Domestic individual investors actively buy stocks. In the photo: at a southern securities company - Photo: BONG MAI

Despite foreign investors' continuous net selling, the VN-Index has still increased a total of 11% since the beginning of the year.

Foreign ownership ratio falls to lowest level in a decade

Mr. Michael Kokalari - Director of Macroeconomic Analysis and Market Research at VinaCapital, said that in the Vietnamese market, domestic individual investors account for 90% of daily trading value. This buying force has offset the $2.4 billion worth of shares that foreign investors have net sold since the beginning of the year.

Foreign investors are net sellers mainly due to profit-taking and concerns about the 4% depreciation of the Vietnamese Dong (VND) since the beginning of the year. Others are "waiting and watching" for recent developments in the country.

According to VinaCapital, a quarter of the foreign investors’ selling volume was through ETF (exchange-traded fund) withdrawals, including the dissolution of Blackrock iShares’ Frontier ETF last month. Thus, after the sale, the foreign investors’ ownership ratio in the Vietnamese stock market has dropped to its lowest level in a decade.

However, the chain of sales related to the fund's dissolution has ended. Some foreign investors have taken advantage of this to increase their long-term strategic investments in Vietnam. For example, Capital Group, Fidelity... are said to have bought a large amount of shares in ACB bank.

Notably, domestic individual investors are still buying. According to Mr. Michael KokalarI, this action comes from expectations of a recovery in corporate profits , up to 19% growth this year. Supported by Vietnam's GDP expected to increase by 6.5 % this year .

Besides, Interest rates in Vietnam are still below 5% , the real estate market is still somewhat frozen , making stocks and gold attractive investment channels.

Stock differentiation

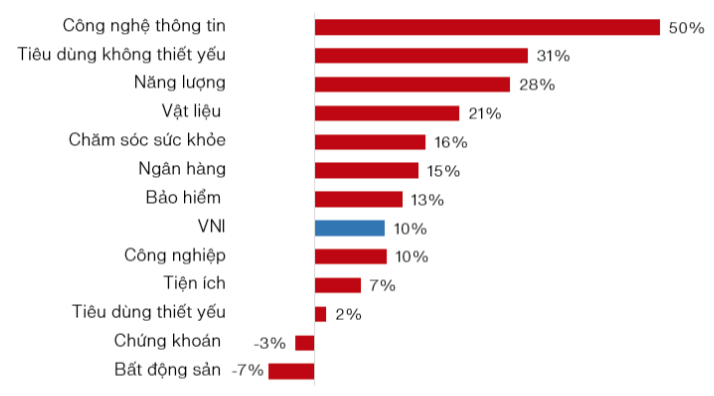

"The large difference in performance between industries is one of the typical features of the Vietnamese stock market," said financial experts.

Typically, the information technology sector , supported by the attraction of artificial intelligence (AI)-related stocks globally. Expected profits of leading enterprises - FPT to increase by more than 20% this year, thanks to service global information technology outsourcing. FPT's stock price has increased by 103% in the past two years, but once increased by 180% before foreign investors took profits.

Stock price movements by industry - Source: VinaCapital

Meanwhile, consumer discretionary stocks also rose. Corporate profits in the sector are forecast to rise 55% in 2024 , after falling 42% last year.

Due to the long-term pent-up demand for transactions, as well as the Government's many policies to restore the market, real estate developers' profits are expected to increase by 80% this year (except for Vinhomes' profits, which may decrease by 12%, due to the timing of revenue recognition of some projects). Moreover, a healthy real estate market will support banks' profit growth.

Investment fund experts predict that VN-Index profits will increase by 33% year-on-year in the second half of 2024 and by another 17% in 2025. However, it is still necessary to pay attention to the risk of VND devaluation.

Confidence in Vietnam's growth-promoting policies

According to VinaCapital, foreign investors have paid more attention to recent political developments in Vietnam.

"We believe that regardless of which leader takes on important positions in the country, the Vietnamese Government's policies will remain focused on attracting FDI and promoting economic growth. These policies have been consistent over the past 25 years and we believe this will continue for many years to come," the investment fund said.

Source: https://tuoitre.vn/khoi-ngoai-giam-ti-le-so-huu-co-phieu-xuong-muc-thap-nhat-mot-thap-ky-2024073119283922.htm

Comment (0)