(Dan Tri) - 2025 is a special year because the transition between the 2014 Social Insurance Law and the 2024 Social Insurance Law (effective from July 1, 2025) will affect tens of millions of people.

Compulsory social insurance contribution level

The salary used as the basis for compulsory social insurance (SI) contributions of employees subject to the salary regime decided by the employer is regulated similarly in the 2014 Social Insurance Law and the 2024 Social Insurance Law, including salary, salary allowances and other additional amounts agreed to be paid regularly and stably in each salary payment period.

Therefore, the compulsory social insurance contribution level of the above group of workers depends on the salary paid by the enterprise and is not affected during the transition between the Social Insurance Law 2014 and the Social Insurance Law 2024.

However, employees subject to the salary regime prescribed by the State will be subject to adjustment.

The 2024 Social Insurance Law adjusts the basis for social insurance contributions for groups of workers implementing the salary regime prescribed by the State (Illustration photo: To Linh).

According to Clause 1, Article 89 of the Law on Social Insurance 2014, for employees subject to the salary regime prescribed by the State, the monthly salary subject to social insurance is the salary according to the salary scale, level, military rank and position allowances, seniority allowances beyond the framework, seniority allowances (if any).

In the 2024 Law on Social Insurance, the monthly salary for compulsory social insurance contributions of employees subject to the salary regime prescribed by the State is stipulated in Clause 1, Article 31.

Accordingly, for employees subject to the salary regime prescribed by the State, the salary used as the basis for social insurance payment is the monthly salary according to position, title, rank, grade, military rank and position allowances, seniority allowances beyond the framework, seniority allowances, and salary retention differential coefficient (if any).

Thus, the 2024 Social Insurance Law adds the basis of "monthly salary according to position and title" to be consistent with the salary reform that the Government is implementing. When applying the new salary table, it is expected that the salary used as the basis for compulsory social insurance contributions for this group of workers will increase, helping to increase social insurance benefits and retirement regimes for workers in the future.

Pension is calculated in 2 stages

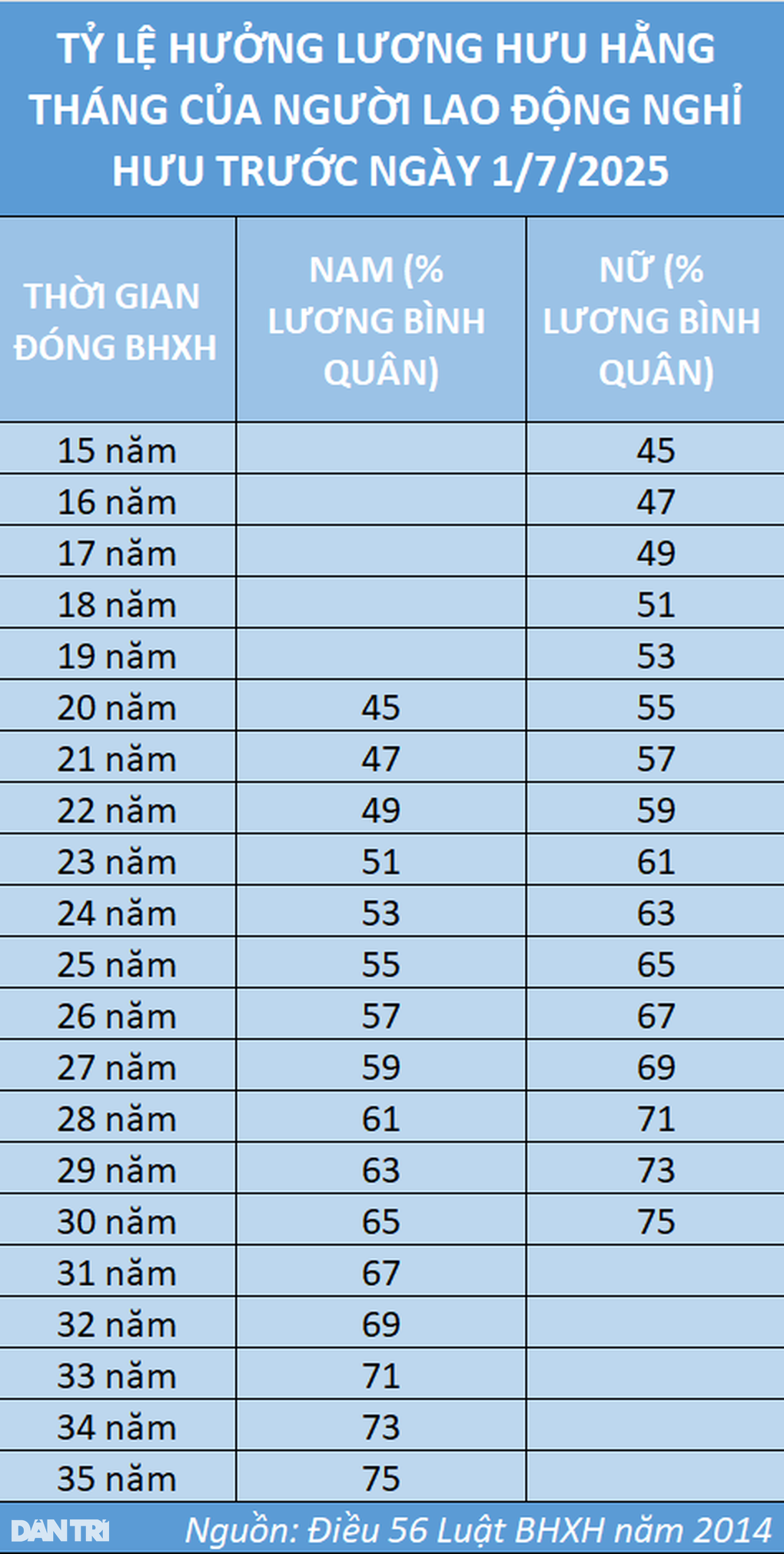

For retirees before July 1, 2025, the monthly pension will be calculated according to the provisions of Article 56 of the Law on Social Insurance 2014.

Accordingly, the monthly pension of employees is calculated at 45% of the average monthly salary for social insurance contributions corresponding to 20 years of social insurance contributions for male employees and 15 years of social insurance contributions for female employees. After that, for each additional year, employees are calculated an additional 2%, up to a maximum of 75%.

Thus, the pension level of employees retiring before July 1, 2025 is calculated according to the following table:

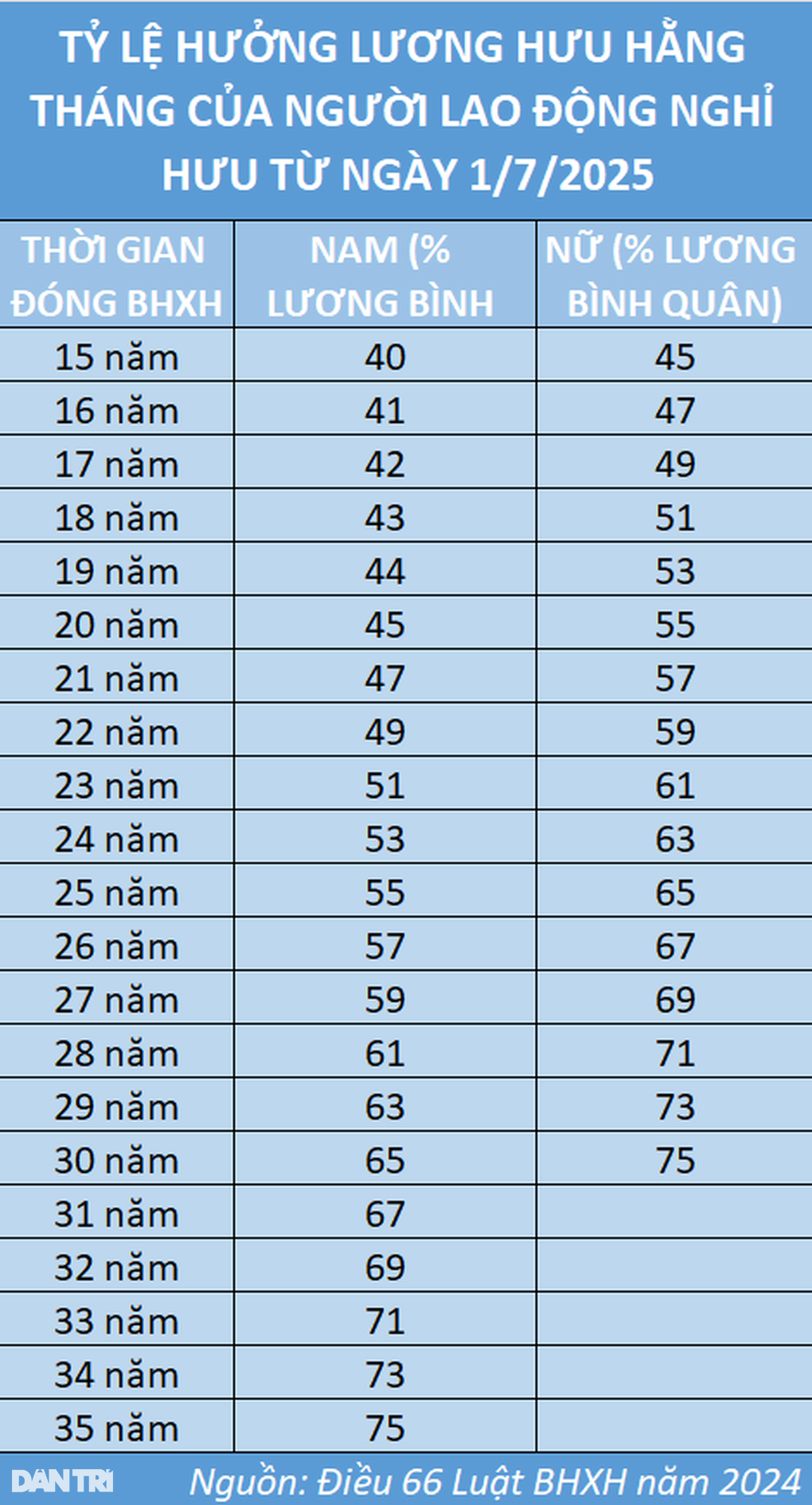

For retirees from July 1, 2025 onwards, the monthly pension will be calculated according to the provisions of Article 66 of the Law on Social Insurance 2024.

Accordingly, for female workers, the monthly pension is equal to 45% of the average salary used as the basis for social insurance contributions corresponding to 15 years of social insurance contributions, then for each additional year of contributions, an additional 2% is calculated until reaching a maximum of 75%;

For male workers, the monthly pension is equal to 45% of the average salary used as the basis for social insurance contributions corresponding to 20 years of social insurance contributions, then for each additional year of contributions, an additional 2% is calculated, with a maximum of 75%.

In case male employees have paid social insurance for 15 years but less than 20 years, the monthly pension is equal to 40% of the average salary used as the basis for social insurance payment corresponding to 15 years of social insurance payment, then for each additional year of payment, 1% is added.

Thus, the pension level of employees retiring from July 1, 2025 onwards is calculated according to the following table:

Source: https://dantri.com.vn/an-sinh/nam-2025-luong-huu-va-muc-dong-bhxh-thay-doi-nhu-the-nao-20241204192114737.htm

Comment (0)