Questions related to additional teaching and learning content are raised by many parents and teachers on forums.

Circular 29/2024 regulating extra teaching and learning issued by the Ministry of Education and Training with many new points will be applied from mid-February. Some teachers wonder whether tutoring at students' homes is considered extra teaching and whether they need to comply with the content of the new Circular or not?

Is it considered extra teaching if a teacher goes to a student's home to tutor?

According to the concept set forth by the Ministry of Education and Training in Circular 29/2024, extra-curricular teaching and learning outside of school is an extra-curricular teaching and learning activity not organized by the school. Therefore, tutoring students at home by teachers in the classroom is also considered a form of extra-curricular teaching.

Families with means often choose to hire home tutors. (Illustration photo)

In case a teacher tutors students for money, he/she must register his/her business according to the provisions of law. The tutor must ensure that he/she has good moral qualities and professional competence appropriate to the subject he/she is tutoring. The teacher must report to the Principal about the subject, location, form, and time of tutoring.

The amount of money collected for extra-curricular tutoring outside of school is agreed upon between the student's parents and the tutor. In case the tutor violates the regulations, he/she will be handled according to the provisions of the law.

Article 4, Circular 29/2024 stipulates that teachers currently teaching at schools are not allowed to teach extra classes outside of school and collect money from students they are teaching at school.

In addition, teachers are not allowed to tutor primary school students except in the following cases: art, physical education, and life skills training.

Private tutors must pay taxes

According to regulations, teachers are allowed to teach extra classes in many places and when they participate in extra classes outside of school under contract, the income from extra teaching activities is also included in taxable income.

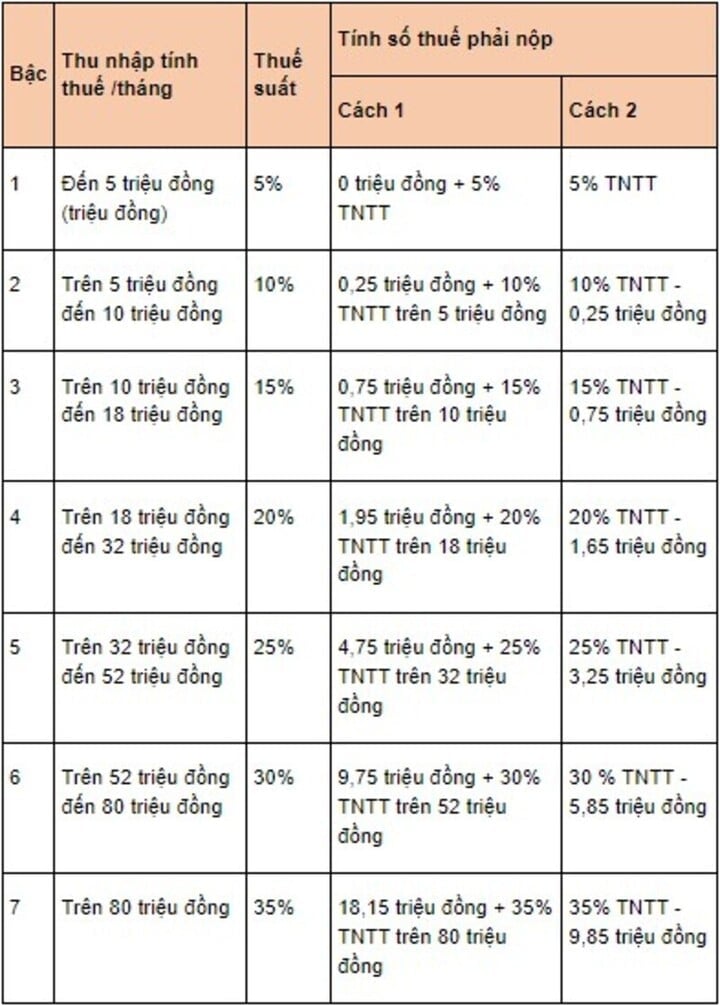

Pursuant to Article 25, Circular 92/2015, personal income tax on income from salaries and wages is determined by the formula: Personal income tax = Taxable income x Tax rate

In which, taxable income is calculated as follows: Taxable income = Taxable income - Deductions. However, the above formula for calculating taxable income only applies to teachers who are resident individuals who sign a teaching contract for 3 months or more.

Tax rates apply according to the progressive tax schedule. (Photo: luatvietnam)

English English

Source: https://vtcnews.vn/giao-vien-den-nha-hoc-sinh-kem-bai-co-duoc-tinh-day-them-ar926616.html

![[Photo] Overcoming all difficulties, speeding up construction progress of Hoa Binh Hydropower Plant Expansion Project](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/bff04b551e98484c84d74c8faa3526e0)

![[Photo] Closing of the 11th Conference of the 13th Central Committee of the Communist Party of Vietnam](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/4/12/114b57fe6e9b4814a5ddfacf6dfe5b7f)

Comment (0)