According to VCCI, regulations restricting individual investors from participating in private bonds as in the Draft Amendment to the Securities Law may cause congestion and disruption in the corporate bond market; affecting the ability to mobilize capital and the solvency of enterprises.

The National Assembly is considering the Draft Law amending the Securities Law; the Accounting Law; the Independent Audit Law; the State Budget Law; the Law on Management and Use of Public Assets; the Tax Administration Law; and the Law on National Reserves (Draft). This is an important draft, having a great impact on businesses in many fields.

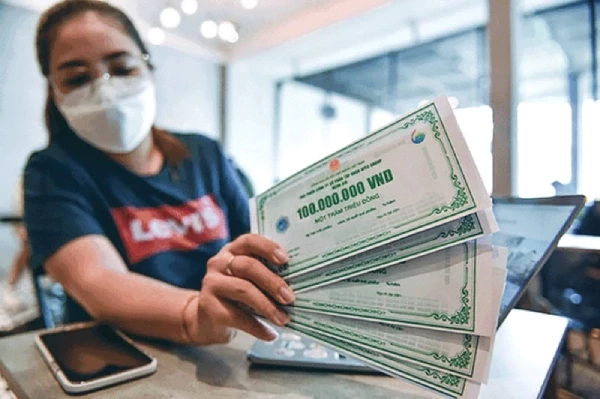

Tomorrow (October 29), the Government will submit to the National Assembly a law amending and supplementing a number of articles of the 7 laws related to finance. In particular, amending a number of articles of the Securities Law, the Government proposes that only professional securities investors who are organizations participate in the private bond market. That is, individual investors will not be allowed to participate in this market.

According to the Ministry of Finance - the agency in charge of drafting the amendment to this law, privately offered bonds, especially those issued by unlisted enterprises, are high-risk products. Many countries do not prohibit professional individual investors from participating in this market, but in reality, buying, selling and investing transactions are carried out between professional organizations.

Regarding this issue, the Vietnam Federation of Commerce and Industry (VCCI) has given some comments.

According to VCCI, it is necessary to consider regulations that do not allow individual investors to invest in privately issued bonds of enterprises other than credit institutions.

Citing feedback from businesses, VCCI said that the regulation not allowing individual investors to invest in privately issued bonds of businesses other than credit institutions (CIs) needs to be considered at some points.

Firstly, the individual bond market has developed more stably after many measures such as operating a bond information page of the Hanoi Stock Exchange (HNX) - where bond information is published; individual bonds are registered and traded centrally at HNX, ensuring transparency.

On the investor side, individual investors have changed after the incidents. One is that the criteria for professional investors have been tightened to ensure that non-professional investors will not participate in this market. Two, individual investors have become aware that this is a risky market and need knowledge before participating.

Second, in the current context, the private bond market is still playing an important role for businesses and individual investors still account for a very large proportion. Public bond issuance is very small (only about 10%) due to regulatory problems. Institutional investors face difficulties due to investment restrictions.

Therefore, according to VCCI, the adjustment as in the Draft will have a huge impact on the capital market. Accordingly, it can cause congestion and disruption in the corporate bond market.

"Currently, corporate bond investment organizations such as commercial banks, securities companies, insurance companies, and investment funds are facing many restrictions on bond investment regulations. Therefore, individual investors are still one of the major investors that can absorb corporate bonds. If these investors are limited, it will be difficult for businesses to issue more because there are not enough investors in the market to absorb the amount of bonds issued," VCCI analyzed.

In addition, the adjustment as in the Draft will affect the capital mobilization and payment capacity of enterprises. Individual investors are almost the only investor group that can invest in individual bonds for debt restructuring purposes. In the coming period, enterprises will need to mobilize capital to restructure maturing debts or restructure debts with high capital mobilization costs (estimated at about 543,000 billion in the next 4 years). Therefore, enterprises will be greatly affected in mobilizing capital to restructure debt, which can strongly affect liquidity in the next 3-5 years.

Based on the above analysis, VCCI recommends that this provision should not be added in this revision. This provision should only be considered after removing obstacles related to regulations on public bond offerings; reducing restrictions on investment activities of institutional investors.

Meanwhile, discussing the policy of restricting individual investors, credit rating company FiinRatings assessed that the current restriction of individual investors' participation in the private bond market is a reasonable policy, because private bonds are inherently not highly standardized and are largely based on negotiation and agreement. Institutional investors are financial institutions that are better able to handle risks from private corporate bonds.

Citing practices in some Asian countries, FiinRatings said that in China, individual investors hardly participate in direct ownership of corporate bonds. Instead, they invest through entrustment and purchase fund certificates managed by fund management companies.

In addition, in Thailand, the participation rate of individual investors is high due to the application of the definition of “High-net-worth investors” (with net assets of 30 million baht, equivalent to about 22 billion VND or more; annual income of at least 2.2 billion VND) or a total securities portfolio of 8 million baht, equivalent to about 6 billion VND).

"To limit the participation of professional individual investors, Vietnam should soon review the investment restrictions and asset allocation into corporate bonds of institutional investors (insurance companies, investment funds, pension funds, etc.) to open up opportunities for these investors to participate in the market more. In addition, promote bond credit ratings to support institutional investors in allocating assets according to risk," FiinRatings suggested.

Minh Thu

Source: https://doanhnghiepvn.vn/kinh-te/chinh-sach/vcci-han-che-nha-dau-tu-ca-nhan-tham-gia-trai-phieu-rieng-le-co-the-gay-dut-gay-thi-truong/20241028084043015

![[Photo] General Secretary To Lam receives First Deputy Secretary General of the African National Congress (ANC) of South Africa](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/bb2999907e1245d5b4c7310a890d8201)

![[Photo] Award ceremony for works on studying and following President Ho Chi Minh](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/a08ce9374fa544c292cca22d4424e6c0)

![[Photo] Vietnamese shipbuilding with the aspiration to reach out to the ocean](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/20/24ecf0ba837b4c2a8b73853b45e40aa7)

![[VIDEO] - Enhancing the value of Quang Nam OCOP products through trade connections](https://vphoto.vietnam.vn/thumb/402x226/vietnam/resource/IMAGE/2025/5/17/5be5b5fff1f14914986fad159097a677)

Comment (0)