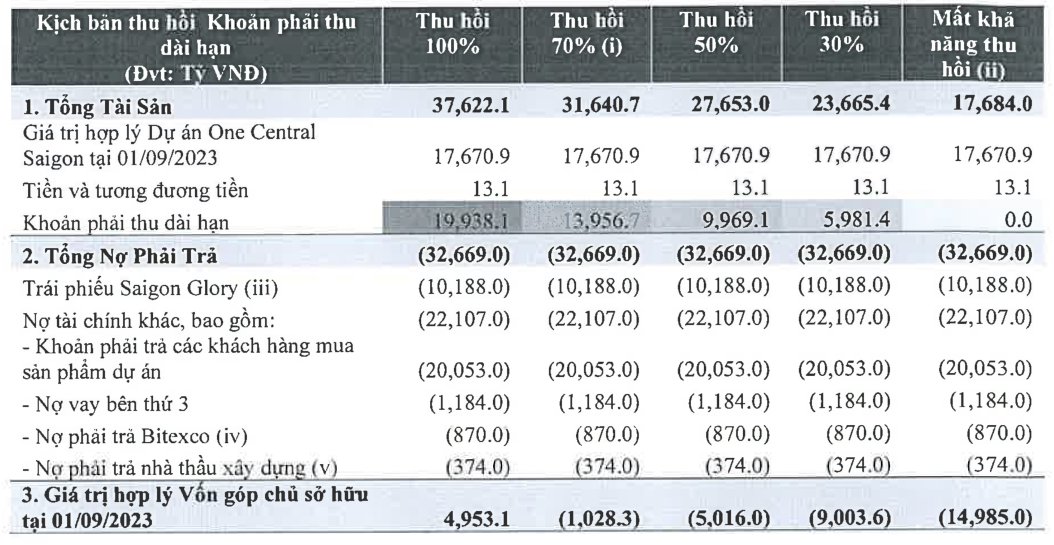

The value of the collateral asset, which is the capital contribution of Saigon Glory, was revalued at negative VND 1,028 billion based on the capital contribution evaluation report in September 2023 of DSC Securities Joint Stock Company - Ho Chi Minh City branch.

The Spirit of Saigon project has stopped construction for many months (Photo: Quang Anh).

The bank previously explained that the value of Tower A according to the Valuation Certificate of Indochina Valuation is VND 11,551 billion - the value of Tower A after construction is completed at December 31, 2024, assuming Saigon Glory has enough money to complete the project.

It should be noted that in its report to the Hanoi Stock Exchange (HNX), Saigon Glory stated that it used VND9,915 billion out of VND10,000 billion in mobilized bonds to restructure debt, and used VND85 billion to build the project.

In September this year, in fact, Tower A was under construction with 4 rough floors (belonging to the tower block), Saigon Glory stopped construction and had no specific plan to continue construction. At the same time, in the report on the evaluation of Saigon Glory's capital contribution value by DSC Securities Company, Saigon Glory's account did not have enough money for construction.

The company has overdue receivables of over VND 19,000 billion from a third party and is assessed by DSC as difficult to collect. Therefore, DPV Company Limited has assessed the assets of Tower A with the current status of not being completed at VND 4,653 billion.

Regarding the assets being the capital contribution of Saigon Glory Company, the initial mortgage value was 7,000 billion VND. In September 2023, according to the results of an independent assessment with DSC, the company's assets including projects, cash, and receivables were assessed as insufficient to pay the total debt of the enterprise (about 32,000 billion VND).

In particular, the largest loss in Saigon Glory's assets is the receivables from third parties worth more than VND 19,000 billion, which are assessed as unlikely to be fully recovered. Therefore, the bank concluded that the fair value of the owner's equity as of September 1, 2023 was negative VND 1,028 billion for the base scenario.

Scenario with Saigon Glory's receivables according to the bank's assessment (Photo of meeting minutes on October 6, 2023).

The minutes stated that during the meeting, the bank requested Saigon Glory to hand over the secured assets (hand over documents and hand over the field, sign authorization contracts as required to serve the auction of assets) before October 31, 2023.

In the opinion of the bank, in case the auction has not taken place or has not been successful, the parties have the right to agree to find a buyer but must have the approval of the bond owner before selling to that buyer. In case the auction is successful, Saigon Glory has no right to find a buyer.

According to the terms of the collateral management contract, the proceeds from the disposal of the collateral will be used to pay for the costs of disposal of the collateral, taxes, fees, etc., and will then be used to pay the bondholders. The remaining amount (if any) will be returned to the guarantors.

In case the amount of money collected from the disposal of the secured assets is still insufficient to pay the bond debt obligation, Saigon Glory shall be obliged to make further payment as prescribed in Article 307 of the Civil Code.

The Siprit of Saigon project is located in the prime location of District 1, Ho Chi Minh City (Photo: Khong Chiem).

Saigon Glory scheduled to hand over documents to handle secured assets before November 31

Saigon Glory Company Limited has just sent a response document to the bank and Tan Viet Securities to clarify some contents related to the handover of secured assets.

Saigon Glory said that the relevant parties have not acknowledged the value of the collateral, which is the capital contribution at Saigon Glory, which is valued at 0 VND. Therefore, changing the value of this asset to minus 1,028.3 billion VND does not accurately reflect the content of the meeting between the parties. To date, the company has not received any valuation certificates or valuation reports for the collateral from the bank in any form.

Saigon Glory said that since the 3-party meeting on October 6, the bank has not yet clarified the process of handing over collateral assets, has not yet sent a list of personnel in charge of receiving collateral assets as well as handover documents requiring written approval from Saigon Glory's Board of Members through the handover of collateral assets.

Saigon Glory said it is still reviewing and classifying handover documents and is facing difficulties because members of the Board of Members do not attend meetings when summoned to compare company records.

Therefore, the company proposed to postpone the handover of related documents until the above contents have been clarified by the parties, with the goal of being able to do so before November 31 as discussed at the meeting on October 6.

The company also said it will coordinate and make efforts to promptly hand over and handle the secured assets in accordance with the provisions of the mortgage contracts and issued bond documents, ensuring full rights of the parties involved and complying with legal regulations.

In 2020, Saigon Glory Company Limited mobilized VND10,000 billion in bonds through 10 odd lots, with a term of 3-5 years and a minimum interest rate of 11%/year for the first year. Of which, VND5,000 billion will mature in June-July 2023 and VND5,000 billion will mature in August 2025.

In October 2022, after the "scandal" over the ability to pay bonds in the financial market related to the arrest of the leader of Van Thinh Phat Group, Saigon Glory committed to buying back all 10,000 billion VND of these bonds before maturity, in 2 phases. In phase 1, the company bought 5,000 billion VND of bonds before maturity no later than June 12, 2023 and in phase 2 no later than June 12, 2024.

Last April, Saigon Glory reported on the situation of principal and interest payments of bonds in 2022 to the Hanoi Stock Exchange. In 2022, the company had 40 interest payments for the 10 lots issued above, with a total payment of nearly VND 1,110 billion.

Source

Comment (0)