LIVE UPDATE TABLE OF GOLD PRICE TODAY 6/28 and EXCHANGE RATE TODAY 6/28

| 1. SJC - Updated: June 27, 2023 08:27 - Website time of supply source - ▼ / ▲ Compared to yesterday. | ||

| Type | Buy | Sell |

| SJC 1L, 10L | 66,350 ▼50K | 66,950 ▼50K |

| SJC 5c | 66,350 ▼50K | 66,970 ▼50K |

| SJC 2c, 1c, 5 phan | 66,350 ▼50K | 66,980 ▼50K |

| SJC 99.99 gold ring 1 chi, 2 chi, 5 chi | 55,450 ▼50K | 56,450 ▼50K |

| SJC 99.99 gold ring 0.5 chi | 55,450 ▼50K | 56,550 ▼50K |

| Jewelry 99.99% | 55,350 ▼50K | 56,050 ▼50K |

| Jewelry 99% | 54,295 ▼50K | 55,495 ▼50K |

| Jewelry 68% | 36,268 ▼34K | 38,268 ▼34K |

| Jewelry 41.7% | 21,525 ▼21K | 23,525 ▼21K |

World gold prices increased slightly in the trading session on June 27.

According to TG&VN at 7:00 p.m. on June 27, the world gold price on the Kitco exchange was at 1,923.1 - 1,924.1 USD/ounce, up 0.3 USD compared to the previous trading session.

The dollar index fell 0.1%, making gold more attractive to buyers holding other currencies.

China is scheduled to release its Purchasing Managers’ Index (PMI) this week and the US will release statistics on a key measure of inflation. These data could provide a clearer picture of the macroeconomic situation of the two economic powers.

US Federal Reserve Chairman Powell will speak at the European Central Bank Forum in Sintra, Portugal, on June 28.

The speech could provide further signals to markets about U.S. interest rate policy. Investors currently see a 77% chance of a rate hike in July, followed by a shift to rate cuts starting in 2024.

In fact, high interest rates will cause investors to "turn their backs" on gold, because gold is a non-yielding asset and a safe investment during times of economic instability.

At the World Economic Forum held in Tianjin (China), Chinese Prime Minister Li Qiang predicted that the country's economic growth in the second quarter of 2023 will be higher than the first quarter of 2023, estimated to reach the growth target of about 5%.

In the Asian market, precious metal prices increased amid a weaker US dollar, while traders were waiting for Fed's Jerome Powell's speech on June 28 to assess the path of interest rates.

At 1:30 p.m. (Vietnam time), spot gold prices increased 0.2% to $1,925.8/ounce. US gold futures increased 0.1% to $1,935.6/ounce.

Domestic gold prices continued to move sideways or slightly decrease by VND50,000-100,000. However, due to the impact of the world gold price decline in recent consecutive sessions, the price of gold bars at Saigon Jewelry Company (SJC) lost the VND67 million/tael mark.

Specifically, at the end of the trading session on June 27, the price of SJC gold on the Hanoi market was listed by Saigon Jewelry Company at 66.35 - 66.95 million VND/tael (buy - sell).

|

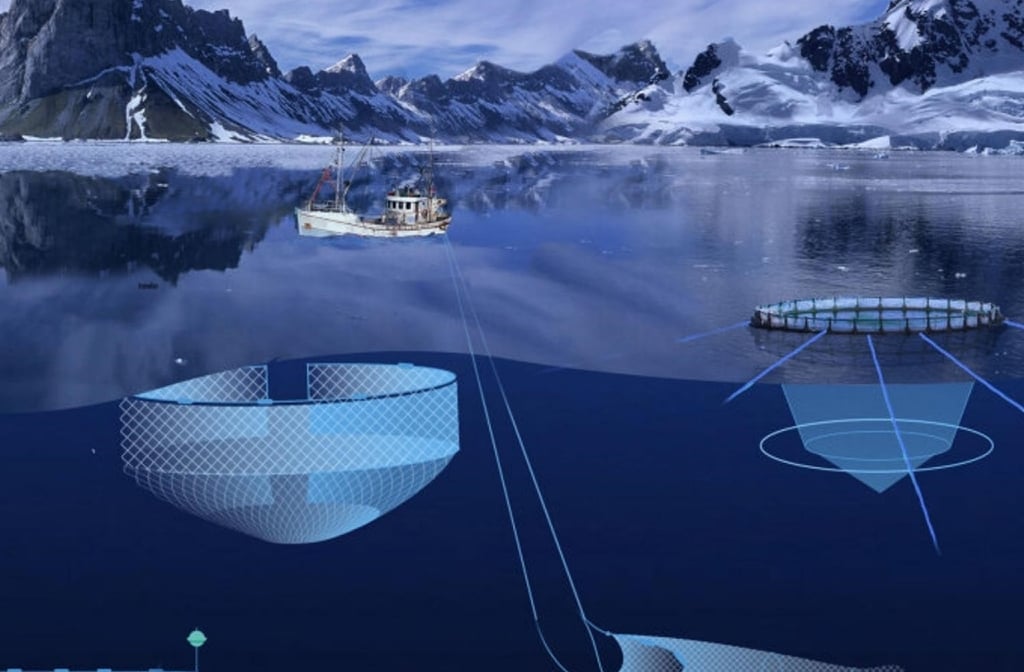

| Gold price today June 28, 2023: Gold price encounters obstacles, there is a reason why investors 'turn away', Vietnamese people love gold jewelry. (Source: Kitco) |

Summary of SJC gold prices at major domestic trading brands at the closing time of June 26:

Saigon Jewelry Company listed the price of SJC gold at 66.35 - 66.95 million VND/tael.

Doji Group currently lists the price of SJC gold at: 66.35 - 66.95 million VND/tael.

Phu Quy Group listed at: 66.4 - 67.0 million VND/tael.

PNJ system listed at: 66.45 - 66.95 million VND/tael.

SJC gold price at Bao Tin Minh Chau is listed at: 66.42 - 66.93 million VND/tael; Rong Thang Long gold brand is traded at 55.67 - 56.52 million VND/tael; jewelry gold price is traded at 55.15 - 56.25 million VND/tael.

American demand for gold is growing rapidly

The Fed's hawkish stance could increase the dollar's appeal as a safe-haven asset, thereby weakening gold.

Overall, gold's technical position doesn't look good after prices fell below $1,940 an ounce, according to Kitco News .

“Gold falling below $1,940 an ounce is a signal that the precious metal could continue to decline,” said Everett Millman, precious metals expert at Gainesville Coins. “New resistance for gold is at $1,940 an ounce and support is at $1,900 an ounce, followed by $1,880 an ounce.”

According to a recent study by Luxembourg-based financial brokerage firm Forex Suggest, Vietnam is the country with the strongest increase in demand for gold jewelry in the world in 2022, with an increase of 51% compared to 2021. Demand for women's gold jewelry in Vietnam has begun to increase rapidly since 2005.

Following Vietnam are the United Arab Emirates (UAE) and Australia with increases of 38% and 30% respectively.

In terms of overall gold demand growth, Vietnam ranks third in the world in 2022 with 37% compared to 2021, following Egypt (55%) and Iran (38%).

According to Mr. Andrew Naylor, regional CEO of the World Gold Council (WGC), due to the Covid-19 pandemic, Vietnamese consumers tend to be cautious when buying high-value goods such as gold.

However, gold sales are expected to increase sharply by the end of 2022 as Vietnam's economy recovers strongly from the pandemic and consumer confidence increases - factors that will help increase gold demand this year.

Forex Suggest research analyzed WGC data on central bank gold reserves to show demand for gold jewelry as well as the value of investors' holdings of gold exchange-traded funds (ETFs) and per capita gold demand in economies around the world.

According to this study, the US is the world's leading country in terms of investment and demand for gold, scoring 8.93/10 points in a ranking of 17 countries. The US is the country with the world's largest central bank gold reserves (8,133 tons) and the world's largest gold ETF holdings (1,667 tons).

American demand for gold also increased rapidly.

According to CNBC , the country's demand for gold bars and coins increased by 5% in 2022 to 302 tons. The US's per capita gold demand is 0.75 grams/person.

Source

Comment (0)