VN-Index has strong profit-taking force, the market is going into correction zone, Vinamilk closes the rights to the General Meeting of Shareholders, MWG is at risk of being eliminated from VN-Diamond, dividend payment schedule,...

VN-Index turned around and dropped sharply by 21 points

Ending a long rally, breaking all 18-month highs, the market witnessed its sharpest decline last weekend.

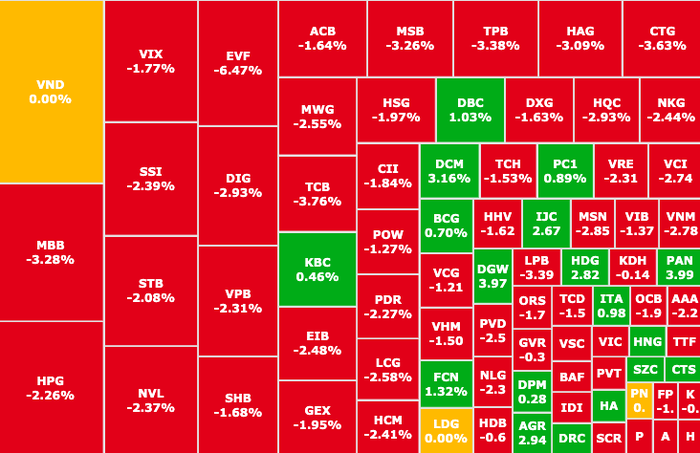

VN-Index "evaporated" 21.11 points, down to 1,247.35 points, the sharpest decline since the session on November 23, 2023. Red dominated with 660 stocks falling, double the number of stocks rising.

At the same time, on the HNX and UPCoM floors, the indexes fell sharply by 236.32 points (-0.44%) and 91.23 points (-0.39%), respectively.

Red covers the whole market

Liquidity increased dramatically with trading volume exceeding 1.3 billion shares. On HOSE alone, liquidity exceeded VND31,500 billion, the highest level in the past 7 months.

The last session of decline with huge liquidity showed that profit-taking pressure appeared widely when stocks had a long uptrend.

Profit-taking pressure mainly appeared in the banking group, TCB (Techcombank, HOSE) led the group of stocks that hindered the market's growth. Next were MBB (MB Bank, HOSE), VPB (VPBank, HOSE), ACB (Asia Commercial Bank, HOSE), LPB (LPBank, HOSE),...

In addition, there are blue-chip stocks with a long-term growth streak: HPG (Hoa Phat Steel, HOSE), MSN (Masan, HOSE), VNM (Vinamilk, HOSE),...

Group of stocks strongly influenced the index last weekend

Source: SSI iBoard

Foreign investors also continued to take profits in the last session of the week, increasing the downward pressure on the VN-Index. On the HOSE floor, foreign investors net sold approximately VND666 billion, of which, VNM (Vinamilk, HOSE), VPB (VPBank, HOSE), KBC (Kinh Bac Real Estate, HOSE) were under the strongest selling pressure with VND126 billion, VND106 billion and VND80 billion.

Experts say the main reason is that the market has experienced a long streak of increases since early November last year, with many stocks increasing sharply by tens of percent.

VN-Index is likely to have another increase towards the 1,300 point resistance level.

VCBS Securities believes that, according to technical analysis, VN-Index will soon have recovery sessions, investors should consider and take advantage of the fluctuations to disburse to buy stocks at attractive prices as soon as the market shows signs of buying again. Some stocks to note in the coming time are securities banks and retail.

SHS Securities assessed that in the short term, VN-Index is likely to have another increase towards the resistance level of 1,300 points. However, from a medium-term perspective, VN-Index is in a strong increase but the increase has not formed a long enough and reliable accumulation base, so the market is likely to correct back to the range of 1,150 - 1,250 points.

DSC Securities believes that a sharp decline with high liquidity is relatively normal. In addition, the last session of the week also showed many clear distribution signals, typically with banks - the leading group in recent times. The market needs a break and necessary accumulation for about 1-2 months. The current strong support level is around 1,200 points. Short-term investors are advised to observe more and not be too hasty at the present time.

Vinamilk closes the right to hold the General Meeting of Shareholders

Vietnam Dairy Products Joint Stock Company (VNM, HOSE) will finalize the list of shareholders attending the 2024 Annual General Meeting of Shareholders on March 18 and pay interim dividends for March 2023. Vinamilk plans to hold the General Meeting online on April 25. Specific content will be updated and sent to shareholders in accordance with the law.

Regarding dividends, Vinamilk will pay the third installment to shareholders at a rate of 9% (1 share will receive 900 VND). The expected dividend payment date is April 26. With nearly 2.09 billion shares in circulation, Vinamilk will have to spend about 1,881 billion VND to pay this dividend.

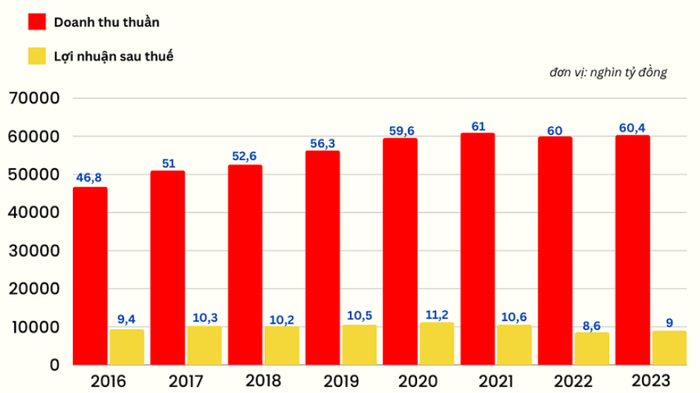

Revenue and profit trends at Vinamilk in recent years

Vinamilk's 2023 business results show signs of improvement (Source: Financial Statements Synthesis)

On the market, VNM shares are priced at VND70,000/share, up nearly 4% compared to the beginning of the year. The corresponding capitalization is about VND146,300 billion, ranking 10th among the most valuable enterprises on the stock exchange.

Business results for the fourth quarter of 2023 showed that the accumulated profit for the whole year reached VND9,019 billion, an increase of 5% compared to 2022, ending two consecutive years of decline.

Mobile World Chairman's sister wants to sell nearly half of MWG shares she holds

Ms. Nguyen Thi Thu Tam, sister of Mr. Nguyen Duc Tai, Chairman of the Board of Directors of Mobile World Investment Corporation (MWG, HOSE) recently registered to sell 200,000 MWG shares due to personal financial needs. After completion, Ms. Tam will still own 329,554 shares (0.023% of charter capital).

MWG is trading at 47,750 VND/share (Source: SSI iBoard)

Previously, Mr. Robert Alan Willett, a non-executive member of the Board of Directors of Mobile World Investment Corporation (MWG), registered to sell 1.2 million MWG shares from February 27 to March 27, 2024. After completion, Mr. Robert will reduce the number of MWG shares held to 6.8 million shares (0.466% of charter capital).

In addition, regarding MWG, many investors see the prospect of MWG (Mobile World, HOSE) being eliminated from this group because MWG is unlikely to meet the criteria in the VN-Diamond index.

Dividend schedule this week

According to statistics, 11 businesses announced dividend payouts this week. All of them paid dividends in cash.

The highest payout ratio is 85%, the lowest is 4%.

Cash dividend payment schedule of enterprises from March 11 to March 17

* GDKHQ: Ex-rights transaction - is the transaction date on which the buyer does not enjoy related rights (right to receive dividends, right to buy additional issued shares, right to attend shareholders' meeting...). The purpose is to close the list of shareholders owning the company's shares .

| Stock code | Floor | GDKHQ Day | Date TH | Proportion |

|---|---|---|---|---|

| SDN | HNX | 11/3 | 3/27 | 5% |

| SHP | HOSE | 11/3 | 3/21 | 10% |

| NTH | HNX | 11/3 | 3/27 | 10% |

| BTP | HOSE | 14/3 | 3/29 | 26.5% |

| DSN | HOSE | 14/3 | 3/4 | 16% |

| NT2 | HOSE | 14/3 | 3/29 | 7% |

| EBS | HNX | 14/3 | April 26 | 8% |

| LAF | HOSE | 14/3 | 12/4 | 15% |

| CII | HOSE | 14/3 | 1/4 | 4% |

| PNJ | HOSE | 3/15 | 12/4 | 6% |

| SMN | HNX | 3/15 | 2/5 | 11% |

Source

Comment (0)