Gold prices today, November 29, 2024, on the international market increased rapidly again due to the geopolitical situation at hot spots. Domestic SJC gold bars and rings also 'danced', rebounding despite having previously plummeted.

Gold price on Kitco floor at 9:00 p.m. (November 28, Vietnam time) was trading at 2,647.1 USD/ounce, up 0.24% compared to the beginning of the session. Gold futures price for December 2024 delivery on Comex New York floor was trading at 2,663.7 USD/ounce.

At the beginning of the trading session, world gold prices increased again due to market concerns about geopolitical risks remaining high as the war escalated in Russia-Ukraine, while the ceasefire between Israel and Hezbollah has not yet taken effect.

Israel's retaliatory measures continue to heighten tensions in the Middle East, said Aneeka Gupta, director of macroeconomic research at WisdomTree.

In addition, gold continues to be well supported by the weakening of the USD, when the DXY index fell to its lowest level in the past 2 weeks, reaching 106.2 points. Accordingly, gold is regaining its appeal to investors after a sharp decline, moving away from the support level of 2,700 USD/ounce.

However, the precious metal’s recovery was limited as recent data showed slowing inflation, suggesting that the US Federal Reserve (Fed) may be cautious about cutting interest rates.

According to the report, American spending increased sharply in October and is likely to continue to increase in the following months. Therefore, the progress of reducing inflation is slowing.

The weakness of the greenback and expectations that the US central bank will cut interest rates in December are helping gold extend its slight recovery after a sharp decline earlier in the week, said Han Tan, a market analyst at Exinity Group.

Minutes from the Fed’s most recent policy meeting released earlier this week showed uncertainty about the economic outlook, raising market expectations for a December rate cut. Markets now see a 70% chance of a 25 basis point rate cut, up from 50% just over a week ago, according to the CME’s FedWatch tool.

In the domestic market, at the end of the session on November 28, the price of 9999 gold bars at SJC and Doji was 82.9 million VND/tael (buy) and 85.4 million VND/tael (sell).

SJC announced the price of gold rings of type 1-5 at only 82.5-84.4 million VND/tael (buy - sell). Doji listed the price of 9999 smooth round gold rings at 83.5-84.7 million VND/tael (buy - sell).

Gold Price Forecast

Phillip Streible, chief market strategist at Blue Line Futures, predicts that gold prices could hit $3,000 an ounce in the first two quarters of 2025, unless a spike in inflation forces the Fed to raise interest rates.

According to Darin Newsom, market analyst at Barchart.com, gold prices may decline slightly in the short term due to market correction. However, in the long term, he believes that gold will continue to increase in price.

Swiss bank UBS believes that gold prices could reach their target of $2,900 an ounce by the end of 2025. The report emphasizes that gold is a safe investment channel, helping to hedge against risks in the context of geopolitical instability and fiscal issues.

Source: https://vietnamnet.vn/gia-vang-hom-nay-29-11-2024-tang-nhanh-nhan-tron-va-mieng-sjc-tiep-da-hoi-phuc-2346686.html

![[Photo] General Secretary To Lam concludes visit to Russia, departs for Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/0acf1081a95e4b1d9886c67fdafd95ed)

![[Photo] General Secretary To Lam arrives in Minsk, begins state visit to Belarus](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/76602f587468437f8b5b7104495f444d)

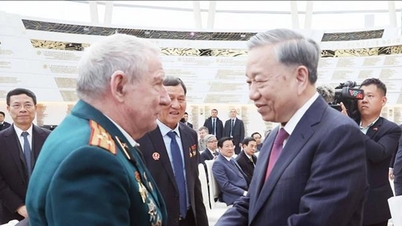

![[Photo] General Secretary To Lam meets and expresses gratitude to Vietnam's Belarusian friends](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/c515ee2054c54a87aa8a7cb520f2fa6e)

![[Photo] National Assembly Chairman Tran Thanh Man attends the Party Congress of the Committee for Culture and Social Affairs](https://vphoto.vietnam.vn/thumb/1200x675/vietnam/resource/IMAGE/2025/5/11/f5ed02beb9404bca998a08b34ef255a6)

Comment (0)