LIVE UPDATE TABLE OF GOLD PRICE TODAY 6/14 AND EXCHANGE RATE TODAY 6/14

| 1. SJC - Updated: June 13, 2023 15:20 - Website time of supply - ▼ / ▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC 1L, 10L | 66,500 | 67,100 |

| SJC 5c | 66,500 | 67,120 |

| SJC 2c, 1c, 5 phan | 66,500 | 67,130 |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 55,600 ▼50K | 56,550 ▼50K |

| SJC 99.99 gold ring 0.5 chi | 55,600 ▼50K | 56,650 ▼50K |

| Jewelry 99.99% | 55,450 ▼50K | 56,150 ▼50K |

| Jewelry 99% | 54,394 ▼50K | 55,594 ▼50K |

| Jewelry 68% | 36,336 ▼34K | 38,336 ▼34K |

| Jewelry 41.7% | 21,567 ▼21K | 23,567 ▼21K |

Gold prices struggled to hold above $1,980 an ounce as U.S. consumers saw inflationary pressures. The dollar fell 0.3 percent to a three-week low, making the greenback-denominated precious metal more attractive.

According to TG&VN at 9:30 p.m. on June 13 (Vietnam time) on Kitco, the gold price was trading at 1,952.70 - 1,953.9 USD/ounce, down 4.8 USD compared to the previous session . The August gold futures price was last traded at 1,981.80 USD/ounce, up 0.56% on the day.

The US Labor Department said its much-anticipated Consumer Price Index (CPI) rose 0.1% last month, after rising 0.4% in April. The data was weaker than expected, with previous forecasts calling for a 0.2% increase. The report said that over the past 12 months, consumer prices rose 4.0% last month, continuing a moderation trend. Economists had expected a 4.1% increase. Inflation rose at its slowest pace in nearly two years.

Investors are also awaiting the US Federal Reserve's policy decision. The precious metals market is expected to see significant fluctuations after the US CPI is clear. However, while gold is considered a hedge against inflation, high interest rates put pressure on the gold market because it reduces the attractiveness of non-interest-bearing assets.

The gold market has attracted some bullish momentum in its initial reaction to the latest inflation data; however, persistently high core inflation is holding back the recovery. Experts say that the next move for gold will largely depend on the Fed’s policy decision later on June 14, which will be based on the recently released inflation data.

|

| Gold price today June 14, 2023: Gold price lacks catalyst to 'sparkle', why is China's gold demand decreasing? (Source: Kitco) |

Market analyst Michael Langford, Director of AirGuide Business Consulting , said that although the market is waiting for the US Consumer Price Index (CPI) and the Fed meeting to determine more clearly the gold price trend, there is still a lack of catalyst for gold to "sparkle" more than other assets regardless of the Fed's policy decision. Although the prospect of weakening US economic growth can support gold prices.

Economists forecast that the US CPI for May 2023 is expected to show a slowdown in inflation, from 4.9% in April 2023 to 4.1%. Although gold is considered a safe investment during inflationary times, higher inflation puts pressure on non-yielding assets like gold.

Traders and most major Wall Street banks now see a 76% chance that the Fed will keep rates unchanged on June 14, according to the CME FedWatch tool. However, last week's better-than-expected U.S. jobs report has bolstered the case for another rate hike this week.

Domestic gold prices remained almost flat in the session of June 13. SJC gold prices are expected to have significant fluctuations following world prices today, after the US CPI data was released on the night of June 13.

Summary of SJC gold prices at major domestic trading brands at the closing time of the trading session on June 13:

Saigon Jewelry Company listed the price of SJC gold at 66.50 - 67.12 million VND/tael.

Doji Group currently lists SJC gold price at: 66.45 - 67.05 million VND/tael.

Phu Quy Group listed at: 66.45 - 67.05 million VND/tael.

PNJ system listed at: 66.45 - 67.00 million VND/tael.

SJC gold price at Bao Tin Minh Chau is listed at: 66.47 - 67.03 million VND/tael; Rong Thang Long gold brand is traded at 55.58 - 56.43 million VND/tael; jewelry gold price is traded at 55.25 - 56.25 million VND/tael.

Converting world gold price according to USD exchange rate at Vietcombank on the morning of June 13: 1 USD = 23,640 VND, world gold price is equivalent to 56.04 million VND/tael, 11.06 million VND/tael lower than SJC gold selling price.

Gold price forecast?

ANZ Bank said that physical gold demand in China, the top consumer of the metal, is falling due to slowing economic growth and weak seasonal demand. The People's Bank of China (PBoC) has cut short-term lending rates to support the economy as it recovers from the Covid-19 pandemic.

China has increased its gold reserves for the seventh consecutive month. Beijing increased its gold holdings by about 16 tons in May 2023, according to data released by the PBoC on June 7. China's total reserves now stand at about 2,092 tons, after adding a total of 144 tons between November 2022 and May 2023, according to Bloomberg .

Central banks around the world also bought a record amount of gold in 2022. Countries increased their reserves of the precious metal amid rising geopolitical uncertainty and rising global inflation.

Analyst Rupert Rowling of investment consultancy Kinesis Money cautioned that the market is trading gold on the assumption that US interest rates will remain at current levels. Any increase could send the precious metal tumbling to $1,900 an ounce.

A pause in Fed rate hikes would be positive for gold, said Edward Moya, senior market analyst at OANDA . Conversely, any sign that the Fed remains aggressive in tightening monetary policy would mean a sharp sell-off in gold.

Nigel Green, CEO and founder of deVere Group , said that while inflation is on track and trending lower, it is still far from the central bank’s 2% target. “Inflation is definitely falling so far, but it’s been very, very gradual. It’s still sticky and a long way from the 2% target, largely due to the tightening labor market. So investors need to be prepared for at least one more rate hike this year, even if the Fed skips it,” said Nigel Green.

Source

![[Photo] Meet the pilots of the Victory Squadron](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/fd30103acbd744b89568ca707378d532)

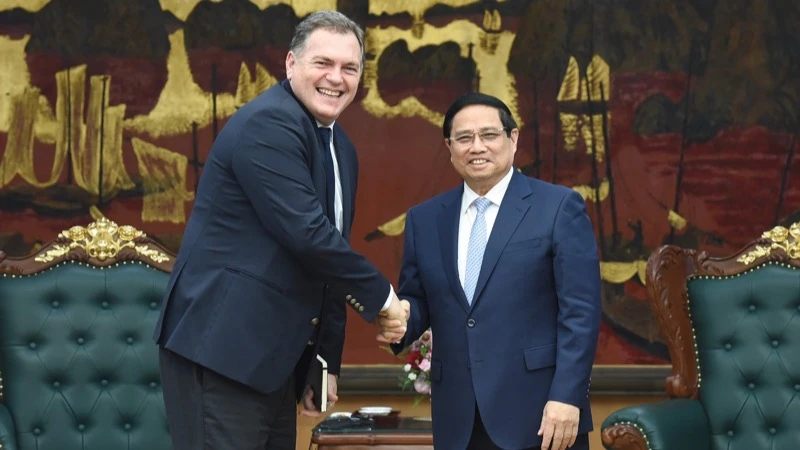

![[Photo] Prime Minister Pham Minh Chinh receives French Minister in charge of Transport](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/21/aa649691f85546d59c3624b1821ab6e2)

Comment (0)