Shock reduction from 10.65% to 5.4%/year

Since March 2023, after the State Bank repeatedly adjusted the operating interest rate down, the mobilization interest rate level has continuously "broken through" new bottoms.

Not stopping there, on the last day of July 2023, the Government Office issued a notice of the Prime Minister's conclusion at the conference to review banking activities in the first 6 months of the year and deploy tasks for the last 6 months of 2023.

The Prime Minister requested that the State Bank continue to implement a proactive and flexible monetary policy. The State Bank needs to continue to reduce lending interest rates, increase credit limits in line with market developments, and effectively when necessary, focusing credit on growth drivers: investment, consumption, export, etc.

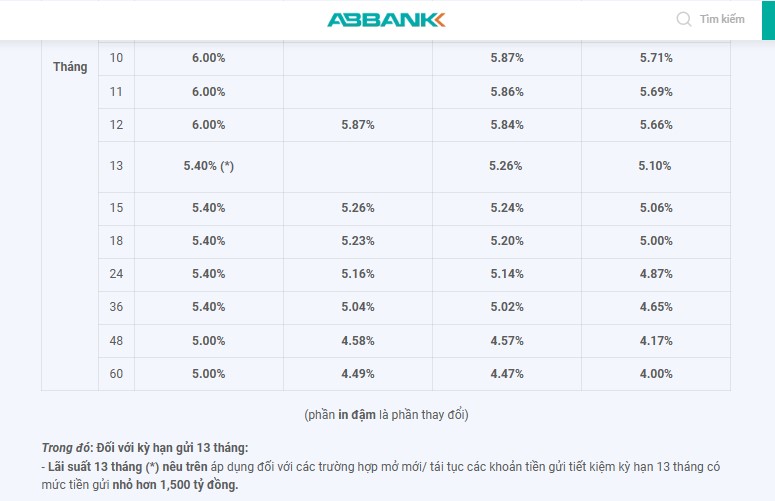

According to ABBank's interest rate list applied from August 1, the 13-month term interest rate is only 5.4%/year instead of the previous figure of 10.65%/year. Screenshot

One of the factors that gives banks room to reduce lending rates is that deposit interest rates continue to decrease.

From August 1, 2023, the market witnessed continued interest rates dropping to lower levels. Notably, An Binh Commercial Joint Stock Bank (ABBank), the unit with the second highest interest rate in the market, suddenly adjusted its interest rate to a shocking decrease.

Specifically, ABBank was previously the "runner-up" in interest rates when it listed the figure of 10.9%/year for a long time. However, not all customers can access this incentive. The 10.9%/year rate applies to deposits with a term of 13 months and a deposit amount of over VND1,500 billion.

In the last few days of July, ABBank attracted attention when it reduced the highest rate from 10.9%/year to 10.65%/year. But most notably, from August 1, 2023, ABBank applied a new interest rate schedule. Accordingly, the number 10.65% was "erased". Instead, the interest rate for a 13-month term dropped sharply to only... 5.4%/year.

In addition, interest rates for long terms (from 15 months to 48 months) have decreased from 6.5%/year to only 5.4%/year. For terms under 12 months, the interest rate is higher at 6%/year.

Banks continue to reduce interest rates

Although not as shocking as ABBank, many other banks have also adjusted their interest rates sharply. Previously, Construction Bank (CB) often applied the highest interest rate of 8.4%/year. But now, this number has been adjusted down to only 7.9%/year.

Previously, BacA Bank regularly applied the highest interest rate of 8.1%/year. Currently, this number has also decreased to 7.9%/year. This is also what Ocean Bank does.

Recently, many banks have also had another round of slight interest rate adjustments.

Currently, after many adjustments, the highest interest rate at Saigon Thuong Tin Commercial Joint Stock Bank (Sacombank) is only 6.85%/year (36-month term). For 6-month and 12-month terms, the interest rate is only 6.1%/year and 6.6%/year.

As for the Super Flexible Savings package, the highest rate is 7.55%/year (36-month term). For a 12-month term, the interest rate is 7.3%/year. However, this interest rate is not applied throughout the entire deposit period but is only valid for the first 30 months and the first 6 months.

Vietnam Thuong Tin Commercial Joint Stock Bank (Vietbank) also changed its listing schedule. Accordingly, the highest rate is 7.3%/year applied for a 15-month term. The remaining long terms have interest rates fluctuating around 7%/year and 7.1%/year.

Recently, the Top 3 banks with the highest interest rates are Vietnam Joint Stock Commercial Bank for Industry and Trade (PVCombank), ABBank and Ho Chi Minh City Development Joint Stock Commercial Bank (HDBank).

ABBank has just reduced interest rates. Meanwhile, PVCombank and HDBank still maintain the highest interest rates of 11%/year and 9.1%/year, respectively.

Specifically, a few days ago, PVCombank lowered the highest rate from 11.5%/year to 11%/year. With 11%/year, PVCombank is still the bank with the highest deposit interest rate in the market. However, this interest rate only applies to deposits over 2,000 billion VND.

As for HDBank, from August 1, HDBank will apply a new interest rate schedule. However, the highest rate remains at 9.1%/year, applied for a 13-month term and a deposit value of VND300 billion or more.

Source

Comment (0)