From January 1, 2025, the calculation of public sector pensions will be based on the entire social insurance contribution period, not the final years as per current regulations.

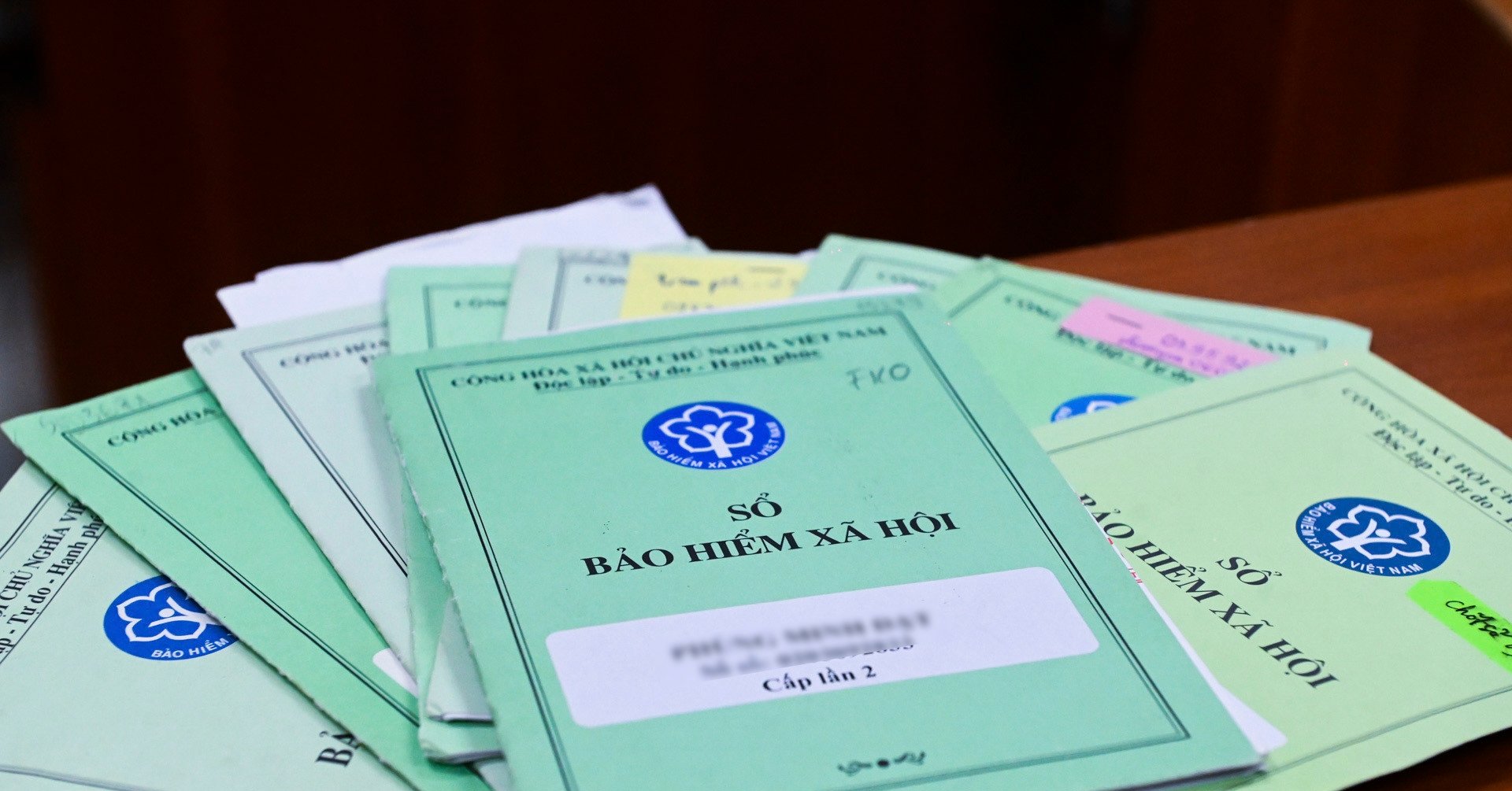

The Ministry of Labor, Invalids and Social Affairs (now the Ministry of Home Affairs) is proposing plans to improve pension and social retirement benefits policies for employees as stipulated in the Social Insurance Law 2024.

The Social Insurance Law 2024, effective from July 1, 2025, stipulates that the minimum period of social insurance contribution to receive pension benefits is reduced from 20 years to 15 years. Employees who want to receive pension benefits must ensure that they have contributed to social insurance for at least 15 years and are of retirement age.

To implement the new Social Insurance Law mentioned above, the Ministry of Labor, Invalids and Social Affairs (now the Ministry of Home Affairs) is drafting a guiding circular, in which the drafting agency maintains the pension calculation method for the state sector.

Specifically, the average monthly salary for social insurance contributions to calculate pensions and one-time benefits for state-sector employees is calculated for the last 5 to 20 years before retirement, depending on the time of participation.

Pursuant to the provisions of Article 62 of the Law on Social Insurance 2024, employees subject to the salary regime prescribed by the State who have paid social insurance for the entire period under this salary regime shall have their average monthly salary calculated for the number of years of social insurance payment before retirement.

Specifically, if participating in social insurance before January 1, 1995, the average monthly salary for social insurance contributions of the last 5 years before retirement will be calculated; if participating in social insurance during the period from January 1, 1995 to December 31, 2000, the average monthly salary for social insurance contributions of the last 6 years before retirement will be calculated.

For employees participating in social insurance from January 1, 2001 to December 31, 2006, the average monthly salary for social insurance contributions of the last 8 years before retirement will be calculated; for employees participating in social insurance from January 1, 2007 to December 31, 2015, the average monthly salary for social insurance contributions of the last 10 years before retirement will be calculated.

For those participating in social insurance from January 1, 2016 to December 31, 2019, the average monthly salary for social insurance contributions of the last 15 years before retirement will be calculated; for those participating in social insurance from January 1, 2020 to December 31, 2024, the average monthly salary for social insurance contributions of the last 20 years before retirement will be calculated; for those participating in social insurance from January 1, 2025 onwards, the average monthly salary for social insurance contributions of the entire period will be calculated.

For employees who have both paid social insurance under the salary regime prescribed by the State and paid social insurance under the salary regime decided by the employer, the average monthly salary for social insurance payment of all periods shall be calculated. In which, the period of payment under the salary regime prescribed by the State shall be calculated as the average monthly salary for social insurance payment according to the number of years of payment before retirement as prescribed above.

Calculated over the entire process to ensure a living pension

According to the new regulations, public sector employees participating in social insurance from January 1, 2025 onwards will have their entire social insurance contribution period calculated on average, similar to the private sector.

The pension rate for female workers who have paid for 15 years is 45% of the average salary used as the basis for social insurance contributions, then 2% is added for each year of social insurance contributions, until the maximum benefit is 75%.

Male workers who have paid social insurance for 15 years will only receive 40% of their average monthly salary. From 16 to 20 years, each year will be calculated with 1%. From the 20th year onwards, the pension rate is 45% and each year of payment will be calculated with 2% added until the maximum benefit is 75%.

Thus, to receive a maximum pension of 75%, female workers must pay social insurance for 30 years, and men must pay 35 years.

Public sector employees have their pension rate reduced by 2% for each year of early retirement, from 6 months to less than 12 months reduced by 1%, in case of early retirement of less than 6 months, the pension rate is not reduced.

Speaking with VietNamNet, a representative of Hanoi Social Insurance said that when public sector salaries are gradually adjusted to increase, adjusting the pension calculation method from the average of the last 5 years to the entire contribution period is consistent with the salary reform policy and ensures the rights of workers.

The representative of the Social Insurance said that because the previous state salary was low, if the social insurance payment period was included, the pension would be very low. This is disadvantageous for workers, especially those working in the state sector.

Now that the salary level in the public sector has increased, it is appropriate to calculate the entire process according to the revised Law on Social Insurance.

The principle of social insurance is that the benefit level is calculated based on the contribution level and the contribution period. When the salary level of the State sector is adjusted to increase closer to the common level of the outside sector, calculating the pension based on the entire process is consistent with the contribution and benefit principle.

A labor and salary expert assessed that calculating pensions based on the entire period of social insurance participation of employees in the state sector as in the non-state sector shows that the salary level between the two sectors is gradually approaching asymptotic levels.

In particular, with the State streamlining and reorganizing its operating apparatus towards efficiency, effectiveness and effectiveness, the salaries of civil servants will certainly be gradually adjusted upward.

When the State salary increases, workers fully participate in social insurance throughout their working life, then of course when they retire, their pension will be enough to live on.

Continue to increase public sector wages and pensions if the economy is favorable

Officials who retire early will not have their pension reduced and will receive additional benefits.

Officials and civil servants who have paid social insurance for 15 years and retire early will keep their pensions.

Source: https://vietnamnet.vn/thay-doi-cach-tinh-luong-huu-khu-vuc-nha-nuoc-tu-2025-2379126.html

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

Comment (0)