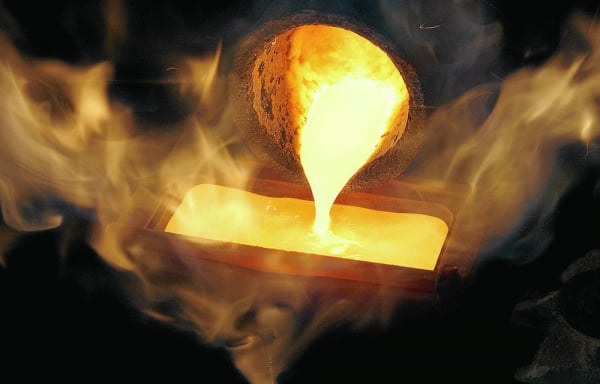

Gold price today, July 19, 2024, recorded SJC increasing sharply when the State Bank "gave the green light" to banks. Experts said that gold price will increase to 2,500 USD/ounce thanks to the stable demand from India and China.

LIVE UPDATE TABLE OF GOLD PRICE TODAY 7/19 and EXCHANGE RATE TODAY 7/19

| 1. SJC - Updated: 07/18/2024 08:46 - Website time of supply - ▼ / ▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC 1L, 10L, 1KG | 78,500 ▲2520K | 80,000 ▲3020K |

| SJC 5c | 78,500 ▲2520K | 80,020 ▲3020K |

| SJC 2c, 1c, 5 phan | 78,500 ▲2520K | 80,030 ▲3020K |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 76,200 ▲220K | 77,600 ▲720K |

| SJC 99.99 gold ring 0.3 chi, 0.5 chi | 76,200 ▲220K | 77,700 ▲720K |

| Jewelry 99.99% | 76,000 ▲120K | 77,200 ▲620K |

| Jewelry 99% | 74,436 ▲614K | 76,436 ▲614K |

| Jewelry 68% | 50,151 ▲421K | 52,651 ▲421K |

| Jewelry 41.7% | 29,846 ▲259K | 32,346 ▲259K |

Update gold price today 7/19/2024

Domestic gold prices recorded SJC gold bars unexpectedly increasing by more than 3 million VND to 80 million VND/tael. Specifically, Saigon Jewelry Company listed the buying and selling prices of SJC gold at 78.5-80 million VND/tael, up 2.52 million VND and 3.02 million VND respectively compared to yesterday's closing price.

Meanwhile, the price of SJC 9999 gold ring was bought at 76 million VND/tael, sold at 77.5 million VND/tael, up 20,000 VND (buy) and 620,000 VND (sell) compared to the previous closing price.

DOJI brand is listed at 78.5 million VND/tael for buying and 80 million VND/tael for selling, up 2.5 million VND and 3.02 million VND respectively compared to the previous session.

The reason for the increase in SJC gold price is because the State Bank increased the selling price of gold to banks.

According to expert Tran Duy Phuong, the State Bank's adjustment of gold prices is reasonable because the world gold price has increased too quickly recently.

Furthermore, the State Bank intervenes in the market with the aim of increasing supply and reducing the gap between domestic and world gold prices, not with the aim of anchoring gold prices. Therefore, if world gold prices increase, domestic gold prices must also increase.

World gold prices remained near the high set in the previous session, at 2,464.5 - 2,464.6 USD/ounce, up 6.4 USD compared to the previous trading session - recorded by TG&VN at 18:56.

The outlook for gold remains bullish, bolstered by the high likelihood of a US Federal Reserve rate cut in September.

Fed Governor Christopher Waller recently "turned the table" and said that a rate cut would come soon as long as inflation and employment data do not show unexpected changes.

Waller’s comments were particularly notable because he has been one of the more hawkish members of the FOMC this year. In May, he said a rate cut would come “a few months down the road” as he waited for more convincing inflation data.

"The labor market is in good shape, with nonfarm payrolls rising while wage growth has cooled. At the same time, the Consumer Price Index (CPI) fell 0.1% in June and was down 3.3% year over year, marking its lowest level since April 2021," Mr. Waller said.

According to CME's FedWatch tool, the market is predicting a 25 basis point rate cut at the Fed's September 2024 meeting.

|

| Gold price today July 19, 2024: SJC gold price increased dramatically when the State Bank of Vietnam "gave the green light", the world left the peak, "opened the door" to go up. (Source: see.news) |

Summary of SJC gold prices at major domestic trading brands at the closing time of July 17:

Saigon Jewelry Company listed at 75.98 - 76.98 million VND/tael.

Doji Group is currently listed at: 76.0 - 76.98 million VND/tael.

PNJ system listed at: 75.8 - 76.98 million VND/tael.

Phu Quy Gold and Silver Group listed at 75.98 - 76.98 million VND/tael.

SJC gold price at Bao Tin Minh Chau is listed at: 75.88 - 76.98 million VND/tael.

Gold's revival has come sooner than expected

Gold has decoupled from the outlook for interest rates and real yields and despite the sharp rally, the bull case remains intact, according to commodity strategists at JP Morgan.

A weaker dollar and lower U.S. interest rates traditionally boost the appeal of non-yielding bullion, but since early 2022, gold’s relationship with real yields has broken down, strategists noted in a July 15 note.

The gold revival has come sooner than expected, as it has become increasingly decoupled from real yields, said Gregory Shearer, head of base and rare metals strategy at JP Morgan.

“We have been structurally bullish on gold since Q4 2022, and with gold surging above $2,400 an ounce in April, the recovery has come much sooner and sharper than expected. What is particularly surprising is that it coincided with a Fed rate cut,” he stressed.

Meanwhile, a report by ANZ Bank (Australia) expects the gold price to increase to 2,500 USD/ounce thanks to the steady demand from India and China.

The Reserve Bank of India (RBI) has also started diversifying its foreign exchange reserves by buying more gold. The central bank bought 37 tonnes of gold in the first half of the year.

“The RBI has been the second-largest buyer of gold this year. The first-half volume implies that total additions this year could reach over 70 tonnes if the pace of purchases continues,” ANZ bank analysts said.

Source: https://baoquocte.vn/gia-vang-hom-nay-1972024-gia-vang-sjc-tang-soc-khi-duoc-bat-den-xanh-the-gioi-roi-dinh-cao-sang-cua-di-len-279153.html

Comment (0)