Gold prices today, October 26, 2024, on the world market are on the rise for the third consecutive week, standing firmly at a record high. Russia officially proposed to BRICS member countries to establish a group-specific precious metals exchange.

[WIDGET_GOLD_RATE:::SJC:]

Update gold price today October 26, 2024

World gold prices, although falling, are on track to rise for the third consecutive week, standing firmly at a record high. Investors are actively buying gold amid rising geopolitical tensions and to preserve assets.

According to the World & Vietnam Newspaper at 5:00 p.m. on October 25 , the world gold price on Kitco was at 2,720.1 - 2,721.1 USD/ounce, down 15.2 USD compared to the previous trading session.

According to Kitco News , on October 24, the Russian Finance Ministry announced that the country has officially proposed to the member countries of the Group of the World's leading emerging economies (BRICS) to establish its own precious metals exchange. This move could completely change the long-standing pricing mechanisms for gold, silver, platinum and other precious metals.

BRICS members also support promoting precious metal trading among member countries based on common quality standards.

The establishment of a metal trading mechanism between BRICS countries will create fair and equal competition based on exchange principles, the Russian Finance Ministry said.

"This mechanism will include the creation of price indicators for metals, gold production and trading standards, identification of market participants, clearing and auditing activities for BRICS countries," Minister of the Ministry Anton Siluanov stressed.

Russia expects the BRICS Precious Metals Exchange "to become the main regulator of precious metal prices".

Meanwhile, Mr. Andy Schectman, Chairman and CEO of Miles Franklin Precious Metals fund, said that the BRICS summit could accelerate the process of re-establishing the global financial system, thereby pushing the price of precious metals up to 150,000 USD/ounce.

|

| Gold price today October 26, 2024: Gold price remains at a high level, Russia 'invites' BRICS to make new moves with the market - precious metals will 'soar'. (Source: Reuters) |

Domestic gold price remains high at 89 million VND/tael at SJC brand.

At the end of the trading session on October 25, Saigon Jewelry Company (SJC) announced the price of SJC gold bars at 87 - 89 million VND/tael (buy - sell), keeping the listed price in both buying and selling directions unchanged compared to the closing price yesterday.

DOJI Gold and Gemstone Group listed the price of SJC gold bars at 87 - 89 million VND/tael (buy - sell), keeping the listed price for both buying and selling unchanged compared to yesterday's closing price.

Phu Quy SJC gold price listed SJC gold bar price at 87.3 - 89 million VND/tael (buy - sell), keeping the listed price in both buying and selling directions unchanged compared to yesterday's closing price.

PNJ gold price in Ho Chi Minh City listed SJC gold bar price at 87.6 - 88.9 million VND/tael (buy - sell), keeping the listed price in both buying and selling directions unchanged compared to the closing price yesterday.

Bao Tin Minh Chau Company listed gold price at 87 - 89 million VND/tael (buy - sell), keeping the listed price in both buying and selling directions unchanged compared to yesterday's closing price.

Phu Nhuan Jewelry Joint Stock Company announced the price of gold rings at 87.6 - 88.9 million VND/tael (buy - sell), keeping the listed price in both buying and selling directions unchanged compared to yesterday's closing price.

Thus, the domestic price of gold bars and gold rings today remained stable compared to yesterday's closing price of 89 million VND/tael sold.

Summary of SJC gold bar prices at major domestic trading brands at the closing time of trading session on October 25:

Saigon Jewelry Company: SJC gold bars 87 - 89 million VND/tael.

Doji Group: SJC gold bars 87 - 89 million VND/tael.

PNJ system: SJC gold bars 87 - 89 million VND/tael.

SJC gold price at Bao Tin Minh Chau is listed at 87 - 89 million VND/tael.

Gold has entered a new bull cycle

Commenting on the world gold price, Mr. Paul Wong, market strategist at Sprott Asset Management emphasized: "Gold has entered a new bullish cycle, driven by factors such as central bank purchases, rising US public debt and the possibility of the USD peaking."

He said that the debt-to-GDP ratio of the world's largest economy often increases gold prices due to concerns about debt sustainability, currency devaluation and debt monetization.

The US Congressional Budget Office projects public debt to rise from 98% of GDP in 2023 to 181% of GDP in 2053 - the highest level in the country's history.

"As public debt increases, governments are likely to print more money to finance their deficits, leading to currency depreciation. This development increases the appeal of gold. Persistent inflationary pressures and difficult macroeconomic conditions affecting global economies mean that central banks and investors are more likely to allocate their investment resources to gold," explained the market strategist at Sprott Asset Management.

Source: https://baoquocte.vn/gia-vang-hom-nay-26102024-gia-vang-giu-muc-cao-chot-vot-nga-ru-brics-co-dong-thai-moi-voi-thi-truong-kim-loai-quy-se-phi-nhu-bay-291348.html

![[Photo] Nearly 2,000 people enthusiastically participated in the Olympic Running Day - For the security of the Fatherland](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/33bed26f570a477daf286b68b14474d4)

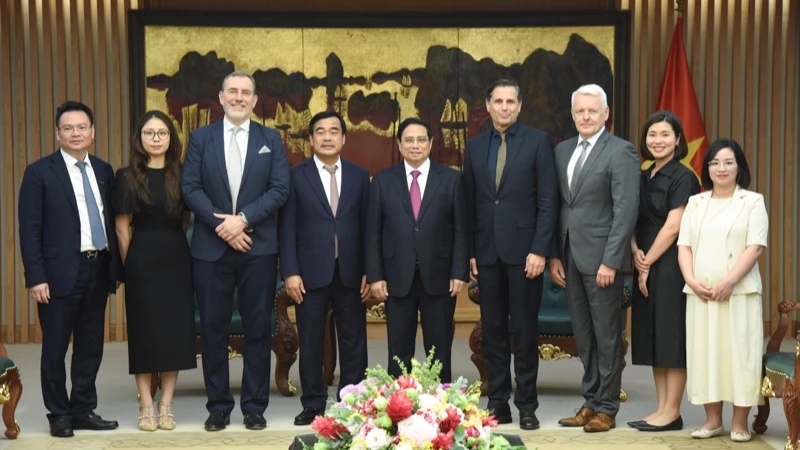

![[Photo] Prime Minister Pham Minh Chinh receives Chairman of Skoda Auto Group](https://vstatic.vietnam.vn/vietnam/resource/IMAGE/2025/3/27/298bbec539e346d99329a8c63edd31e5)

Comment (0)